Embark Results Presentation Deck

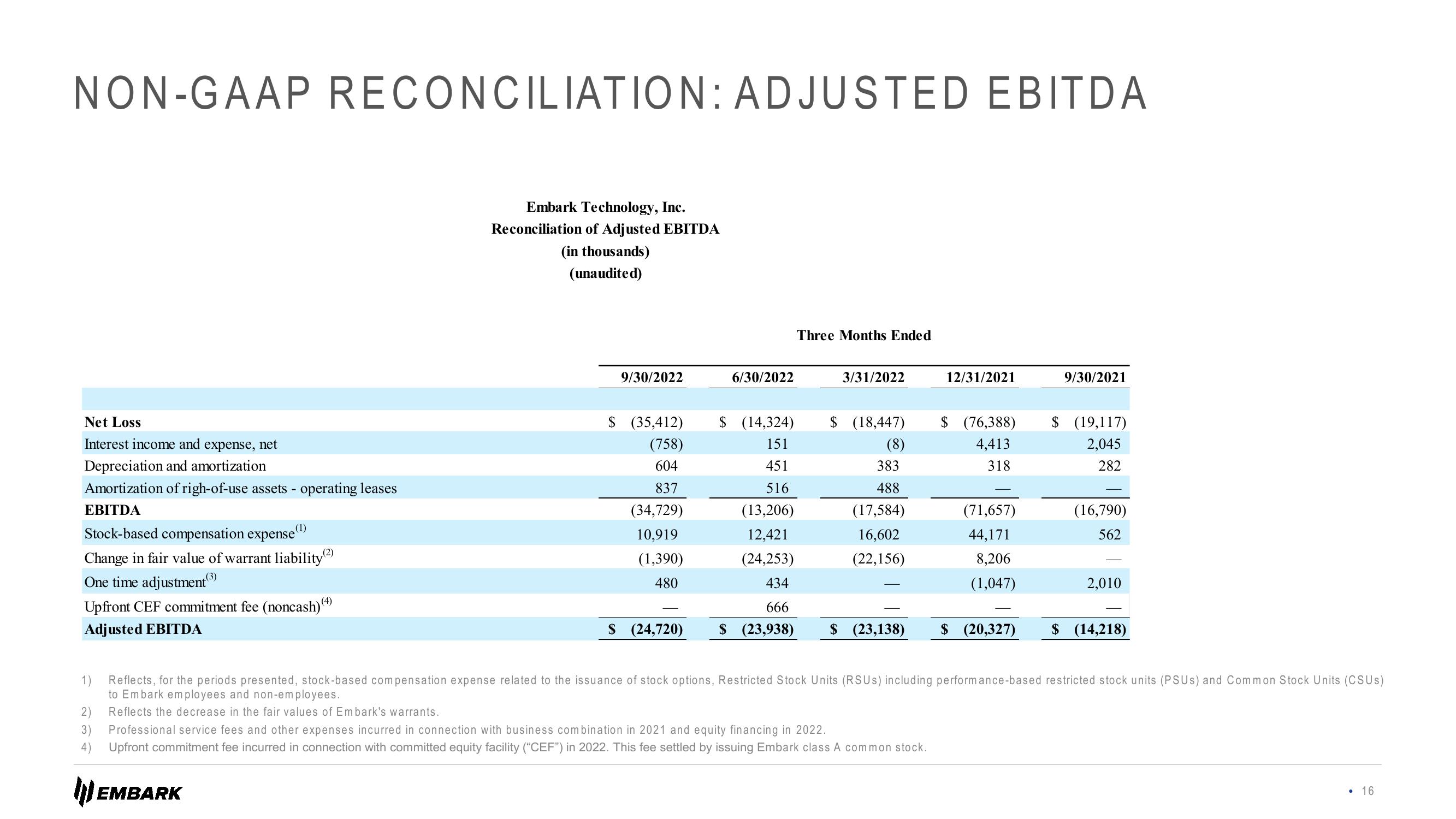

NON-GAAP RECONCILIATION: ADJUSTED EBITDA

Net Loss

Interest income and expense, net

Depreciation and amortization

Amortization of righ-of-use assets - operating leases

EBITDA

Stock-based compensation expense (¹)

Change in fair value of warrant liability (2)

One time adjustment (³)

Upfront CEF commitment fee (noncash) (4)

Adjusted EBITDA

Embark Technology, Inc.

Reconciliation of Adjusted EBITDA

(in thousands)

(unaudited)

EMBARK

9/30/2022

$ (35,412)

(758)

604

837

(34,729)

10,919

(1,390)

480

$ (24,720)

6/30/2022

Three Months Ended

3/31/2022

$ (14,324) $ (18,447) $ (76,388)

151

4,413

318

451

516

(13,206)

12,421

(24,253)

434

666

$ (23,938) $ (23,138) $ (20,327)

(8)

383

488

(17,584)

16,602

(22,156)

12/31/2021

3) Professional service fees and other expenses incurred in connection with business combination in 2021 and equity financing in 2022.

4) Upfront commitment fee incurred in connection with committed equity facility ("CEF") in 2022. This fee settled by issuing Embark class A common stock.

(71,657)

44,171

8,206

(1,047)

9/30/2021

$ (19,117)

2,045

282

(16,790)

562

2,010

1)

Reflects, for the periods presented, stock-based compensation expense related to the issuance of stock options, Restricted Stock Units (RSUS) including performance-based restricted stock units (PSUS) and Common Stock Units (CSUS)

to Embark employees and non-employees.

2) Reflects the decrease in the fair values of Embark's warrants.

$ (14,218)

. 16View entire presentation