WeWork Investor Day Presentation Deck

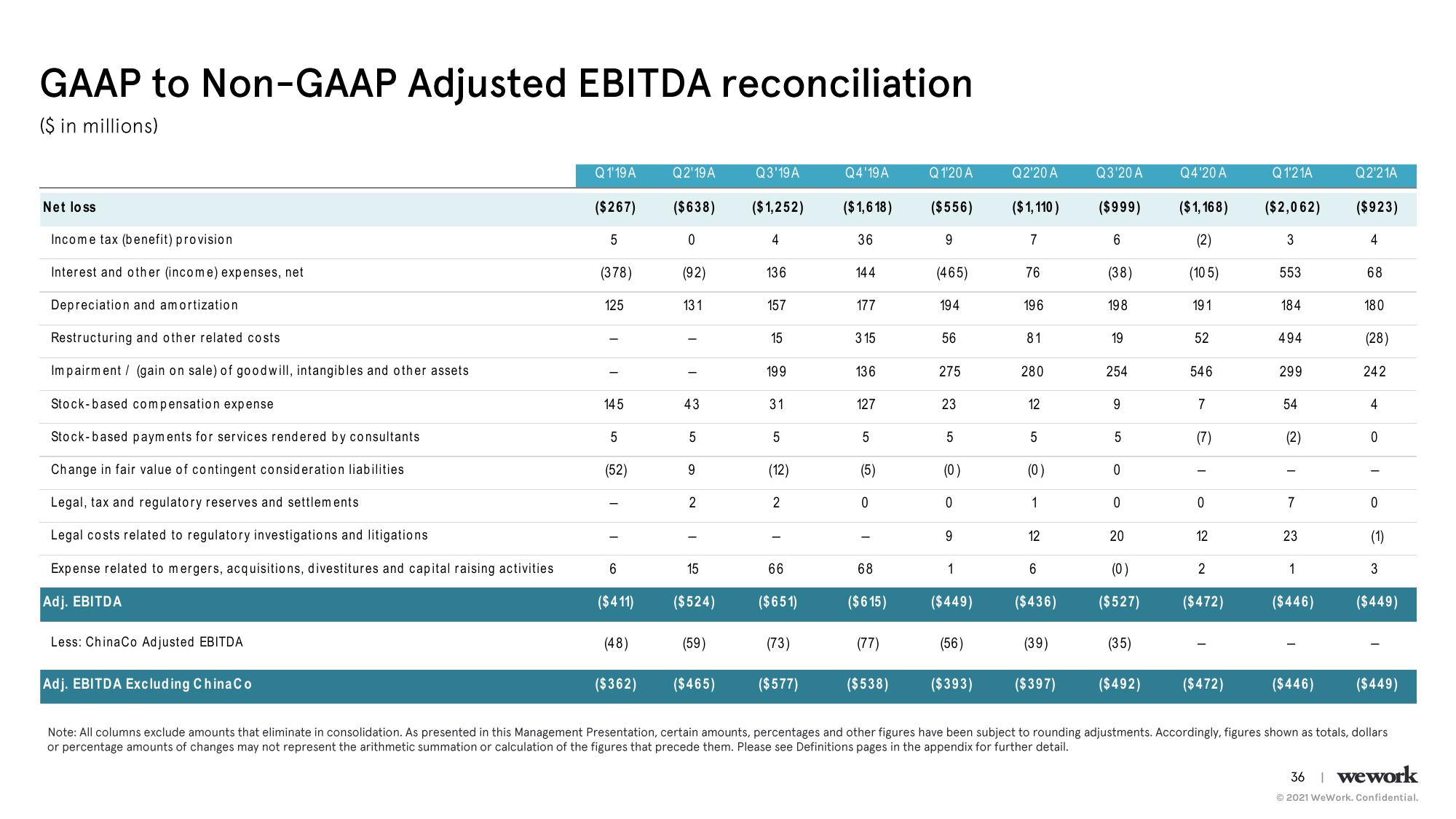

GAAP to Non-GAAP Adjusted EBITDA reconciliation

($ in millions)

Net loss

Income tax (benefit) provision

Interest and other (income) expenses, net

Depreciation and amortization.

Restructuring and other related costs

Impairment (gain on sale) of goodwill, intangibles and other assets

Stock-based compensation expense

Stock-based payments for services rendered by consultants

Change in fair value of contingent consideration liabilities

Legal, tax and regulatory reserves and settlements

Legal costs related to regulatory investigations and litigations

Expense related to mergers, acquisitions, divestitures and capital raising activities

Adj. EBITDA

Less: ChinaCo Adjusted EBITDA

Adj. EBITDA Excluding China Co

Q1'19 A

($267)

5

(378)

125

145

5

(52)

6

($411)

(48)

($362)

Q2'19 A

($638)

0

(92)

131

43

5

9

2

15

($524)

(59)

($465)

Q3'19 A

($1,252)

4

136

157

15

199

31

5

(12)

2

66

($651)

(73)

($577)

Q4'19 A

($ 1,618)

36

144

177

315

136

127

5

(5)

0

68

($615)

(77)

Q 1'20 A

($556)

9

(465)

194

56

275

23

5

(0)

0

9

1

($449)

Q2'20 A

($ 1,110)

7

76

196

81

280

12

5

(0)

1

12

6

($436)

(56)

($538) ($393) ($397)

(39)

Q3'20 A

($999)

co

6

(38)

198

19

254

9

5

0

0

20

(0)

($527)

Q4'20 A

($ 1,168)

(2)

(105)

191

52

546

7

(7)

0

12

2

($472)

(35)

($492) ($472)

Q1'21A

($2,062)

3

553

184

494

299

54

(2)

7

23

1

($446)

Q2'21A

($923)

4

68

180

(28)

242

4

0

(1)

3

($449)

($446) ($449)

Note: All columns exclude amounts that eliminate in consolidation. As presented in this Management Presentation, certain amounts, percentages and other figures have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars

or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them. Please see Definitions pages in the appendix for further detail.

36 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation