Allwyn Investor Conference Presentation Deck

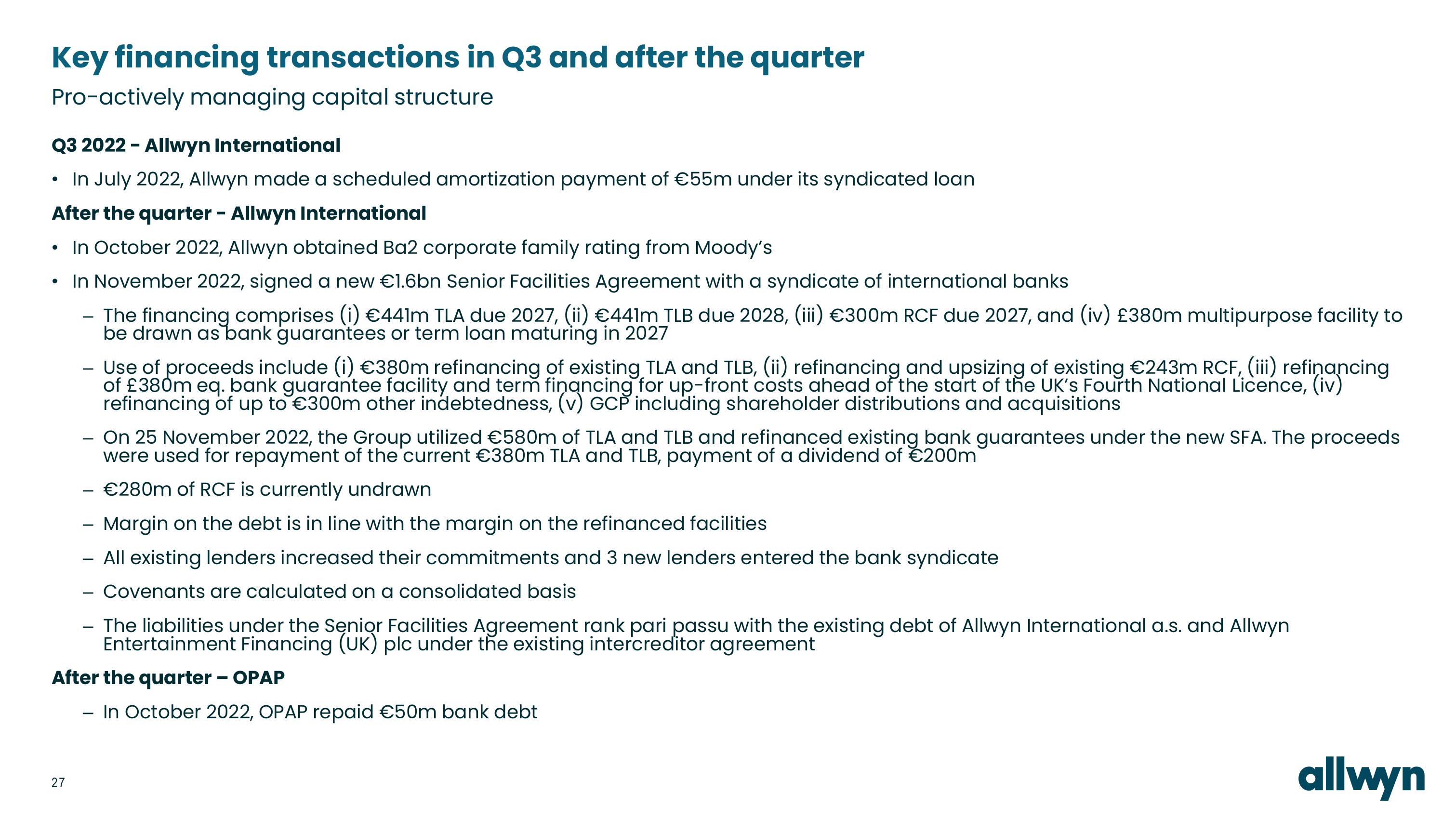

Key financing transactions in Q3 and after the quarter

Pro-actively managing capital structure

Q3 2022 - Allwyn International

In July 2022, Allwyn made a scheduled amortization payment of €55m under its syndicated loan

After the quarter - Allwyn International

• In October 2022, Allwyn obtained Ba2 corporate family rating from Moody's

• In November 2022, signed a new €1.6bn Senior Facilities Agreement with a syndicate of international banks

- The financing comprises (i) €441m TLA due 2027, (ii) €441m TLB due 2028, (iii) €300m RCF due 2027, and (iv) £380m multipurpose facility to

be drawn as bank guarantees or term loan maturing in 2027

●

- Use of proceeds include (i) €380m refinancing of existing TLA and TLB, (ii) refinancing and upsizing of existing €243m RCF, (iii) refinancing

of £380m eq. bank guarantee facility and term financing for up-front costs ahead of the start of the UK's Fourth National Licence, (iv)

refinancing of up to €300m other indebtedness, (v) GCP including shareholder distributions and acquisitions

27

On 25 November 2022, the Group utilized €580m of TLA and TLB and refinanced existing bank guarantees under the new SFA. The proceeds

were used for repayment of the current €380m TLA and TLB, payment of a dividend of €200m

€280m of RCF is currently undrawn

Margin on the debt is in line with the margin on the refinanced facilities

- All existing lenders increased their commitments and 3 new lenders entered the bank syndicate

- Covenants are calculated on a consolidated basis

The liabilities under the Senior Facilities Agreement rank pari passu with the existing debt of Allwyn International a.s. and Allwyn

Entertainment Financing (UK) plc under the existing intercreditor agreement

After the quarter - OPAP

- In October 2022, OPAP repaid €50m bank debt

allwynView entire presentation