First Merchants Results Presentation Deck

Asset Quality

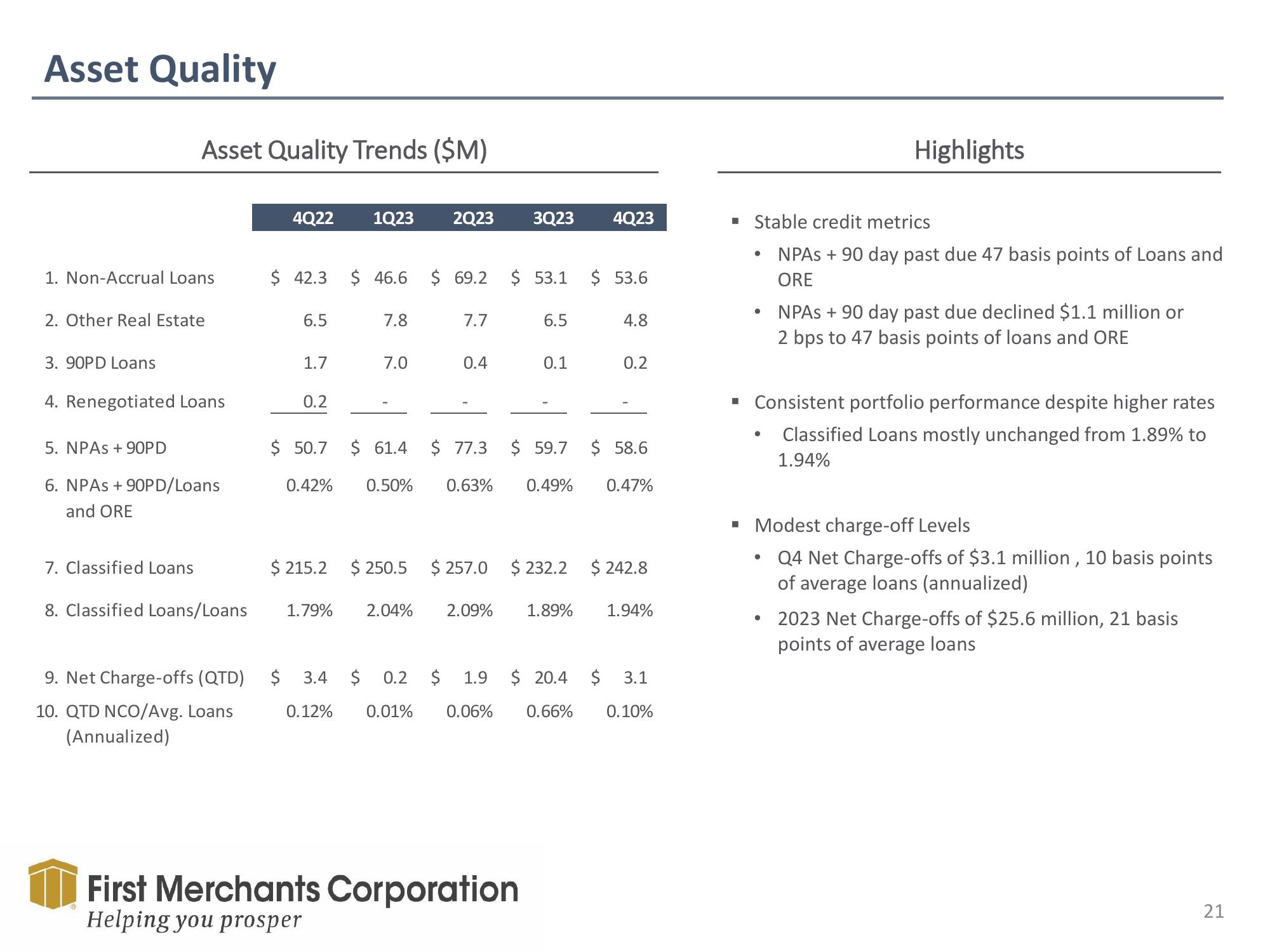

Asset Quality Trends ($M)

1. Non-Accrual Loans

2. Other Real Estate

3. 90PD Loans

4. Renegotiated Loans

5. NPAS + 90PD

6. NPAS + 90PD/Loans

and ORE

7. Classified Loans

8. Classified Loans/Loans

9. Net Charge-offs (QTD)

10. QTD NCO/Avg. Loans

(Annualized)

4Q22

$ 42.3

6.5

1.7

0.2

1Q23 2Q23 3Q23 4Q23

$ 46.6 $ 69.2 $ 53.1 $ 53.6

7.8

7.0

7.7

0.4

6.5

0.1

4.8

First Merchants Corporation

Helping you prosper

0.2

$ 50.7 $ 61.4 $ 77.3 $59.7 $ 58.6

0.42% 0.50% 0.63% 0.49% 0.47%

$ 215.2 $ 250.5 $ 257.0 $ 232.2 $ 242.8

1.79% 2.04% 2.09% 1.89% 1.94%

$ 3.4 $ 0.2 $ 1.9 $ 20.4 $ 3.1

0.12% 0.01% 0.06% 0.66% 0.10%

▪ Stable credit metrics

●

Highlights

●

NPAS + 90 day past due 47 basis points of Loans and

ORE

NPAS + 90 day past due declined $1.1 million or

2 bps to 47 basis points of loans and ORE

▪ Consistent portfolio performance despite higher rates

Classified Loans mostly unchanged from 1.89% to

1.94%

▪ Modest charge-off Levels

Q4 Net Charge-offs of $3.1 million, 10 basis points

of average loans (annualized)

• 2023 Net Charge-offs of $25.6 million, 21 basis

points of average loans

21View entire presentation