Bakkt SPAC Presentation Deck

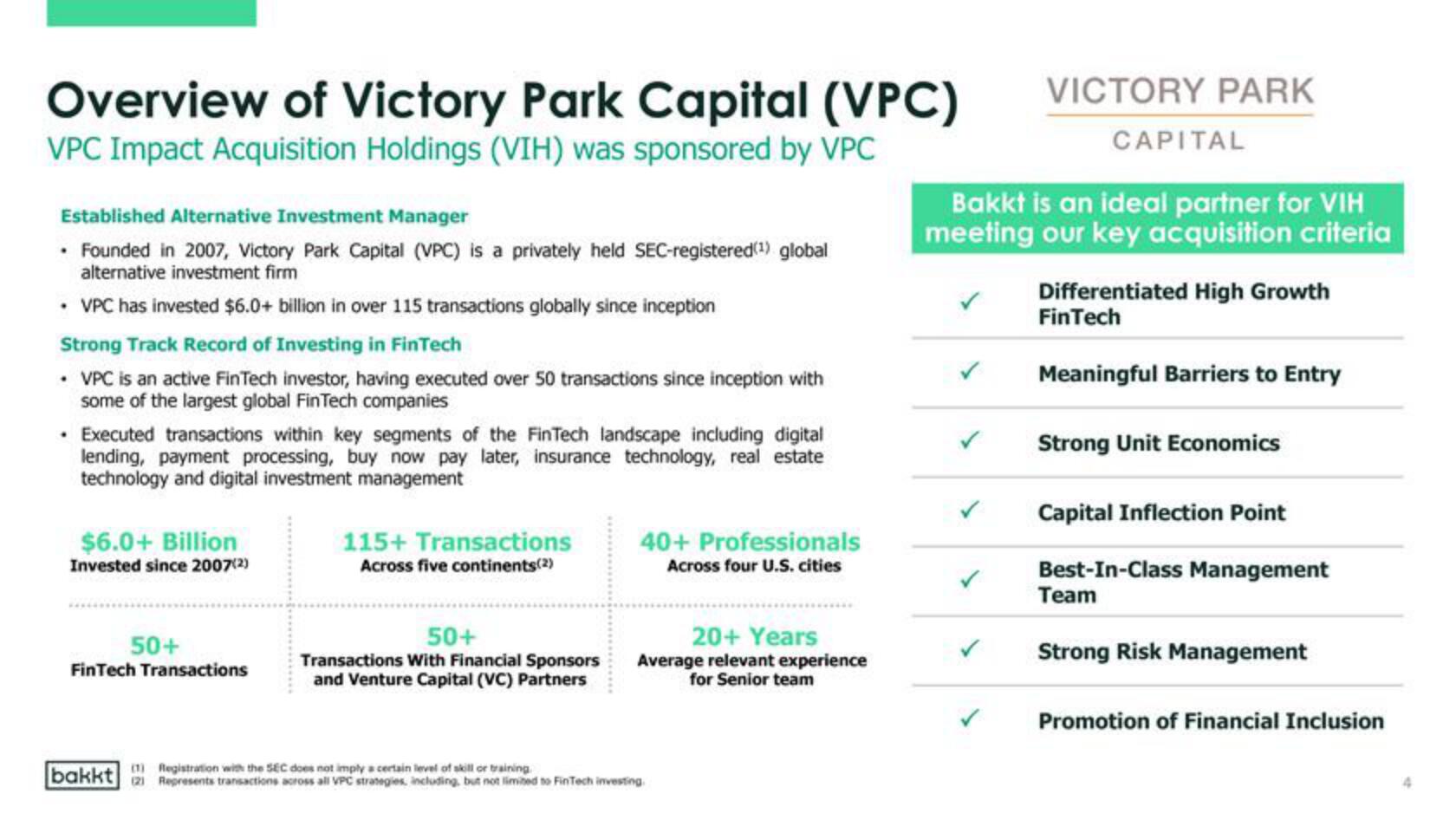

Overview of Victory Park Capital (VPC)

VPC Impact Acquisition Holdings (VIH) was sponsored by VPC

Established Alternative Investment Manager

. Founded in 2007, Victory Park Capital (VPC) is a privately held SEC-registered (¹) global

alternative investment firm

• VPC has invested $6.0+ billion in over 115 transactions globally since inception

Strong Track Record of Investing in FinTech

• VPC is an active FinTech investor, having executed over 50 transactions since inception with

some of the largest global FinTech companies

.

• Executed transactions within key segments of the FinTech landscape including digital

lending, payment processing, buy now pay later, insurance technology, real estate

technology and digital investment management

$6.0+ Billion

Invested since 2007(2)

50+

FinTech Transactions

bakkt

115+ Transactions

Across five continents(2)

50+

Transactions With Financial Sponsors

and Venture Capital (VC) Partners

40+ Professionals

Across four U.S. cities

20+ Years

Average relevant experience

for Senior team

(1) Registration with the SEC does not imply a certain level of skill or training.

(2) Represents transactions across all VPC strategies, including, but not limited to FinTech investing.

VICTORY PARK

CAPITAL

Bakkt is an ideal partner for VIH

meeting our key acquisition criteria

Differentiated High Growth

FinTech

Meaningful Barriers to Entry

Strong Unit Economics

Capital Inflection Point

Best-In-Class Management

Team

Strong Risk Management

Promotion of Financial InclusionView entire presentation