Alternus Energy SPAC Presentation Deck

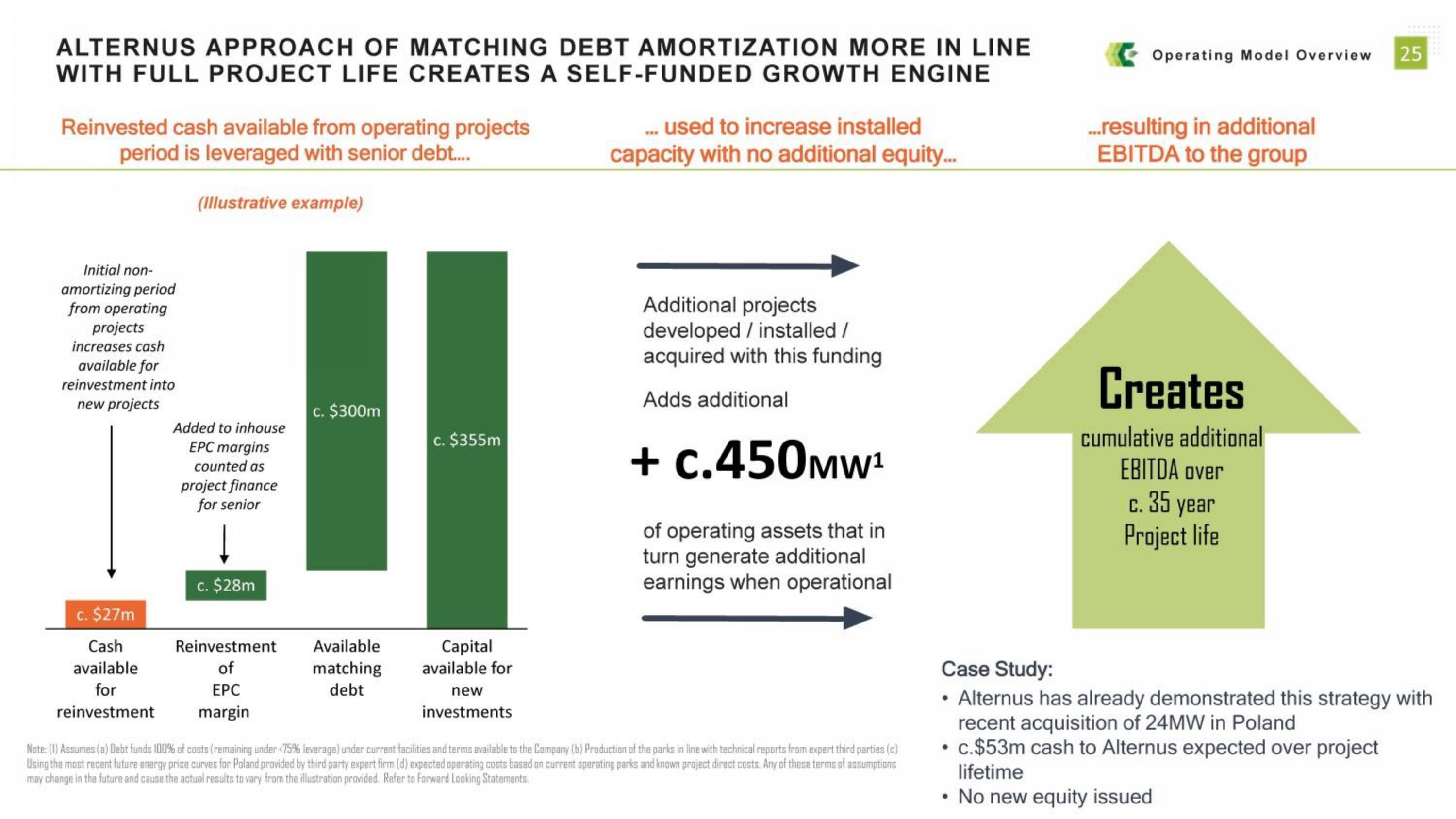

ALTERNUS APPROACH OF MATCHING DEBT AMORTIZATION MORE IN LINE

WITH FULL PROJECT LIFE CREATES A SELF-FUNDED GROWTH ENGINE

Reinvested cash available from operating projects

period is leveraged with senior debt....

Initial non-

amortizing period

from operating

projects

increases cash

available for

reinvestment into

new projects

c. $27m

Cash

available

for

reinvestment

(Illustrative example)

Added to inhouse

EPC margins

counted as

project finance

for senior

c. $28m

Reinvestment

of

EPC

margin

c. $300m

Available

matching

debt

c. $355m

Capital

available for

new

investments

... used to increase installed

capacity with no additional equity...

Additional projects

developed / installed /

acquired with this funding

Adds additional

+ C.450MW¹

of operating assets that in

turn generate additional

earnings when operational

Note: (1) Assumes (a) Debt funds 100% of costs (remaining under <75% leverage) under current facilities and terms available to the Company (b) Production of the parks in line with technical reports from expert third parties (c)

Using the most recent future energy price curves for Poland provided by third party expert firm (d) expected operating costs based on current operating parks and known project direct costs. Any of these terms of assumptions

may change in the future and cause the actual results to vary from the illustration provided. Refer to Forward Looking Statements.

Operating Model Overview

●

...resulting in additional

EBITDA to the group

Creates

cumulative additional

EBITDA over

c. 35 year

Project life

25

Case Study:

Alternus has already demonstrated this strategy with

recent acquisition of 24MW in Poland

• c.$53m cash to Alternus expected over project

lifetime

• No new equity issuedView entire presentation