Topps SPAC Presentation Deck

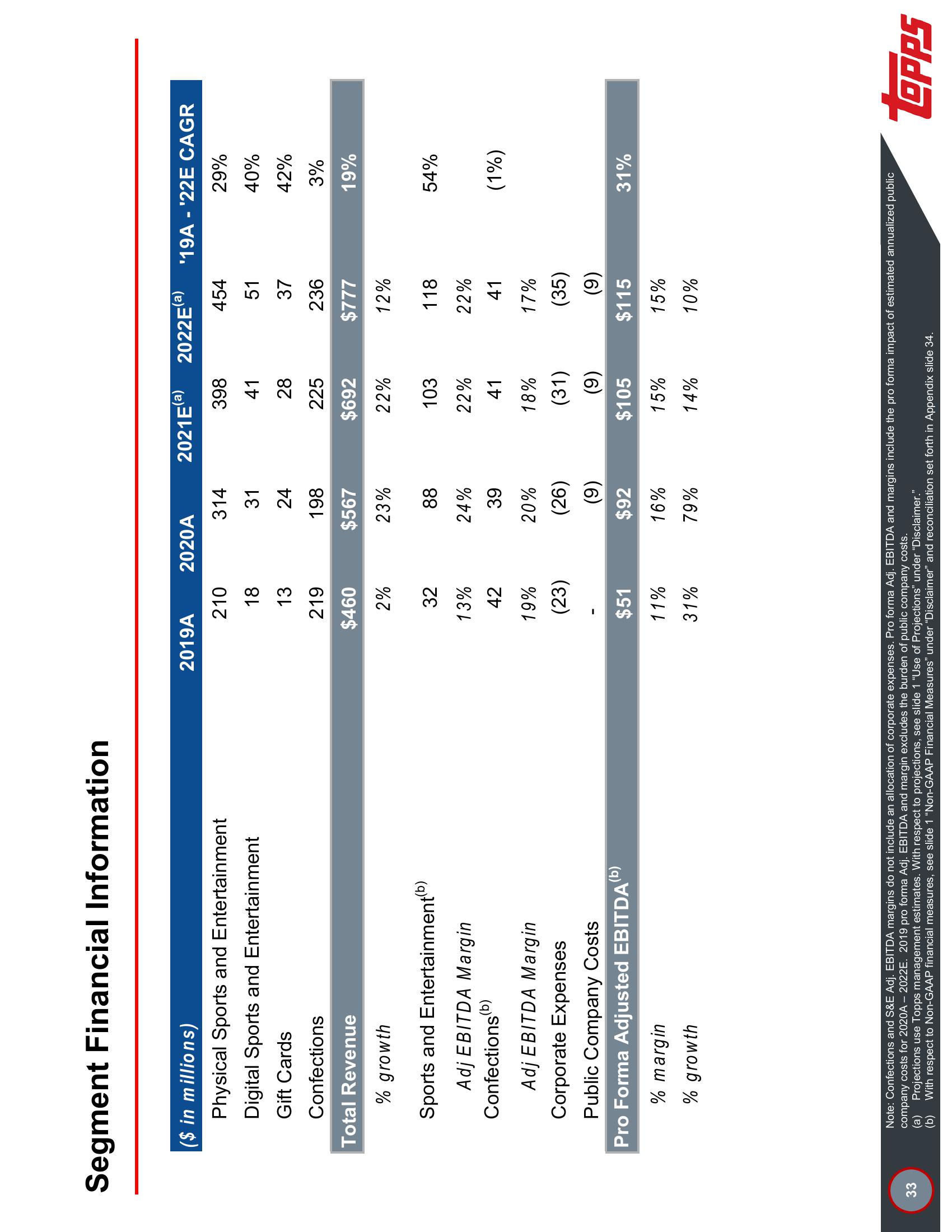

Segment Financial Information

33

($ in millions)

Physical Sports and Entertainment

Digital Sports and Entertainment

Gift Cards

Confections

Total Revenue

% growth

Sports and Entertainment(b)

Adj EBITDA Margin

Confections(b)

Adj EBITDA Margin

Corporate Expenses

Public Company Costs

Pro Forma Adjusted EBITDA (b)

% margin

% growth

2019A 2020A

210

18

13

219

$460

2%

32

13%

42

19%

(23)

$51

11%

31%

314

31

24

198

$567

23%

88

24%

39

20%

(26)

(9)

$92

16%

79%

2021E(a) 2022E(a)

398

41

28

225

$692

22%

103

22%

41

18%

(31)

(9)

$105

15%

14%

454

51

37

236

$777

12%

118

22%

41

17%

(35)

(9)

$115

15%

10%

'19A - '22E CAGR

29%

40%

42%

3%

19%

54%

(1%)

31%

Note: Confections and S&E Adj. EBITDA margins do not include an allocation of corporate expenses. Pro forma Adj. EBITDA and margins include the pro forma impact of estimated annualized public

company costs for 2020A - 2022E. 2019 pro forma Adj. EBITDA and margin excludes the burden of public company costs.

(a) Projections use Topps management estimates. With respect to projections, see slide 1 "Use of Projections" under "Disclaimer."

(b)

With respect to Non-GAAP financial measures, see slide 1 "Non-GAAP Financial Measures" under "Disclaimer" and reconciliation set forth in Appendix slide 34.

LOPPSView entire presentation