Kinnevik Results Presentation Deck

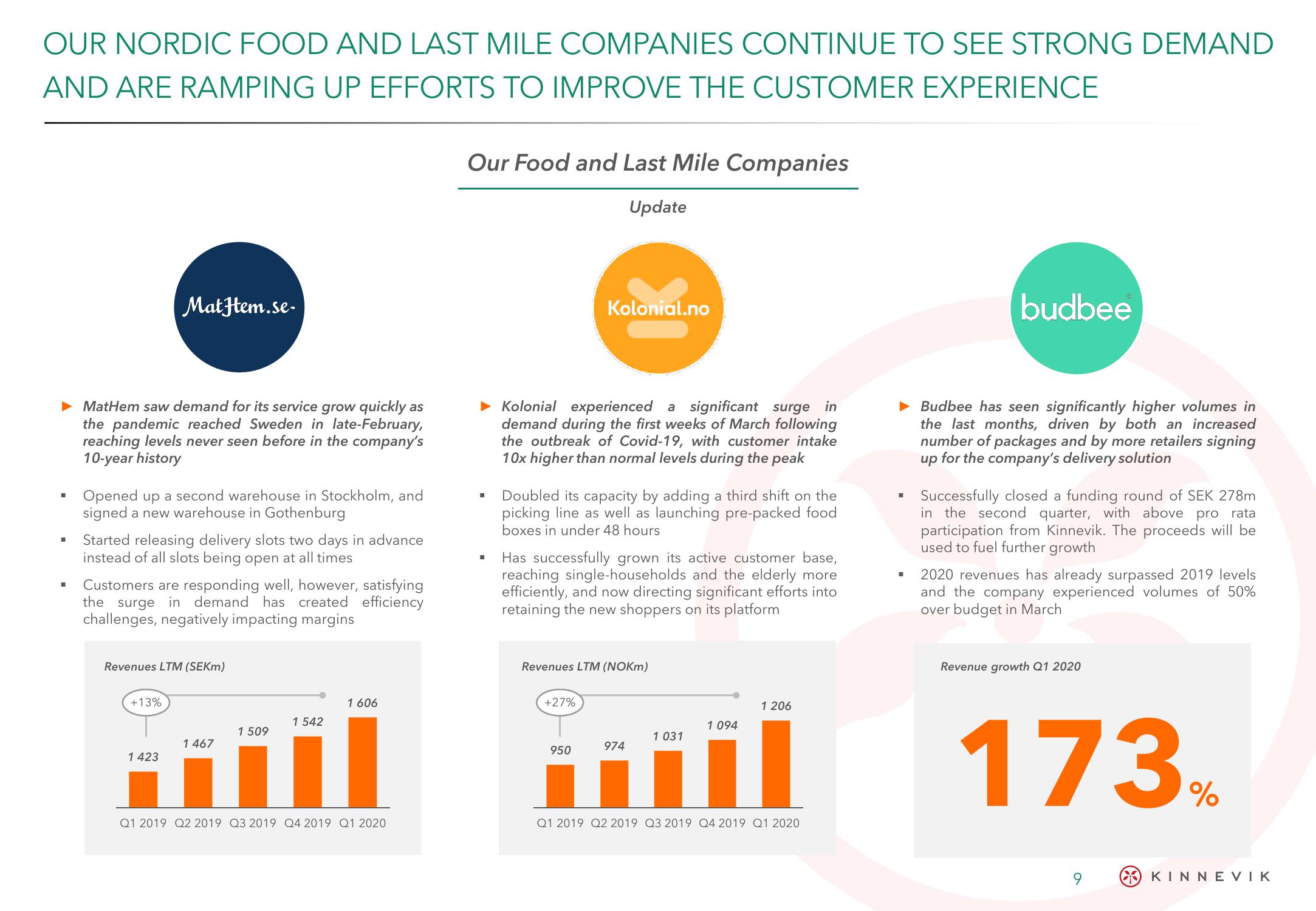

OUR NORDIC FOOD AND LAST MILE COMPANIES CONTINUE TO SEE STRONG DEMAND

AND ARE RAMPING UP EFFORTS TO IMPROVE THE CUSTOMER EXPERIENCE

► MatHem saw demand for its service grow quickly as

the pandemic reached Sweden in late-February,

reaching levels never seen before in the company's

10-year history

I

MatItem.se.

Opened up a second warehouse in Stockholm, and

signed a new warehouse in Gothenburg

Started releasing delivery slots two days in advance

instead of all slots being open at all times

Customers are responding well, however, satisfying

the surge in demand has created efficiency

challenges, negatively impacting margins

Revenues LTM (SEKm)

+13%

1423

1 467

1 509

1 542

1606

Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020

Our Food and Last Mile Companies

Update

■

1

Kolonial experienced a significant surge in

demand during the first weeks of March following

the outbreak of Covid-19, with customer intake

10x higher than normal levels during the peak

Kolonial.no

Doubled its capacity by adding a third shift on the

picking line as well as launching pre-packed food

boxes in under 48 hours

Has successfully grown its active customer base,

reaching single-households and the elderly more

efficiently, and now directing significant efforts into

retaining the new shoppers on its platform

Revenues LTM (NOKm)

+27%

950

1 031

1 094

1 206

974

T

Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020

I

budbee

Budbee has seen significantly higher volumes in

the last months, driven by both an increased

number of packages and by more retailers signing

up for the company's delivery solution

Successfully closed a funding round of SEK 278m

in the second quarter, with above pro rata

participation from Kinnevik. The

oceeds will be

used to fuel further growth

2020 revenues has already surpassed 2019 levels

and the company experienced volumes of 50%

over budget in March

Revenue growth Q1 2020

173%

KINNEVIKView entire presentation