J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

CORPORATE & INVESTMENT BANK

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except where otherwise noted)

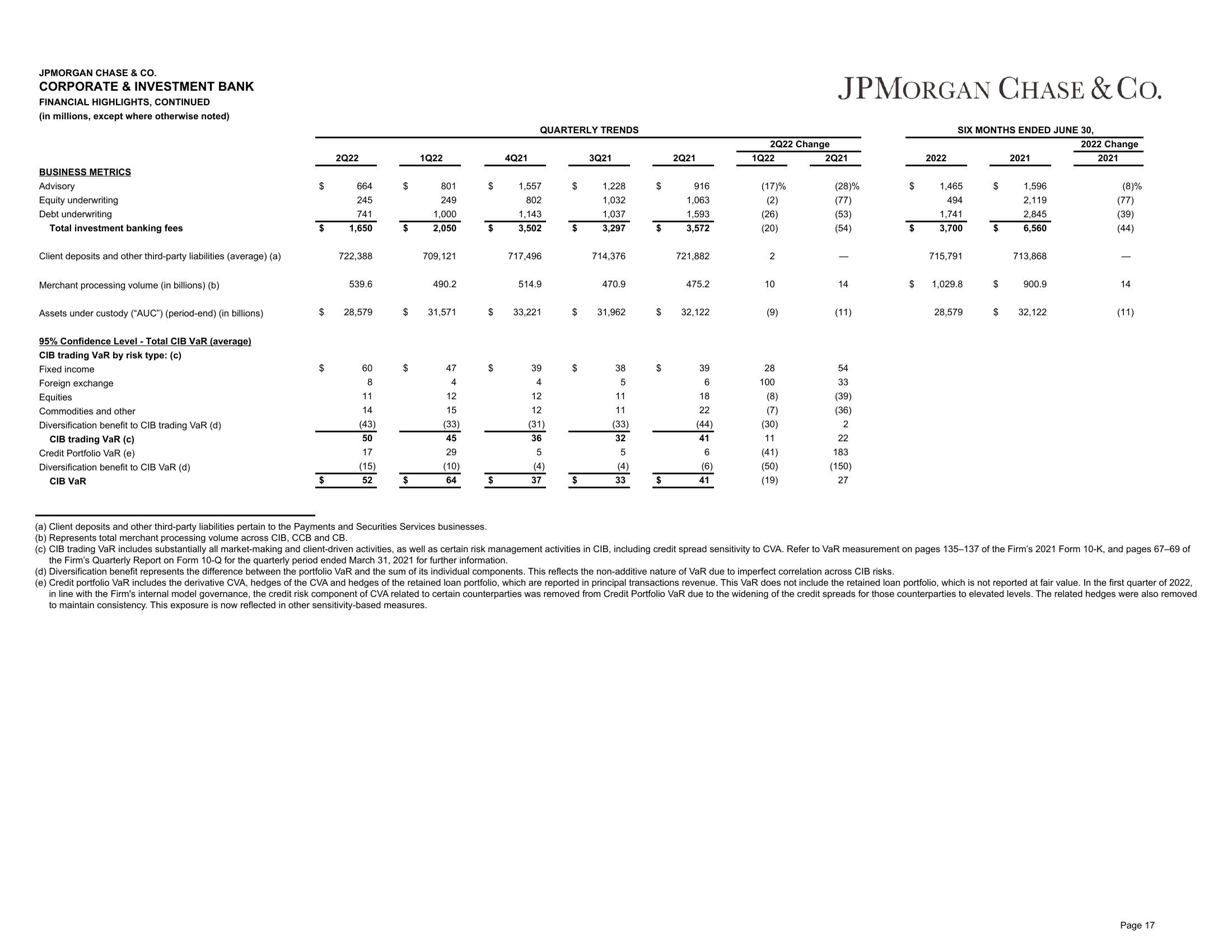

BUSINESS METRICS

Advisory

Equity underwriting

Debt underwriting

Total investment banking fees

Client deposits and other third-party liabilities (average) (a)

Merchant processing volume (in billions) (b)

Assets under custody ("AUC") (period-end) (in billions)

95% Confidence Level - Total CIB VaR (average)

CIB trading VaR by risk type: (c)

Fixed income

Foreign exchange

Equities

Commodities and other

Diversification benefit to CIB trading VaR (d)

CIB trading VaR (c)

Credit Portfolio VaR (e)

Diversification benefit to CIB VaR (d)

CIB VaR

$

$

$

2Q22

$

664

245

741

1,650

722,388

$ 28,579

539.6

60

8

11

14

(43)

50

17

(15)

52

$

$

1Q22

$

801

249

1,000

2,050

709,121

490.2

$ 31,571

47

4

12

15

(33)

45

29

(10)

64

$

$

$

4Q21

$

QUARTERLY TRENDS

1,557

802

1,143

3,502

717,496

$ 33,221

514.9

39

4

12

12

(31)

36

5

(4)

37

$

$

3Q21

$

1,228

1,032

1,037

3,297

714,376

$ 31,962

470.9

38

5

11

11

(33)

32

5

(4)

33

$

$

$

$

2Q21

916

1,063

1,593

3,572

721,882

475.2

32,122

39

6

18

22

(44)

41

6

(6)

41

2Q22 Change

1Q22

(17)%

(2)

(26)

(20)

2

10

(9)

28

100

(8)

(7)

(30)

11

(41)

(50)

(19)

JPMORGAN CHASE & Co.

2Q21

(28)%

(77)

(53)

(54)

1

14

(11)

54

33

(39)

(36)

2

22

183

(150)

27

$

$

$

2022

SIX MONTHS ENDED JUNE 30,

1,465

494

1,741

3,700

715,791

1,029.8

28,579

$

$

$

$

2021

1,596

2,119

2,845

6,560

713,868

900.9

32,122

2022 Change

2021

(8)%

(77)

(39)

(44)

1

14

(11)

(a) Client deposits and other third-party liabilities pertain to the Payments and Securities Services businesses.

(b) Represents total merchant processing volume across CIB, CCB and CB.

(c) CIB trading VaR includes substantially all market-making and client-driven activities, as well as certain risk management activities in CIB, including credit spread sensitivity to CVA. Refer to VaR measurement on pages 135-137 of the Firm's 2021 Form 10-K, and pages 67-69 of

the Firm's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021 for further information.

(d) Diversification benefit represents the difference between the portfolio VaR and the sum of its individual components. This reflects the non-additive nature of VaR due to imperfect correlation across CIB risks.

(e) Credit portfolio VaR includes the derivative CVA, hedges of the CVA and hedges of the retained loan portfolio, which are reported in principal transactions revenue. This VaR does not include the retained loan portfolio, which is not reported at fair value. In the first quarter of 2022,

in line with the Firm's internal model governance, the credit risk component of CVA related to certain counterparties was removed from Credit Portfolio VaR due to the widening of the credit spreads for those counterparties to elevated levels. The related hedges were also removed

to maintain consistency. This exposure is now reflected in other sensitivity-based measures.

Page 17View entire presentation