PropertyGuru SPAC Presentation Deck

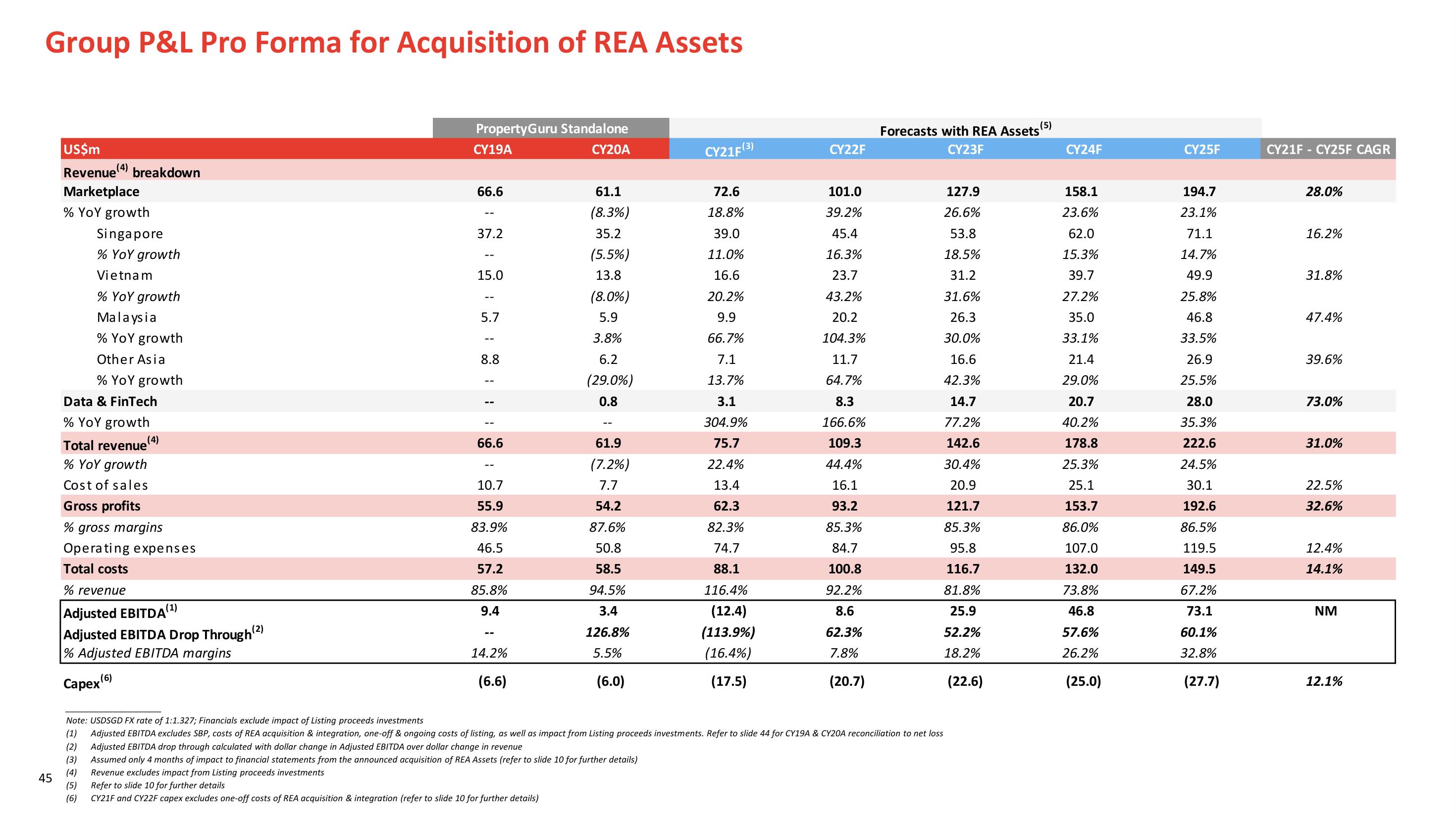

Group P&L Pro Forma for Acquisition of REA Assets

45

US$m

Revenue breakdown

Marketplace

% YoY growth

Singapore

% YoY growth

Vietnam

% YoY growth

Malaysia

% YoY growth

Other Asia

% YoY growth

Data & FinTech

% YoY growth

Total revenue (4)

% YoY growth

Cost of sales

Gross profits

% gross margins

Operating expenses

Total costs

% revenue

Adjusted EBITDA (¹)

Adjusted EBITDA Drop Through(²)

% Adjusted EBITDA margins

Capex (6)

PropertyGuru Standalone

CY20A

CY19A

66.6

37.2

15.0

5.7

8.8

--

66.6

--

10.7

55.9

83.9%

46.5

57.2

85.8%

9.4

--

14.2%

(6.6)

61.1

(8.3%)

35.2

(5.5%)

13.8

(8.0%)

5.9

3.8%

6.2

(29.0%)

0.8

Refer to slide 10 for further details

CY21F and CY22F capex excludes one-off costs of REA acquisition & integration (refer to slide 10 for further details)

--

61.9

(7.2%)

7.7

54.2

87.6%

50.8

58.5

94.5%

3.4

126.8%

5.5%

(6.0)

CY21F (3)

72.6

18.8%

39.0

11.0%

16.6

20.2%

9.9

66.7%

7.1

13.7%

3.1

304.9%

75.7

22.4%

13.4

62.3

82.3%

74.7

88.1

116.4%

(12.4)

(113.9%)

(16.4%)

(17.5)

CY22F

101.0

39.2%

45.4

16.3%

23.7

43.2%

20.2

104.3%

11.7

64.7%

8.3

166.6%

109.3

44.4%

16.1

93.2

85.3%

84.7

100.8

92.2%

8.6

62.3%

7.8%

(20.7)

Forecasts with REA Assets (5)

CY23F

127.9

26.6%

53.8

18.5%

31.2

31.6%

26.3

30.0%

16.6

42.3%

14.7

77.2%

142.6

30.4%

20.9

121.7

85.3%

95.8

116.7

81.8%

25.9

52.2%

18.2%

(22.6)

Note: USDSGD FX rate of 1:1.327; Financials exclude impact of Listing proceeds investments

(1) Adjusted EBITDA excludes SBP, costs of REA acquisition & integration, one-off & ongoing costs of listing, as well as impact from Listing proceeds investments. Refer to slide 44 for CY19A & CY20A reconciliation to net loss

(2) Adjusted EBITDA drop through calculated with dollar change in Adjusted EBITDA over dollar change in revenue

(3)

Assumed only 4 months of impact to financial statements from the announced acquisition of REA Assets (refer to slide 10 for further details)

Revenue excludes impact from Listing proceeds investments

(4)

(5)

(6)

CY24F

158.1

23.6%

62.0

15.3%

39.7

27.2%

35.0

33.1%

21.4

29.0%

20.7

40.2%

178.8

25.3%

25.1

153.7

86.0%

107.0

132.0

73.8%

46.8

57.6%

26.2%

(25.0)

CY25F

194.7

23.1%

71.1

14.7%

49.9

25.8%

46.8

33.5%

26.9

25.5%

28.0

35.3%

222.6

24.5%

30.1

192.6

86.5%

119.5

149.5

67.2%

73.1

60.1%

32.8%

(27.7)

CY21F CY25F CAGR

28.0%

16.2%

31.8%

47.4%

39.6%

73.0%

31.0%

22.5%

32.6%

12.4%

14.1%

NM

12.1%View entire presentation