IGI SPAC Presentation Deck

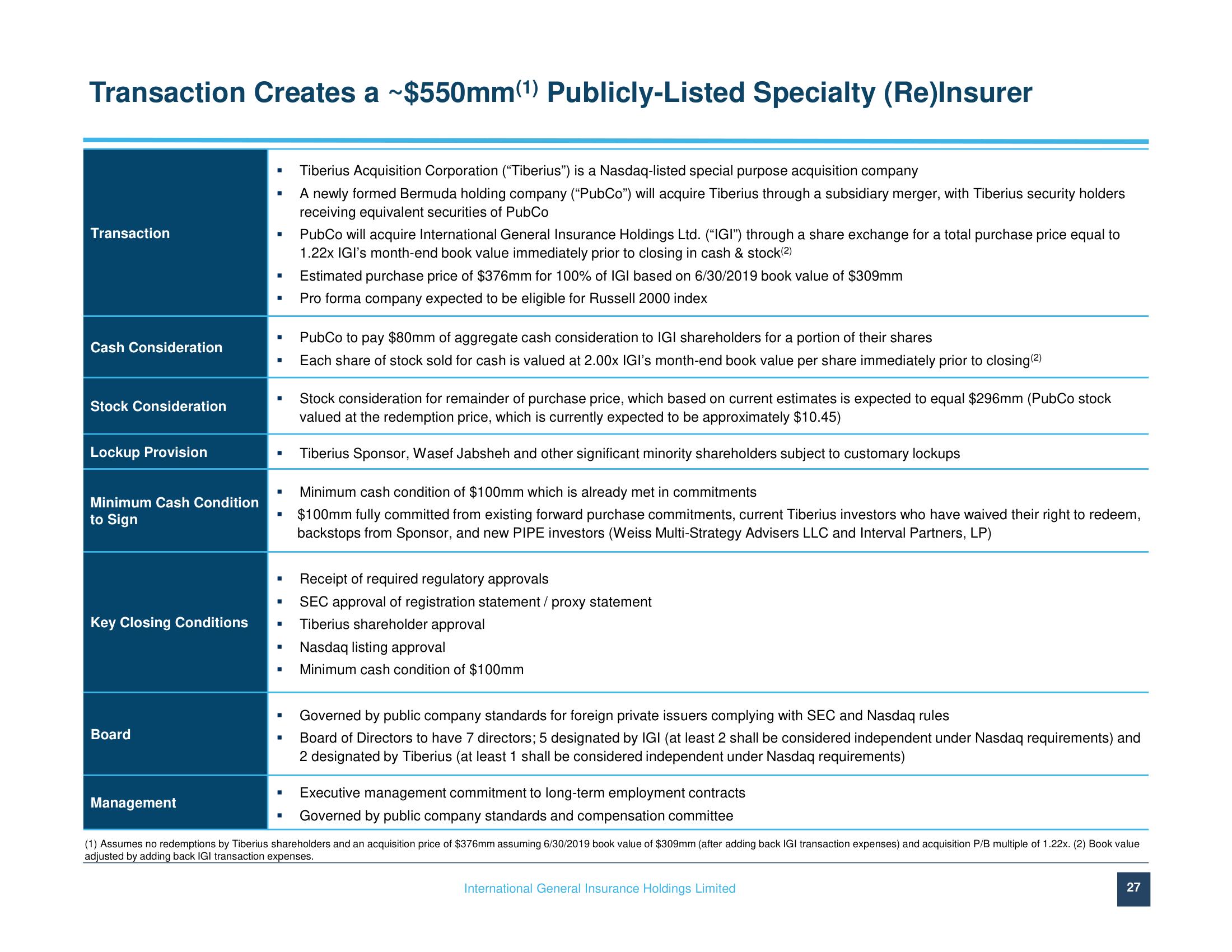

Transaction Creates a ~$550mm(1) Publicly-Listed Specialty (Re)Insurer

Transaction

Cash Consideration

Stock Consideration

Lockup Provision

Minimum Cash Condition

to Sign

Key Closing Conditions

Board

Management

I

■

■

■

■

■

■

-

■

■

■

■

■

■

■

■

Tiberius Acquisition Corporation ("Tiberius") is a Nasdaq-listed special purpose acquisition company

A newly formed Bermuda holding company ("PubCo") will acquire Tiberius through a subsidiary merger, with Tiberius security holders

receiving equivalent securities of PubCo

PubCo will acquire International General Insurance Holdings Ltd. ("IGI") through a share exchange for a total purchase price equal to

1.22x IGI's month-end book value immediately prior to closing in cash & stock(2)

Estimated purchase price of $376mm for 100% of IGI based on 6/30/2019 book value of $309mm

Pro forma company expected to be eligible for Russell 2000 index

PubCo to pay $80mm of aggregate cash consideration to IGI shareholders for a portion of their shares

Each share of stock sold for cash is valued at 2.00x IGI's month-end book value per share immediately prior to closing (2)

Stock consideration for remainder of purchase price, which based on current estimates is expected to equal $296mm (PubCo stock

valued at the redemption price, which is currently expected to be approximately $10.45)

Tiberius Sponsor, Wasef Jabsheh and other significant minority shareholders subject to customary lockups

Minimum cash condition of $100mm which is already met in commitments

$100mm fully committed from existing forward purchase commitments, current Tiberius investors who have waived their right to redeem,

backstops from Sponsor, and new PIPE investors (Weiss Multi-Strategy Advisers LLC and Interval Partners, LP)

Receipt of required regulatory approvals

SEC approval of registration statement / proxy statement

Tiberius shareholder approval

Nasdaq listing approval

Minimum cash condition of $100mm

Governed by public company standards for foreign private issuers complying with SEC and Nasdaq rules

Board of Directors to have 7 directors; 5 designated by IGI (at least 2 shall be considered independent under Nasdaq requirements) and

2 designated by Tiberius (at least 1 shall be considered independent under Nasdaq requirements)

Executive management commitment to long-term employment contracts

Governed by public company standards and compensation committee

(1) Assumes no redemptions by Tiberius shareholders and an acquisition price of $376mm assuming 6/30/2019 book value of $309mm (after adding back IGI transaction expenses) and acquisition P/B multiple of 1.22x. (2) Book value

adjusted by adding back IGI transaction expenses.

International General Insurance Holdings Limited

27View entire presentation