Barclays Capital 2010 Global Financial Services Conference

Non-Core run-down & EU Disposals on track

XRBS

Non-Core run-down and EU disposals progressing well, lowers execution risk

Non-Core

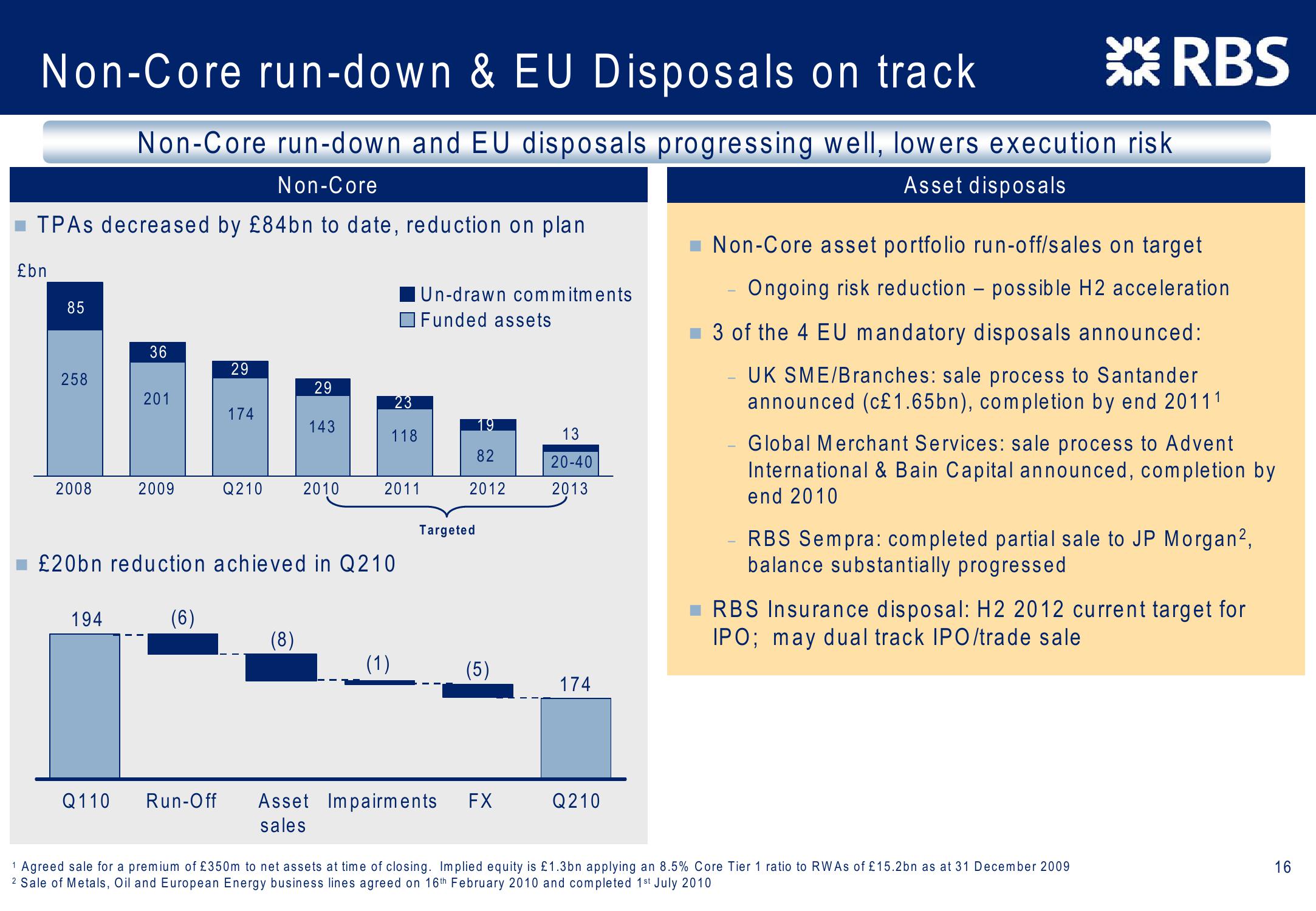

TPAS decreased by £84bn to date, reduction on plan

£bn

85

| Un-drawn commitments

Funded assets

36

29

258

29

201

23

174

143

19

118

82

2008

2009

Q210

2010

2011

2012

13

20-40

2013

Targeted

£20bn reduction achieved in Q210

194

(6)

(8)

(1)

(5)

174

Asset disposals

Non-Core asset portfolio run-off/sales on target

-

Ongoing risk reduction - possible H2 acceleration

3 of the 4 EU mandatory disposals announced:

UK SME/Branches: sale process to Santander

announced (c£1.65bn), completion by end 20111

Global Merchant Services: sale process to Advent

International & Bain Capital announced, completion by

end 2010

RBS Sempra: completed partial sale to JP Morgan²,

balance substantially progressed

RBS Insurance disposal: H2 2012 current target for

IPO; may dual track IPO/trade sale

Q110 Run-Off

Asset Impairments

sales

FX

Q210

1 Agreed sale for a premium of £350m to net assets at time of closing. Implied equity is £1.3bn applying an 8.5% Core Tier 1 ratio to RWAs of £15.2bn as at 31 December 2009

2 Sale of Metals, Oil and European Energy business lines agreed on 16th February 2010 and completed 1st July 2010

16View entire presentation