Q2 2018 Fixed Income Investor Conference Call

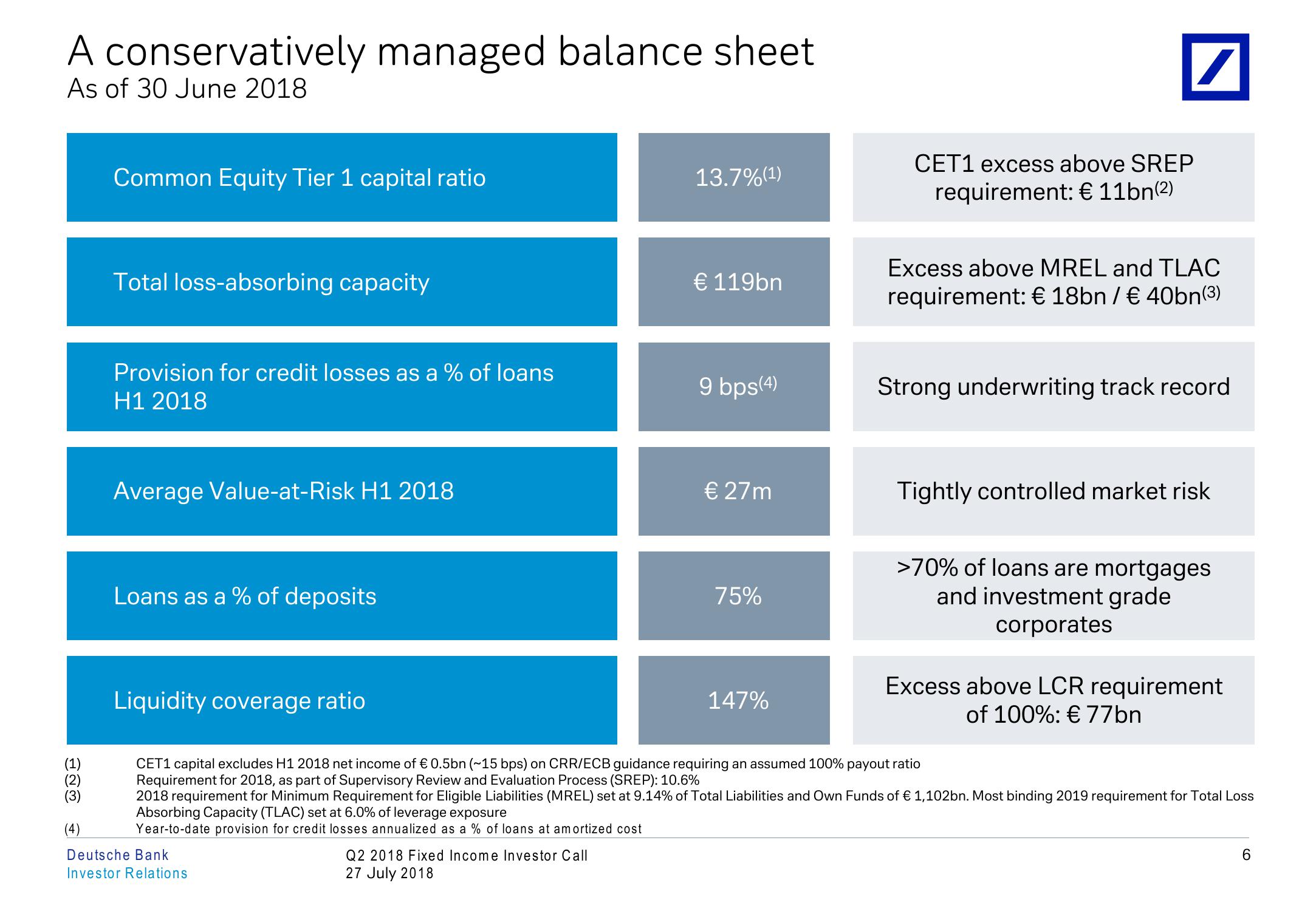

A conservatively managed balance sheet

As of 30 June 2018

Common Equity Tier 1 capital ratio

Total loss-absorbing capacity

13.7% (1)

CET1 excess above SREP

requirement: € 11bn (2)

☑

€ 119bn

Excess above MREL and TLAC

requirement: € 18bn / € 40bn (3)

Provision for credit losses as a % of loans

H1 2018

9 bps(4)

Strong underwriting track record

Average Value-at-Risk H1 2018

Loans as a % of deposits

Liquidity coverage ratio

€ 27m

Tightly controlled market risk

75%

147%

>70% of loans are mortgages

and investment grade

corporates

Excess above LCR requirement

of 100%: € 77bn

(1)

(2)

CET1 capital excludes H1 2018 net income of € 0.5bn (~15 bps) on CRR/ECB guidance requiring an assumed 100% payout ratio

Requirement for 2018, as part of Supervisory Review and Evaluation Process (SREP): 10.6%

(3)

(4)

2018 requirement for Minimum Requirement for Eligible Liabilities (MREL) set at 9.14% of Total Liabilities and Own Funds of € 1,102bn. Most binding 2019 requirement for Total Loss

Absorbing Capacity (TLAC) set at 6.0% of leverage exposure

Year-to-date provision for credit losses annualized as a % of loans at amortized cost

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

6View entire presentation