Bank of America Investment Banking Pitch Book

Preliminary Valuation Considerations

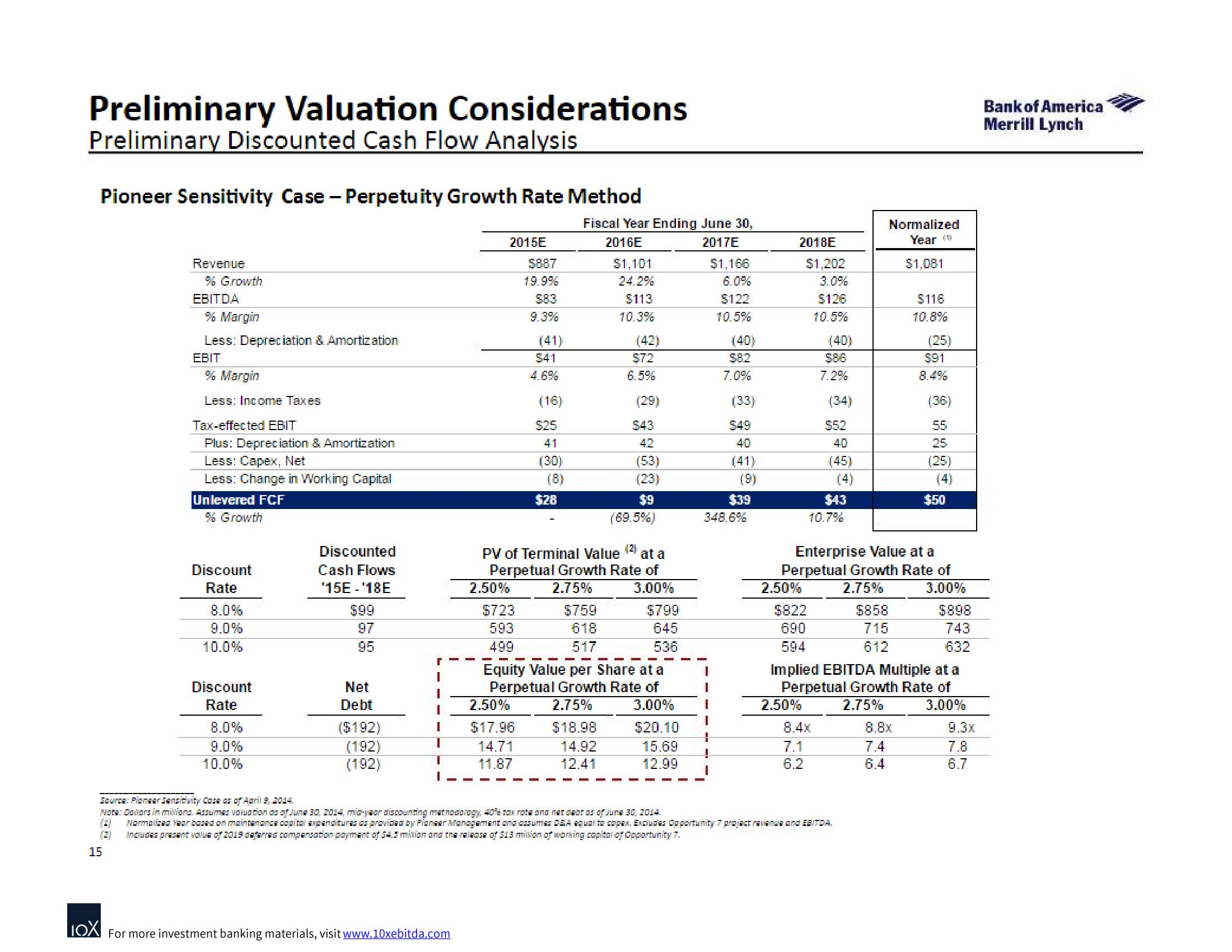

Preliminary Discounted Cash Flow Analysis

Pioneer Sensitivity Case - Perpetuity Growth Rate Method

Revenue

% Growth

EBITDA

% Margin

Less: Depreciation & Amortization

EBIT

% Margin

Less: Income Taxes

Tax-effected EBIT

Plus: Depreciation & Amortization

Less: Capex, Net

Less: Change in Working Capital

Unlevered FCF

% Growth

Discount

Rate

8.0%

9.0%

10.0%

Discount

Rate

8.0%

9.0%

10.0%

Discounted

Cash Flows

'15E - '18E

$99

97

95

Net

Debt

($192)

(192)

(192)

1

I

I

LOX For more investment banking materials, visit www.10xebitda.com

2015E

2.50%

$723

593

499

$887

19.9%

$83

9.3%

(41)

2.50%

$17.96

14.71

11.87

$41

4.6%

(16)

$25

41

(30)

(8)

$28

Fiscal Year Ending June 30,

2016E

2017E

$759

618

517

$1,101

24.2%

$113

10.3%

(2)

PV of Terminal Value at a

Perpetual Growth Rate of

2.75%

3.00%

(42)

$18.98

14.92

12.41

$7.2

6.5%

(29)

$43

42

(53)

(23)

$9

(69.5%)

Equity Value per Share at a

Perpetual Growth Rate of

2.75% 3.00%

$799

645

536

$20.10

15.69

12.99

$1,166

6.0%

$122

10.5%

1

(40)

$82

7.0%

(33)

$49

40

(41)

(9)

$39

348.6%

2018E

2.50%

$1,202

3.0%

$126

10.5%

$822

690

594

2.50%

(40)

S86

7.2%

(34)

8.4x

7.1

6.2

$52

40

(45)

$43

10.7%

Source: Pioneer Sensitivity Cose as of April 9, 2014.

Note: Dollars in milions. Assumes valuation as of June 30, 2014, mid-year discounting methodology 40% tax rate and net debt as of June 30, 2014.

(3) Normalized Year based on maintenance capital axpenditures as provided by Pioneer Management and assumes D&A equal to capax. Excludes Opportunity 7 project revenue and EBITDA.

(2) Includes present value of 2019 deferred compensation payment of 54.5 million and the release of $13 million of working capital of Opportunity 7.

15

Normalized

Year (

$1,081

Enterprise Value at a

Perpetual Growth Rate of

2.75%

3.00%

$858

715

612

$116

10.8%

(25)

8.8x

7.4

6.4

$91

8.4%

(36)

55

25

(25)

Implied EBITDA Multiple at a

Perpetual Growth Rate of

2.75%

3.00%

$50

$898

743

632

9.3x

7.8

6.7

Bank of America

Merrill LynchView entire presentation