Kinnevik Results Presentation Deck

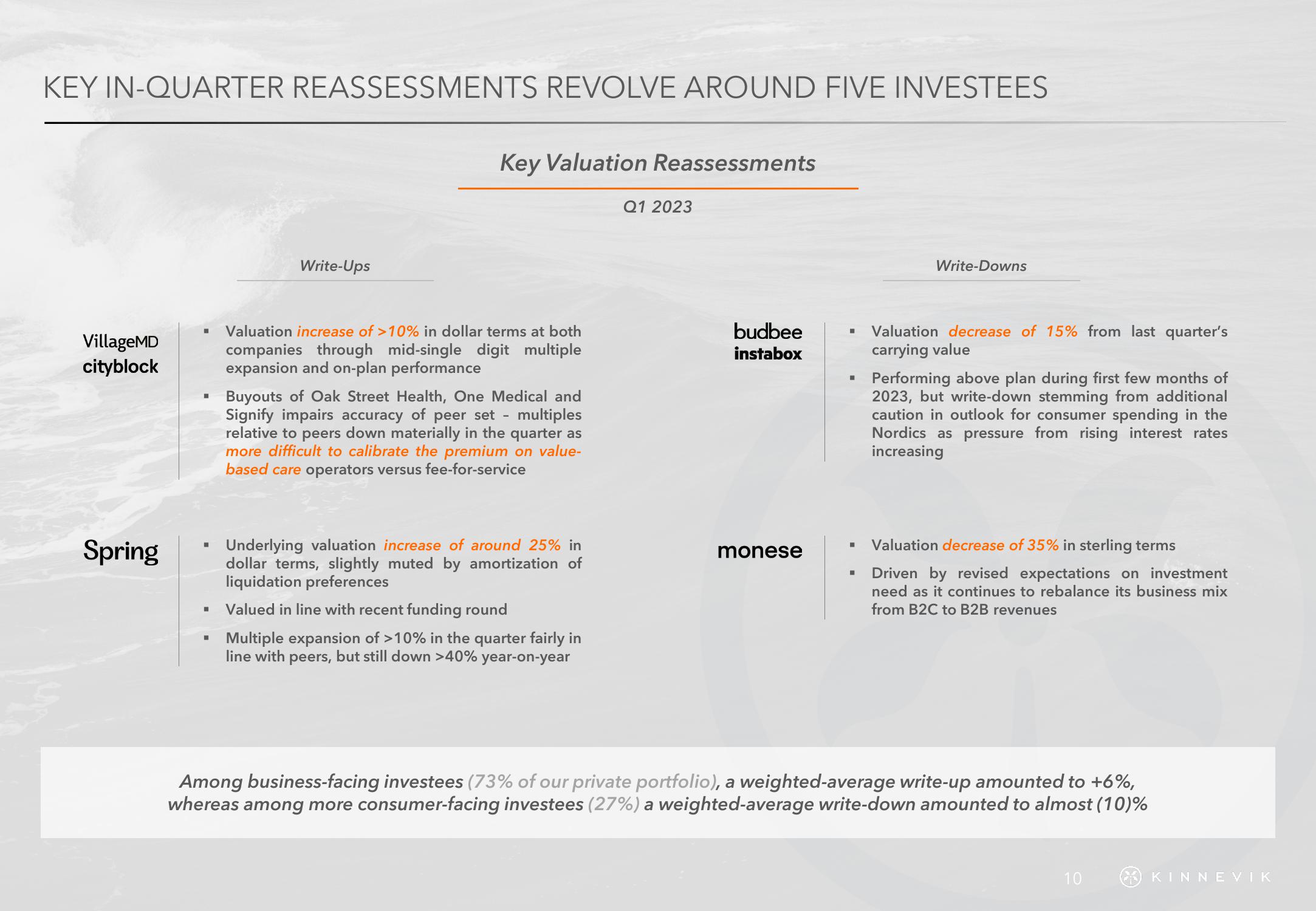

KEY IN-QUARTER REASSESSMENTS REVOLVE AROUND FIVE INVESTEES

VillageMD

cityblock

Spring

Write-Ups

■

Key Valuation Reassessments

W Valuation increase of >10% in dollar terms at both

companies through mid-single digit multiple

expansion and on-plan performance

Buyouts of Oak Street Health, One Medical and

Signify impairs accuracy of peer set - multiples

relative to peers down materially in the quarter as

more difficult to calibrate the premium on value-

based care operators versus fee-for-service

Underlying valuation increase of around 25% in

dollar terms, slightly muted by amortization of

liquidation preferences

Valued in line with recent funding round

Multiple expansion of >10% in the quarter fairly in

line with peers, but still down >40% year-on-year

Q1 2023

budbee

instabox

monese

H

■

H

■

Write-Downs

Valuation decrease of 15% from last quarter's

carrying value

Performing above plan during first few months of

2023, but write-down stemming from additional

caution in outlook for consumer spending in the

Nordics as pressure from rising interest rates

increasing

Valuation decrease of 35% in sterling terms

Driven by revised expectations on investment

need as it continues to rebalance its business mix

from B2C to B2B revenues

Among business-facing investees (73% of our private portfolio), a weighted-average write-up amounted to +6%,

whereas among more consumer-facing investees (27%) a weighted-average write-down amounted to almost (10)%

10

KINNEVIKView entire presentation