Terran Orbital SPAC Presentation Deck

Sources & Uses and Pro-Forma Valuation

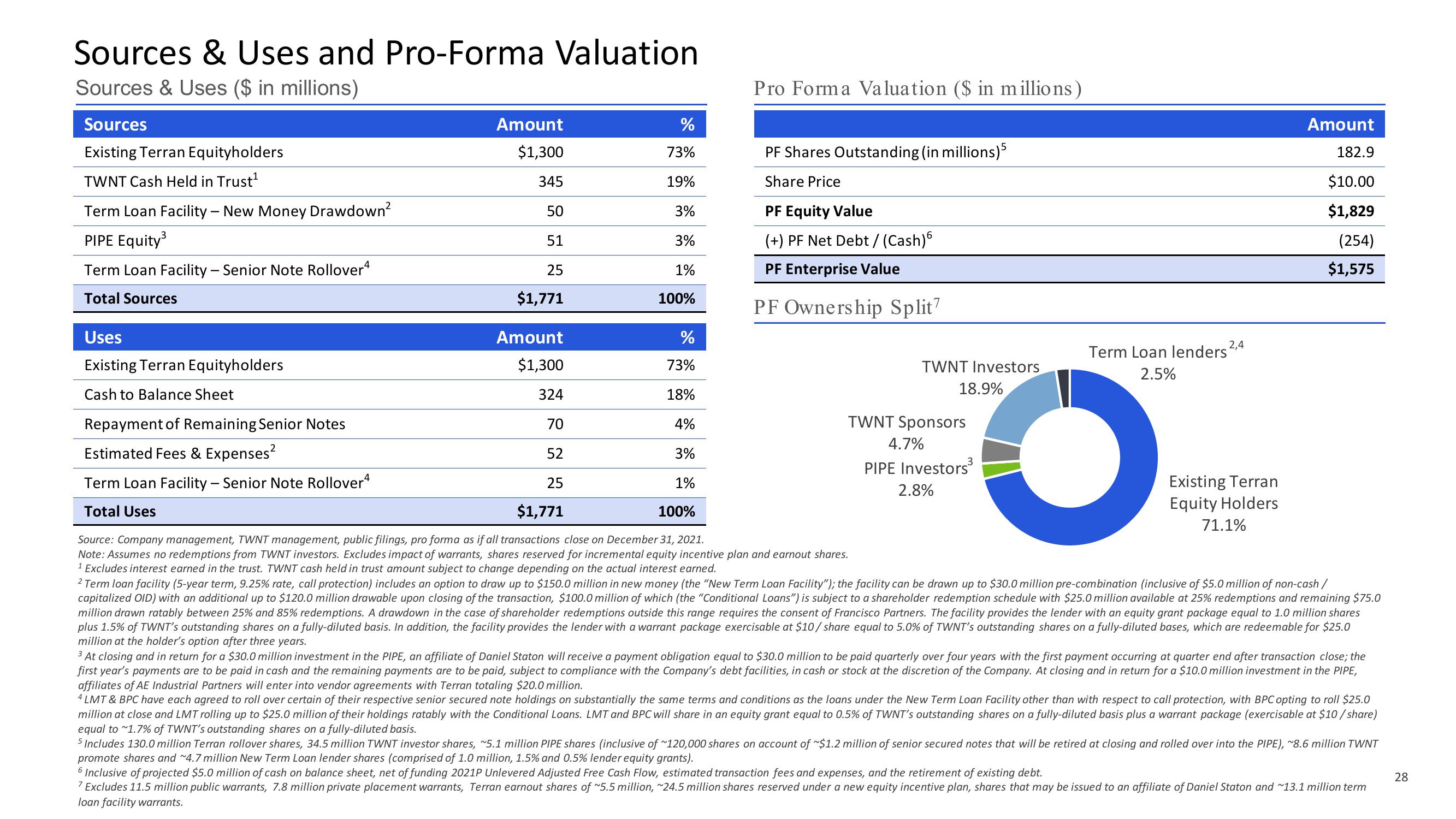

Sources & Uses ($ in millions)

Sources

Existing Terran Equityholders

TWNT Cash Held in Trust¹

Term Loan Facility - New Money Drawdown²

PIPE Equity³

Term Loan Facility - Senior Note Rollover4

Total Sources

Uses

Existing Terran Equityholders

Cash to Balance Sheet

Amount

$1,300

345

50

51

25

$1,771

Repayment of Remaining Senior Notes

Estimated Fees & Expenses²

Term Loan Facility - Senior Note Rollover4

Total Uses

%

73%

19%

3%

3%

1%

100%

Amount

$1,300

324

70

52

Pro Forma Valuation ($ in millions)

PF Shares Outstanding (in millions)5

Share Price

%

73%

18%

4%

3%

25

1%

$1,771

100%

Source: Company management, TWNT management, public filings, pro forma as if all transactions close on December 31, 2021.

Note: Assumes no redemptions from TWNT investors. Excludes impact of warrants, shares reserved for incremental equity incentive plan and earnout shares.

1 Excludes interest earned in the trust. TWNT cash held in trust amount subject to change depending on the actual interest earned.

2 Term loan facility (5-year term, 9.25% rate, call protection) includes an option to draw up to $150.0 million in new money (the "New Term Loan Facility"); the facility can be drawn up to $30.0 million pre-combination (inclusive of $5.0 million of non-cash /

capitalized OID) with an additional up to $120.0 million drawable upon closing of the transaction, $100.0 million of which (the "Conditional Loans") is subject to a shareholder redemption schedule with $25.0 million available at 25% redemptions and remaining $75.0

million drawn ratably between 25% and 85% redemptions. A drawdown in the case of shareholder redemptions outside this range requires the consent of Francisco Partners. The facility provides the lender with an equity grant package equal to 1.0 million shares

plus 1.5% of TWNT's outstanding shares on a fully-diluted basis. In addition, the facility provides the lender with a warrant package exercisable at $10/share equal to 5.0% of TWNT's outstanding shares on a fully-diluted bases, which are redeemable for $25.0

million at the holder's option after three years.

PF Equity Value

(+) PF Net Debt / (Cash)6

PF Enterprise Value

PF Ownership Split7

TWNT Investors

18.9%

TWNT Sponsors

4.7%

PIPE Investors³

2.8%

Term Loan lenders

2.5%

2,4

Amount

182.9

$10.00

$1,829

(254)

$1,575

Existing Terran

Equity Holders

71.1%

3 At closing and in return for a $30.0 million investment in the PIPE, an affiliate of Daniel Staton will receive a payment obligation equal to $30.0 million to be paid quarterly over four years with the first payment occurring at quarter end after transaction close; the

first year's payments are to be paid in cash and the remaining payments are to be paid, subject to compliance with the Company's debt facilities, in cash or stock at the discretion of the Company. At closing and in return for a $10.0 million investment in the PIPE,

affiliates of AE Industrial Partners will enter into vendor agreements with Terran totaling $20.0 million.

4 LMT & BPC have each agreed to roll over certain of their respective senior secured note holdings on substantially the same terms and conditions as the loans under the New Term Loan Facility other than with respect to call protection, with BPC opting to roll $25.0

million at close and LMT rolling up to $25.0 million of their holdings ratably with the Conditional Loans. LMT and BPC will share in an equity grant equal to 0.5% of TWNT's outstanding shares on a fully-diluted basis plus a warrant package (exercisable at $10/share)

equal to 1.7% of TWNT's outstanding shares on a fully-diluted basis.

5 Includes 130.0 million Terran rollover shares, 34.5 million TWNT investor shares, ~5.1 million PIPE shares (inclusive of ~120,000 shares on account of $1.2 million of senior secured notes that will be retired at closing and rolled over into the PIPE), ~8.6 million TWNT

promote shares and ~4.7 million New Term Loan lender shares (comprised of 1.0 million, 1.5% and 0.5% lender equity grants).

6 Inclusive of projected $5.0 million of cash on balance sheet, net of funding 2021P Unlevered Adjusted Free Cash Flow, estimated transaction fees and expenses, and the retirement of existing debt.

7 Excludes 11.5 million public warrants, 7.8 million private placement warrants, Terran earnout shares of ~5.5 million, ~24.5 million shares reserved under a new equity incentive plan, shares that may be issued to an affiliate of Daniel Staton and ~13.1 million term

loan facility warrants.

28View entire presentation