HSBC Investor Day Presentation Deck

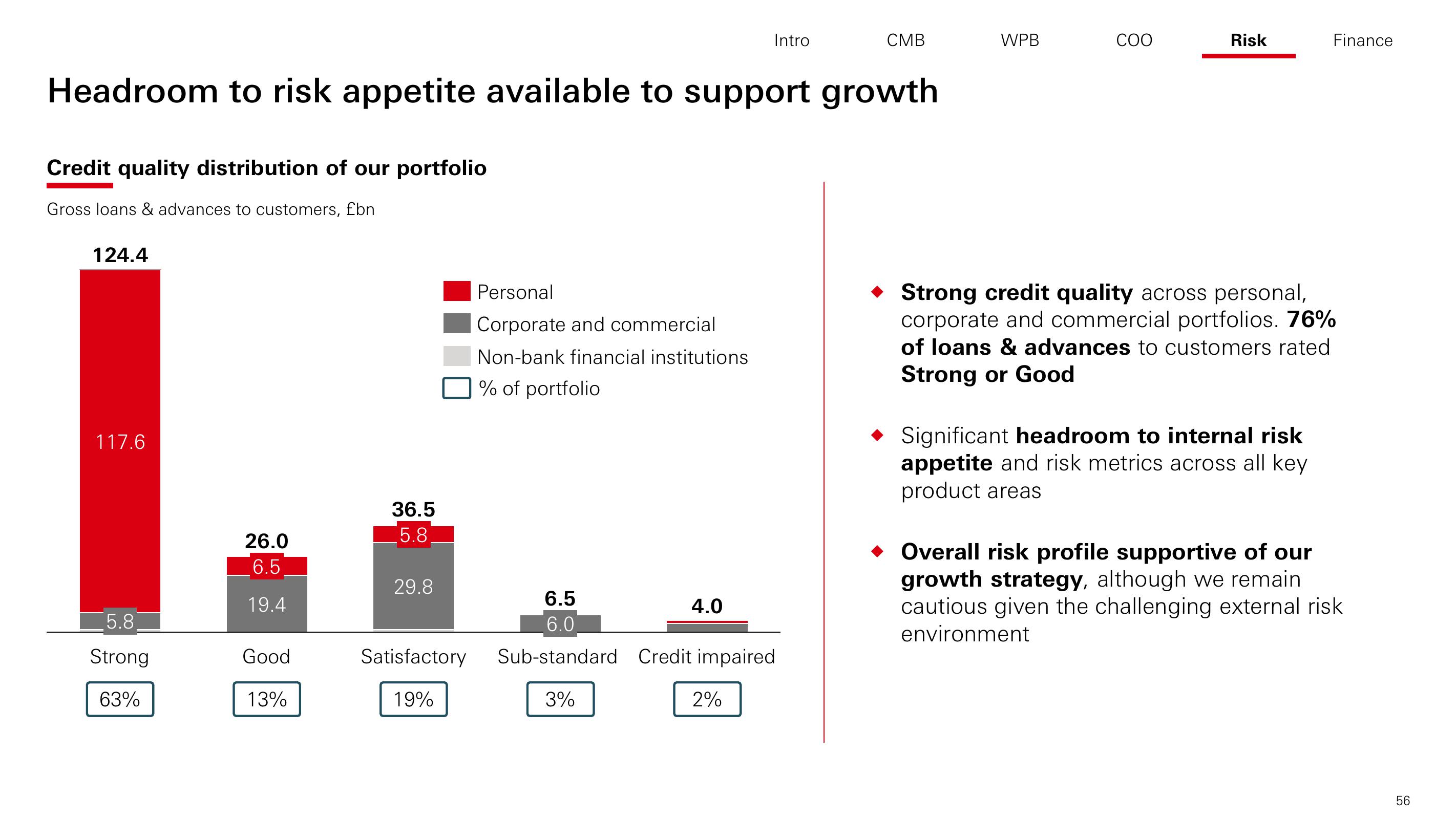

Credit quality distribution of our portfolio

Gross loans & advances to customers, £bn

Headroom to risk appetite available to support growth

124.4

117.6

5.8

Strong

63%

26.0

6.5

19.4

Good

13%

36.5

5.8

29.8

Satisfactory

19%

Personal

Corporate and commercial

Non-bank financial institutions

% of portfolio

6.5

6.0

Sub-standard Credit impaired

3%

Intro

4.0

2%

CMB

WPB

COO

Risk

Strong credit quality across personal,

corporate and commercial portfolios. 76%

of loans & advances to customers rated

Strong or Good

Significant headroom to internal risk

appetite and risk metrics across all key

product areas

Finance

Overall risk profile supportive of our

growth strategy, although we remain

cautious given the challenging external risk

environment

56View entire presentation