P3 Health Partners SPAC Presentation Deck

Right Space

Right Team

Right Model

P3's Projected Mature Market Ramp

Commentary

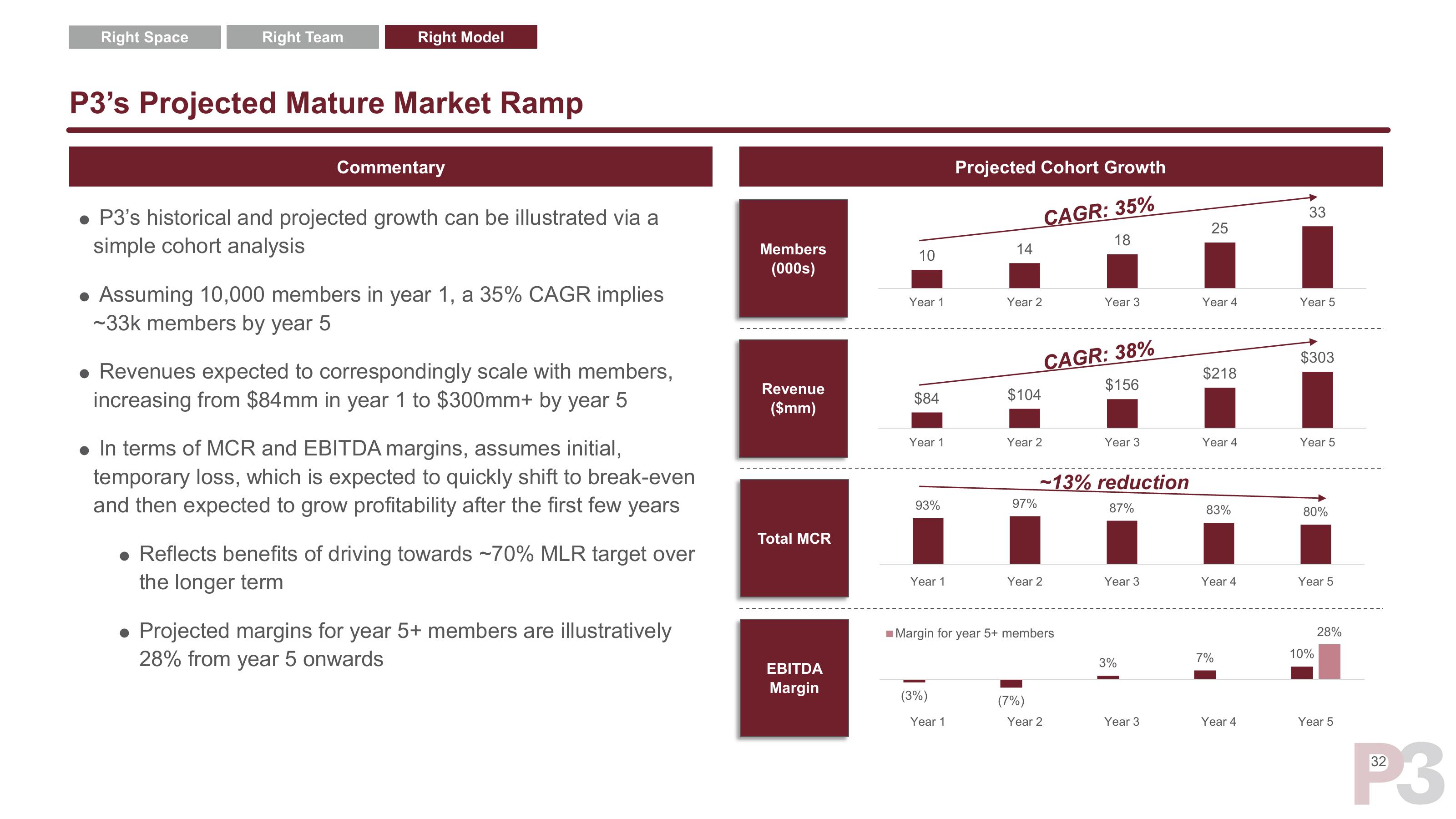

• P3's historical and projected growth can be illustrated via a

simple cohort analysis

• Assuming 10,000 members in year 1, a 35% CAGR implies

-33k members by year 5

Revenues expected to correspondingly scale with members,

increasing from $84mm in year 1 to $300mm+ by year 5

• In terms of MCR and EBITDA margins, assumes initial,

temporary loss, which is expected to quickly shift to break-even

and then expected to grow profitability after the first few years

• Reflects benefits of driving towards ~70% MLR target over

the longer term

• Projected margins for year 5+ members are illustratively

28% from year 5 onwards

Members

(000s)

Revenue

($mm)

Total MCR

EBITDA

Margin

10

Year 1

$84

Year 1

93%

Year 1

(3%)

Projected Cohort Growth

CAGR: 35%

Year 1

14

Year 2

$104

Year 2

97%

Year 2

■Margin for year 5+ members

(7%)

18

Year 2

Year 3

CAGR: 38%

$156

-13% reduction

Year 3

87%

Year 3

3%

Year 3

25

Year 4

$218

Year 4

83%

Year 4

7%

Year 4

co

33

Year 5

$303

Year 5

80%

Year 5

10%

28%

Year 5

32

P3View entire presentation