Liberty Global Results Presentation Deck

RECONCILIATIONS - VODAFONEZIGGO JV

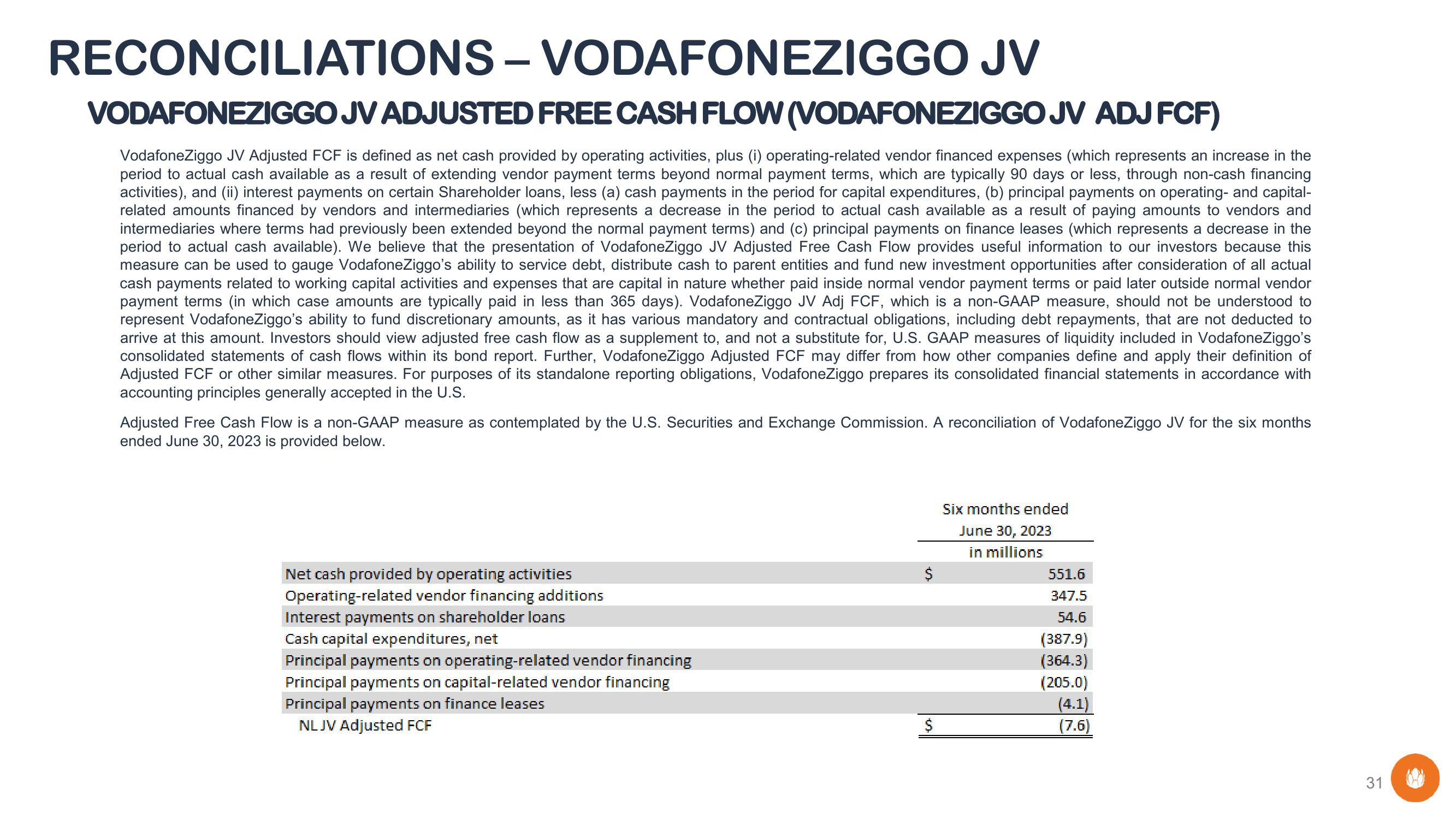

VODAFONEZIGGO JV ADJUSTED FREE CASH FLOW (VODAFONEZIGGO JV ADJ FCF)

VodafoneZiggo JV Adjusted FCF is defined as net cash provided by operating activities, plus (i) operating-related vendor financed expenses (which represents an increase in the

period to actual cash available as a result of extending vendor payment terms beyond normal payment terms, which are typically 90 days or less, through non-cash financing

activities), and (ii) interest payments on certain Shareholder loans, less (a) cash payments in the period for capital expenditures, (b) principal payments on operating- and capital-

related amounts financed by vendors and intermediaries (which represents a decrease in the period to actual cash available as a result of paying amounts to vendors and

intermediaries where terms had previously been extended beyond the normal payment terms) and (c) principal payments on finance leases (which represents a decrease in the

period to actual cash available). We believe that the presentation of VodafoneZiggo JV Adjusted Free Cash Flow provides useful information to our investors because this

measure can be used to gauge VodafoneZiggo's ability to service debt, distribute cash to parent entities and fund new investment opportunities after consideration of all actual

cash payments related to working capital activities and expenses that are capital in nature whether paid inside normal vendor payment terms or paid later outside normal vendor

payment terms (in which case amounts are typically paid in less than 365 days). VodafoneZiggo JV Adj FCF, which is a non-GAAP measure, should not be understood to

represent VodafoneZiggo's ability to fund discretionary amounts, as it has various mandatory and contractual obligations, including debt repayments, that are not deducted to

arrive at this amount. Investors should view adjusted free cash flow as a supplement to, and not a substitute for, U.S. GAAP measures of liquidity included in VodafoneZiggo's

consolidated statements of cash flows within its bond report. Further, VodafoneZiggo Adjusted FCF may differ from how other companies define and apply their definition of

Adjusted FCF or other similar measures. For purposes of its standalone reporting obligations, VodafoneZiggo prepares its consolidated financial statements in accordance with

accounting principles generally accepted in the U.S.

Adjusted Free Cash Flow is a non-GAAP measure as contemplated by the U.S. Securities and Exchange Commission. A reconciliation of VodafoneZiggo JV for the six months

ended June 30, 2023 is provided below.

Net cash provided by operating activities

Operating-related vendor financing additions

Interest payments on shareholder loans

Cash capital expenditures, net

Principal payments on operating-related vendor financing

Principal payments on capital-related vendor financing

Principal payments on finance leases

NL JV Adjusted FCF

$

$

Six months ended

June 30, 2023

in millions

551.6

347.5

54.6

(387.9)

(364.3)

(205.0)

(4.1)

(7.6)

31 (View entire presentation