jetBlue Mergers and Acquisitions Presentation Deck

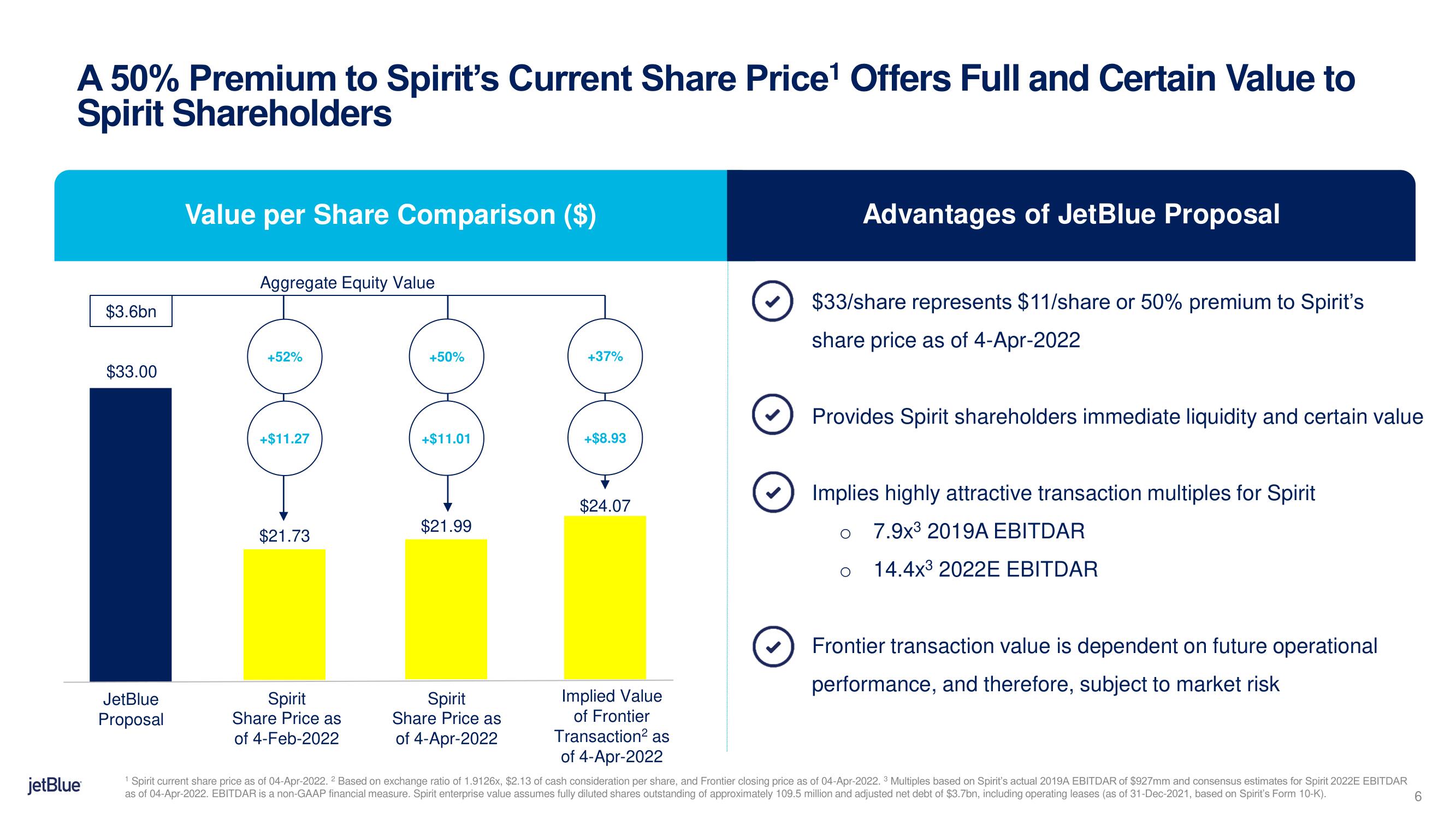

A 50% Premium to Spirit's Current Share Price¹ Offers Full and Certain Value to

Spirit Shareholders

jetBlue

$3.6bn

$33.00

JetBlue

Proposal

Value per Share Comparison ($)

Aggregate Equity Value

+52%

+$11.27

$21.73

Spirit

Share Price as

of 4-Feb-2022

+50%

+$11.01

$21.99

Spirit

Share Price as

of 4-Apr-2022

+37%

+$8.93

$24.07

Implied Value

of Frontier

Transaction² as

of 4-Apr-2022

$33/share represents $11/share or 50% premium to Spirit's

share price as of 4-Apr-2022

Advantages of JetBlue Proposal

Provides Spirit shareholders immediate liquidity and certain value

Implies highly attractive transaction multiples for Spirit

7.9x³ 2019A EBITDAR

14.4x³ 2022E EBITDAR

O

O

Frontier transaction value is dependent on future operational

performance, and therefore, subject to market risk

1 Spirit current share price as of 04-Apr-2022. 2 Based on exchange ratio of 1.9126x, $2.13 of cash consideration per share, and Frontier closing price as of 04-Apr-2022. 3 Multiples based on Spirit's actual 2019A EBITDAR of $927mm and consensus estimates for Spirit 2022E EBITDAR

as of 04-Apr-2022. EBITDAR is a non-GAAP financial measure. Spirit enterprise value assumes fully diluted shares outstanding of approximately 109.5 million and adjusted net debt of $3.7bn, including operating leases (as of 31-Dec-2021, based on Spirit's Form 10-K).

6View entire presentation