Evercore Investment Banking Pitch Book

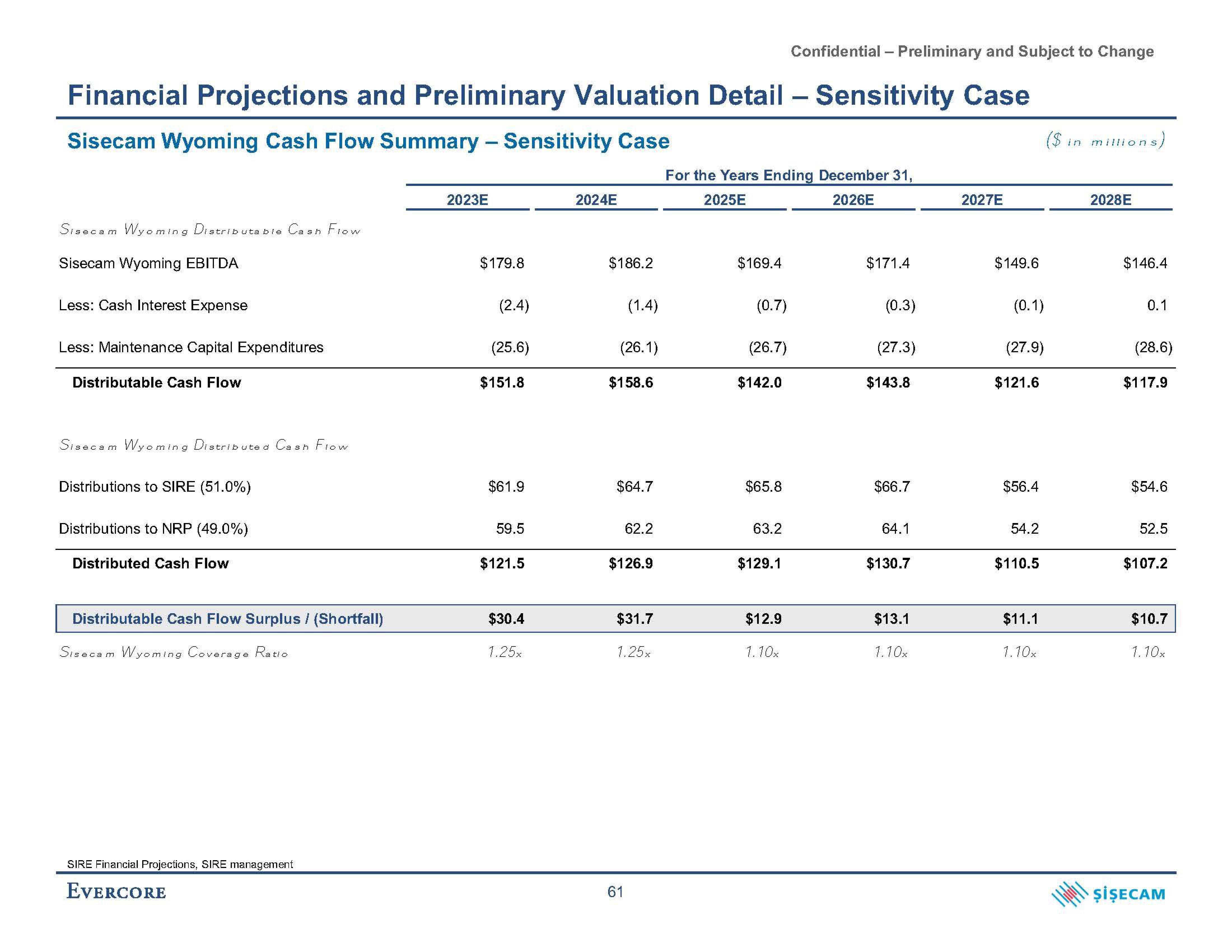

Financial Projections and Preliminary Valuation Detail - Sensitivity Case

Sisecam Wyoming Cash Flow Summary - Sensitivity Case

Sisecam Wyoming Distributable Cash Flow

Sisecam Wyoming EBITDA

Less: Cash Interest Expense

Less: Maintenance Capital Expenditures

Distributable Cash Flow

Sisecam Wyoming Distributed Cash Flow

Distributions to SIRE (51.0%)

Distributions to NRP (49.0%)

Distributed Cash Flow

Distributable Cash Flow Surplus / (Shortfall)

Sisecam Wyoming Coverage Ratio

SIRE Financial Projections, SIRE management

EVERCORE

2023E

$179.8

(2.4)

(25.6)

$151.8

$61.9

59.5

$121.5

$30.4

1.25x

2024E

$186.2

(1.4)

(26.1)

$158.6

$64.7

62.2

$126.9

$31.7

1.25x

61

For the Years Ending December 31,

2025E

2026E

$169.4

(0.7)

(26.7)

$142.0

$65.8

63.2

$129.1

Confidential - Preliminary and Subject to Change

$12.9

1.10x

$171.4

(0.3)

(27.3)

$143.8

$66.7

64.1

$130.7

$13.1

1.10x

2027E

$149.6

(0.1)

(27.9)

$121.6

$56.4

54.2

$110.5

$11.1

1.10x

in millions)

2028E

$146.4

0.1

(28.6)

$117.9

$54.6

52.5

$107.2

$10.7

1.10x

ŞİŞECAMView entire presentation