Q2 Quarter 2023

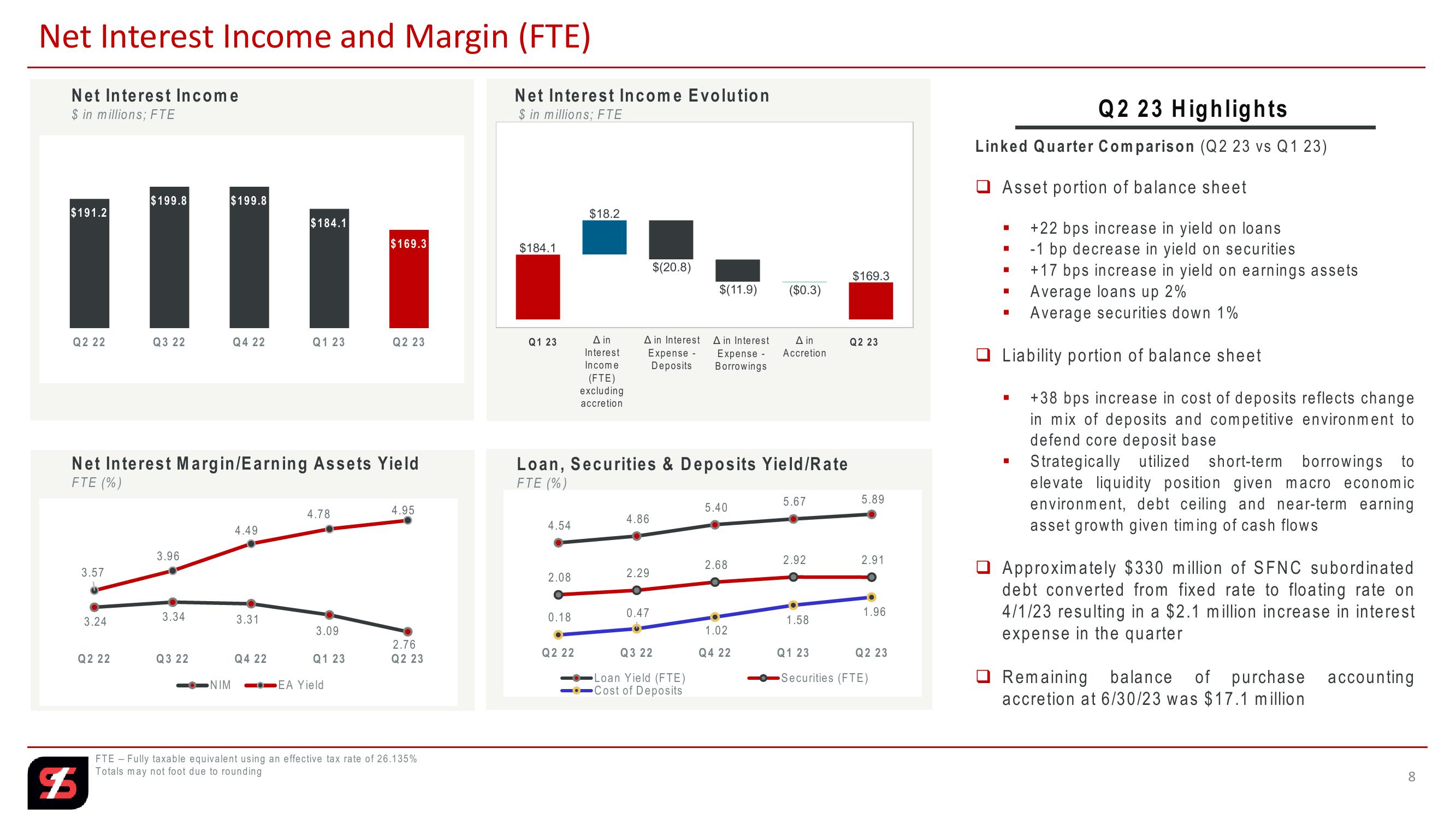

Net Interest Income and Margin (FTE)

Net Interest Income

$ in millions; FTE

Net Interest Income Evolution

$ in millions; FTE

$199.8

$199.8

$191.2

$184.1

$169.3

$184.1

Illi

$

$18.2

$(20.8)

☐

$169.3

$(11.9)

($0.3)

☐

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

Q1 23

A in

Interest

Income

A in Interest

Expense -

Deposits

A in Interest

Expense -

Borrowings

A in

Accretion

Q2 23

(FTE)

excluding

accretion

Loan, Securities & Deposits Yield/Rate

5.67

5.89

5.40

4.86

4.54

Net Interest Margin/Earning Assets Yield

FTE (%)

FTE (%)

4.95

4.78

4.49

3.96

3.57

2.68

2.92

2.91

2.08

2.29

0.47

3.34

3.24

3.31

0.18

1.96

1.58

3.09

1.02

Q2 22

Q3 22

Q4 22

Q1 23

2.76

Q2 23

Q2 22

Q3 22

Q4 22

Loan Yield (FTE)

Q1 23

Securities (FTE)

Q2 23

-NIM

EA Yield

Cost of Deposits

FTE - Fully taxable equivalent using an effective tax rate of 26.135%

Totals may not foot due to rounding

Q2 23 Highlights

Linked Quarter Comparison (Q2 23 vs Q1 23)

☐ Asset portion of balance sheet

☐

◉

+22 bps increase in yield on loans

-1 bp decrease in yield on securities

+17 bps increase in yield on earnings assets

Average loans up 2%

Average securities down 1%

Liability portion of balance sheet

☐

+38 bps increase in cost of deposits reflects change

in mix of deposits and competitive environment to

defend core deposit base

Strategically utilized short-term borrowings to

elevate liquidity position given macro economic

environment, debt ceiling and near-term earning

asset growth given timing of cash flows

Approximately $330 million of SFNC subordinated

debt converted from fixed rate to floating rate on

4/1/23 resulting in a $2.1 million increase in interest

expense in the quarter

Remaining balance of purchase

accretion at 6/30/23 was $17.1 million

accounting

8View entire presentation