Investor Presentation

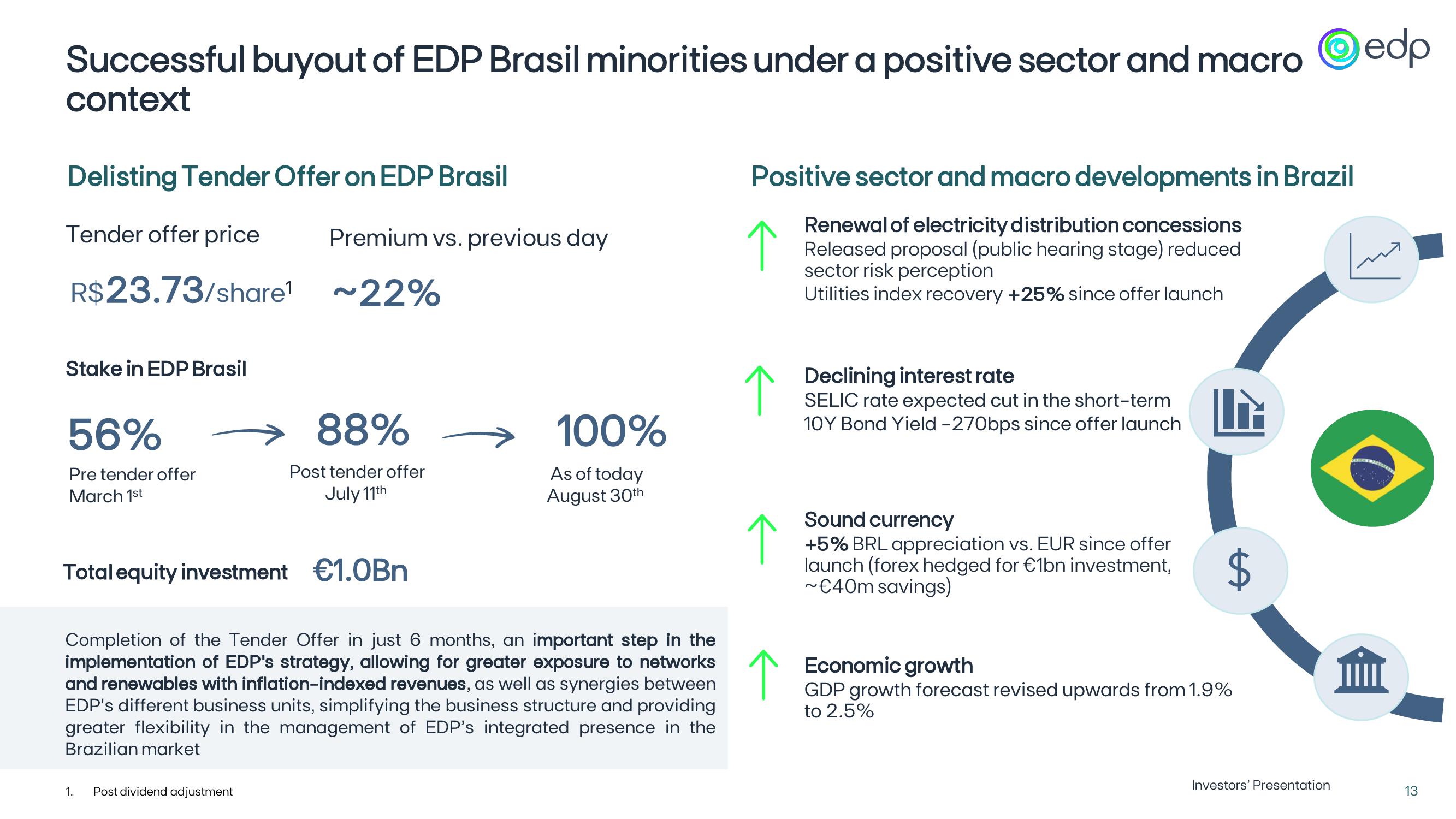

Successful buyout of EDP Brasil minorities under a positive sector and macro edp

context

Delisting Tender Offer on EDP Brasil

Tender offer price

Premium vs. previous day

R$ 23.73/share¹ ~22%

Stake in EDP Brasil

56%

88%

Pre tender offer

March 1st

Post tender offer

July 11th

Positive sector and macro developments in Brazil

Renewal of electricity distribution concessions

Released proposal (public hearing stage) reduced

sector risk perception

Utilities index recovery +25% since offer launch

↑

Declining interest rate

100%

SELIC rate expected cut in the short-term

10Y Bond Yield -270bps since offer launch

As of today

August 30th

Total equity investment €1.0Bn

Completion of the Tender Offer in just 6 months, an important step in the

implementation of EDP's strategy, allowing for greater exposure to networks

and renewables with inflation-indexed revenues, as well as synergies between

EDP's different business units, simplifying the business structure and providing

greater flexibility in the management of EDP's integrated presence in the

Brazilian market

↑

↑

Sound currency

+5% BRL appreciation vs. EUR since offer

launch (forex hedged for €1bn investment,

~€40m savings)

Economic growth

GDP growth forecast revised upwards from 1.9%

to 2.5%

1.

Post dividend adjustment

$

Investors' Presentation

13View entire presentation