Inovalon Results Presentation Deck

Q1 2017 Financial Highlights

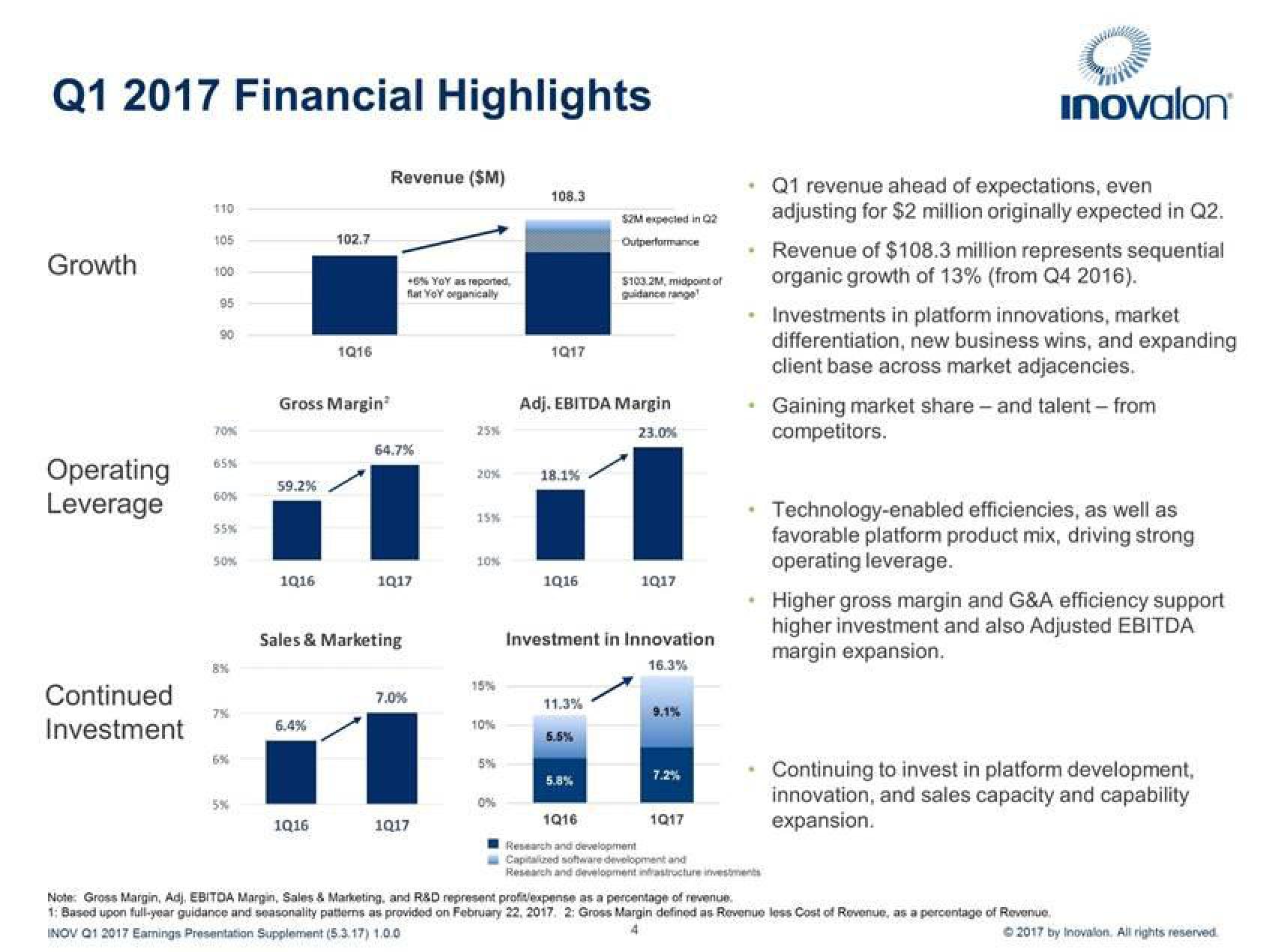

Growth

Operating

Leverage

Continued

Investment

110

105

95

90

70%

65%

55%

50%

8%

7%

5%

59.2%

Gross Margin

1Q16

102.7

6.4%

1Q16

1016

Revenue ($M)

Sales & Marketing

+6% YOY as reported

Bat YoY organically

64.7%

1017

7.0%

1017

20%

15%

10%

5%

108.3

1017

18.1%

Adj. EBITDA Margin

23.0%

1016

11.3%

52M expected in 02

Outperformance

5.5%

$103.2M, midpoint of

guidance range

Investment in Innovation

16.3%

5.8%

1017

7.2%

#

1Q16

Research and development

Capitalized software development and

Research and development infrastructure investment

1017

inovalon

Q1 revenue ahead of expectations, even

adjusting for $2 million originally expected in Q2.

Revenue of $108.3 million represents sequential

organic growth of 13% (from Q4 2016).

Investments in platform innovations, market

differentiation, new business wins, and expanding

client base across market adjacencies.

Gaining market share - and talent - from

competitors.

Technology-enabled efficiencies, as well as

favorable platform product mix, driving strong

operating leverage.

Higher gross margin and G&A efficiency support

higher investment and also Adjusted EBITDA

margin expansion.

Continuing to invest in platform development,

innovation, and sales capacity and capability

expansion.

Note: Gross Margin, Adj. EBITDA Margin, Sales & Marketing, and R&D represent profilexpense as a percentage of revenue.

1: Based upon full-year guidance and seasonality patterns as provided on February 22, 2017, 2: Gross Margin defined as Revenue less Cost of Revenue, as a percentage of Revenue.

INOV 01 2017 Earnings Presentation Supplement (5.3.17) 1.0.0

4

© 2017 by Inovalon. All rights reservedView entire presentation