OnesSpaWorld SPAC

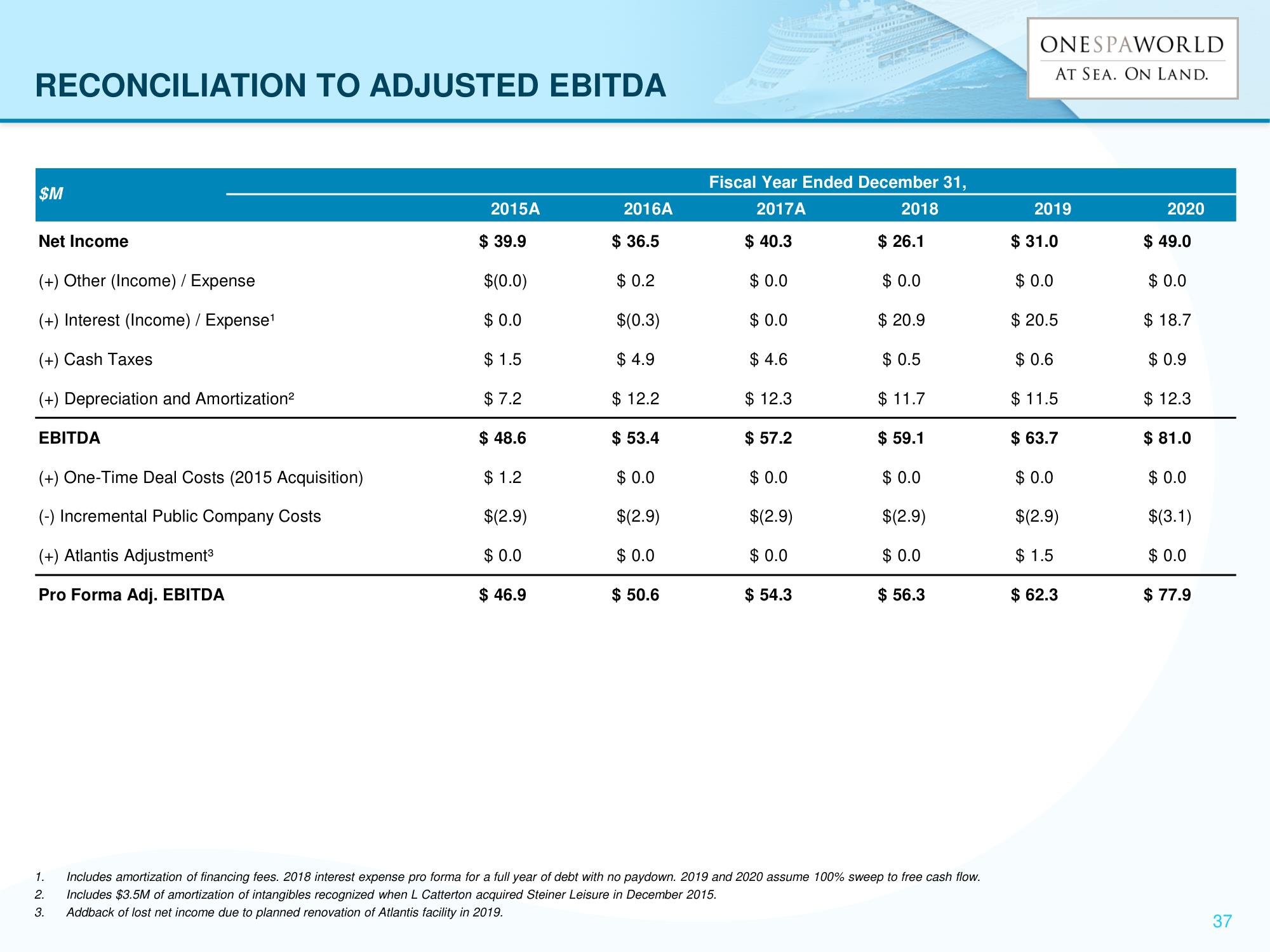

RECONCILIATION TO ADJUSTED EBITDA

$M

Net Income

(+) Other (Income) / Expense

(+) Interest (Income) / Expense¹

(+) Cash Taxes

(+) Depreciation and Amortization²

EBITDA

(+) One-Time Deal Costs (2015 Acquisition)

(-) Incremental Public Company Costs

(+) Atlantis Adjustment³

Pro Forma Adj. EBITDA

2015A

$39.9

$(0.0)

$0.0

$1.5

$7.2

$48.6

$1.2

$(2.9)

$ 0.0

$ 46.9

2016A

$36.5

$0.2

$(0.3)

$4.9

$ 12.2

$ 53.4

$0.0

$(2.9)

$0.

$ 50.6

Fiscal Year Ended December 31,

2017A

2018

$ 40.3

$0.0

$0.0

$4.6

$ 12.3

$ 57.2

$ 0.0

$(2.9)

$ 0.0

$ 54.3

$26.1

$ 0.0

$20.9

$0.5

$11.7

$59.1

$ 0.0

$(2.9)

$ 0.0

$ 56.3

1.

Includes amortization of financing fees. 2018 interest expense pro forma for a full year of debt with no paydown. 2019 and 2020 assume 100% sweep to free cash flow.

2. Includes $3.5M of amortization of intangibles recognized when L Catterton acquired Steiner Leisure in December 2015.

3. Addback of lost net income due to planned renovation of Atlantis facility in 2019.

ONESPAWORLD

AT SEA. ON LAND.

2019

$31.0

$ 0.0

$20.5

$ 0.6

$11.5

$ 63.7

$ 0.0

$(2.9)

$1.5

$62.3

2020

$49.0

$ 0.0

$18.7

$0.9

$ 12.3

$ 81.0

$0.0

$(3.1)

$0.

$77.9

37View entire presentation