Deutsche Bank Results Presentation Deck

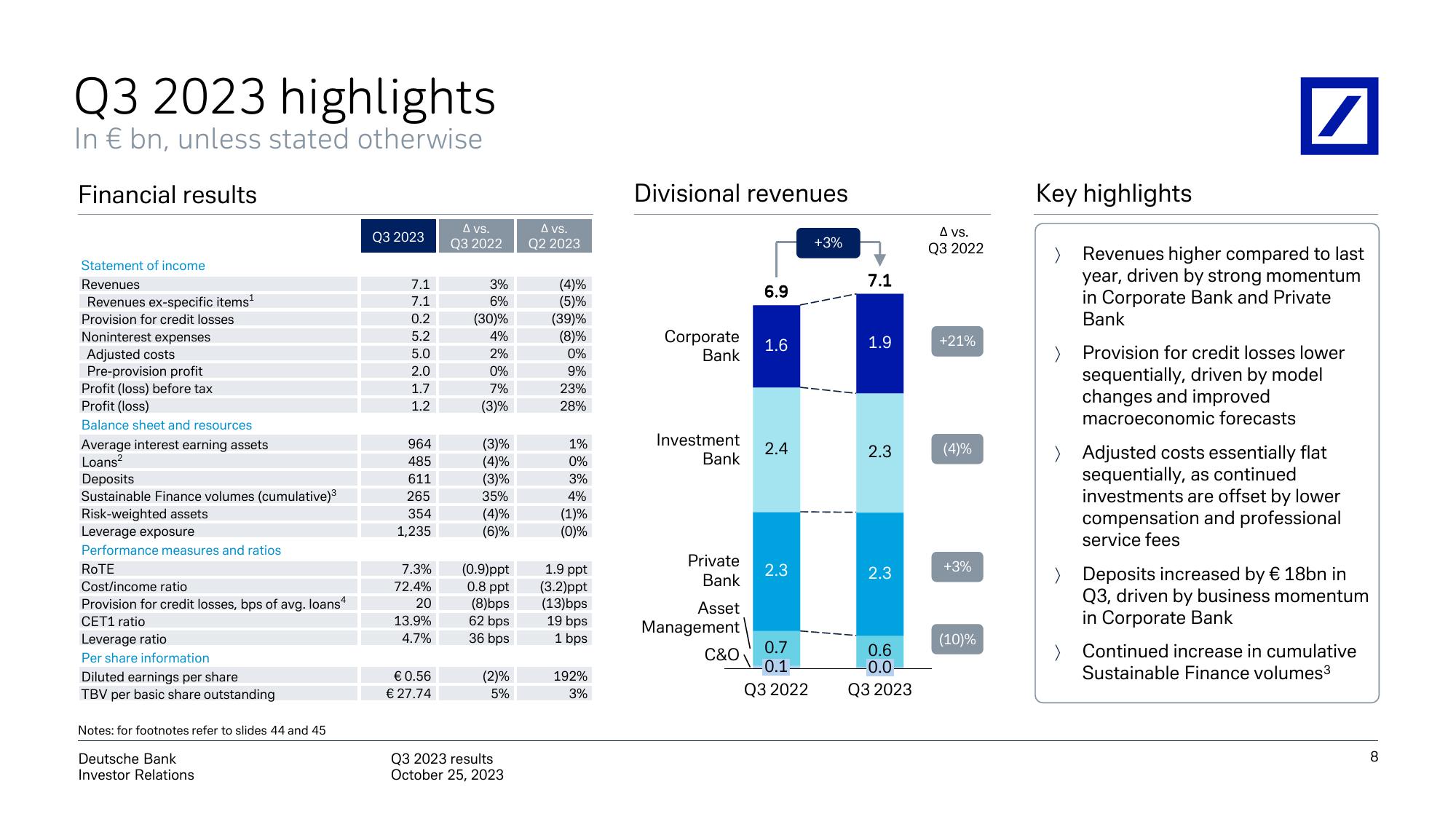

Q3 2023 highlights

In € bn, unless stated otherwise

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Profit (loss)

Balance sheet and resources

Average interest earning assets

Loans²

Deposits

Sustainable Finance volumes (cumulative)³

Risk-weighted assets

Leverage exposure

Performance measures and ratios

ROTE

Cost/income ratio

Provision for credit losses, bps of avg. loans4

CET1 ratio

Leverage ratio

Per share information

Diluted earnings per share

TBV per basic share outstanding

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

Q3 2023

7.1

7.1

0.2

5.2

5.0

2.0

1.7

1.2

964

485

611

265

354

1,235

7.3%

72.4%

20

13.9%

4.7%

€ 0.56

€ 27.74

A vs.

Q3 2022

3%

6%

(30)%

4%

2%

0%

7%

(3)%

(3)%

(4)%

(3)%

35%

(4)%

(6)%

(0.9)ppt

0.8 ppt

(8)bps

62 bps

36 bps

(2)%

5%

Q3 2023 results

October 25, 2023

A vs.

Q2 2023

(4)%

(5)%

(39)%

(8)%

0%

9%

23%

28%

1%

0%

3%

4%

(1)%

(0)%

1.9 ppt

(3.2)ppt

(13)bps

19 bps

1 bps

192%

3%

Divisional revenues

Corporate 1.6

Bank

Investment

Bank

Private

Bank

Asset

Management

6.9

C&O

2.4

2.3

0.7

-0.1

Q3 2022

+3%

7.1

1.9

2.3

2.3

0.6

-0.0-

Q3 2023

A vs.

Q3 2022

+21%

(4)%

+3%

(10)%

Key highlights

/

Revenues higher compared to last

year, driven by strong momentum

in Corporate Bank and Private

Bank

Provision for credit losses lower

sequentially, driven by model

changes and improved

macroeconomic forecasts

> Adjusted costs essentially flat

sequentially, as continued

investments are offset by lower

compensation and professional

service fees

> Deposits increased by € 18bn in

Q3, driven by business momentum

in Corporate Bank

> Continued increase in cumulative

Sustainable Finance volumes3

8View entire presentation