J.P.Morgan Investment Banking Pitch Book

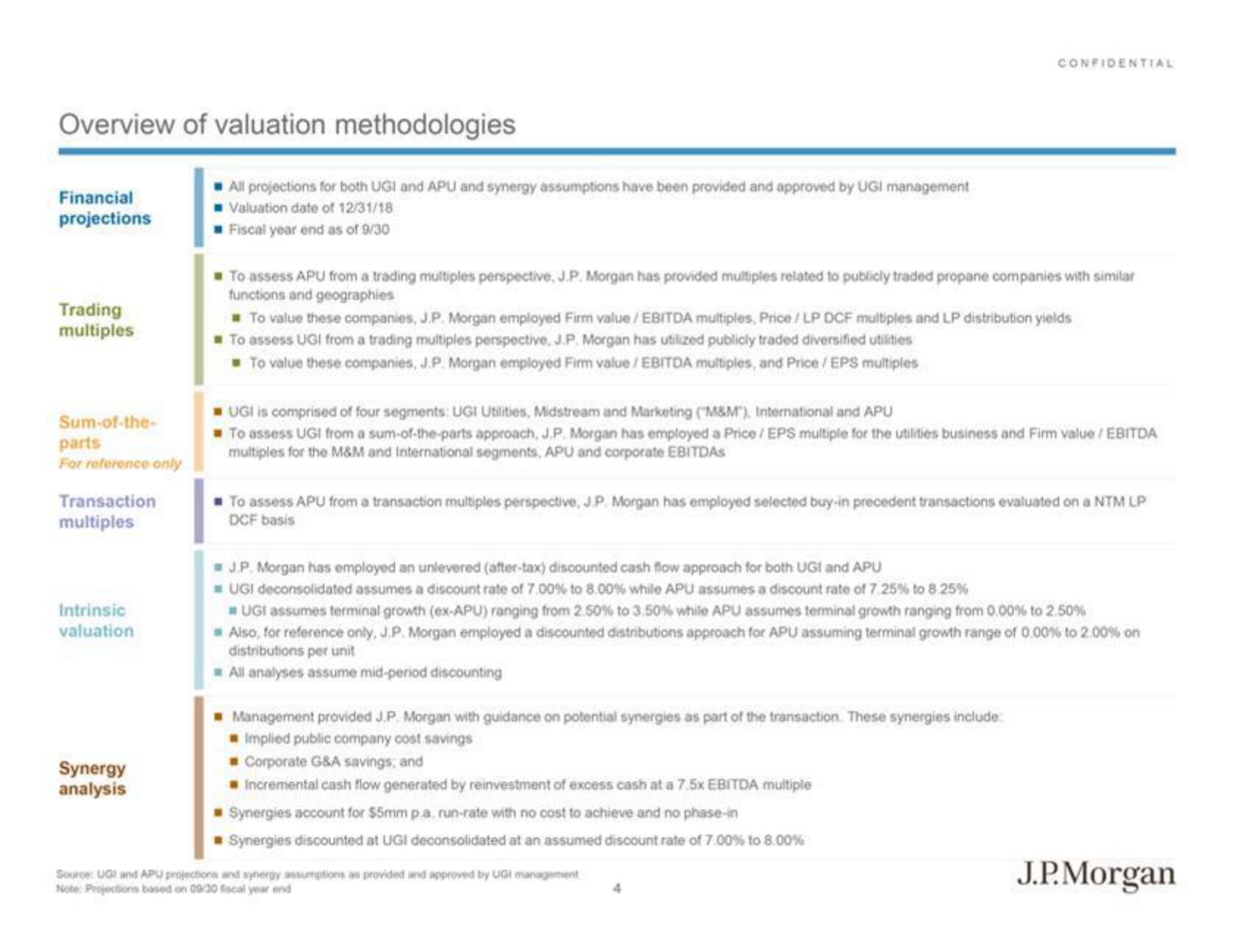

Overview of valuation methodologies

Financial

projections

Trading

multiples

Sum-of-the-

parts

For reference only

Transaction

multiples

Intrinsic

valuation

Synergy

analysis

All projections for both UGI and APU and synergy assumptions have been provided and approved by UGI management

Valuation date of 12/31/18

Fiscal year end as of 9/30

To assess APU from a trading multiples perspective, J.P. Morgan has provided multiples related to publicly traded propane companies with similar

functions and geographies

☐ To value these companies, J.P. Morgan employed Firm value / EBITDA multiples, Price/LP DCF multiples and LP distribution yields

To assess UGI from a trading multiples perspective, J.P. Morgan has utilized publicly traded diversified utilities

To value these companies, J.P. Morgan employed Firm value / EBITDA multiples, and Price / EPS multiples

UGI is comprised of four segments: UGI Utilities, Midstream and Marketing ("M&M). International and APU

To assess UGI from a sum-of-the-parts approach, J.P. Morgan has employed a Price / EPS multiple for the utilities business and Firm value / EBITDA

multiples for the M&M and International segments, APU and corporate EBITDAS

To assess APU from a transaction multiples perspective, J.P. Morgan has employed selected buy-in precedent transactions evaluated on a NTM LP

DCF basis

J.P. Morgan has employed an unlevered (after-tax) discounted cash flow approach for both UGI and APU

UGI deconsolidated assumes a discount rate of 7.00% to 8.00% while APU assumes a discount rate of 7.25% to 8.25%

CONFIDENTIAL

#UGI assumes terminal growth (ex-APU) ranging from 2.50% to 3.50% while APU assumes terminal growth ranging from 0.00% to 2.50%

Also, for reference only, J.P. Morgan employed a discounted distributions approach for APU assuming terminal growth range of 0.00% to 2.00% on

distributions per unit

All analyses assume mid-period discounting

Management provided J.P. Morgan with guidance on potential synergies as part of the transaction. These synergies include:

Implied public company cost savings

☐ Corporate G&A savings; and

■ Incremental cash flow generated by reinvestment of excess cash at a 7.5x EBITDA multiple

Synergies account for $5mm p.a. run-rate with no cost to achieve and no phase-in

Synergies discounted at UGI deconsolidated at an assumed discount rate of 7.00% to 8.00%

Source: UGI and APU projections and synergy assumptions as provided and approved by UGI management

Note: Projections based on 09:30 fiscal year end

4

J.P.MorganView entire presentation