Kering Investor Presentation Deck

●

576

H1 22 Kering

Eyewear

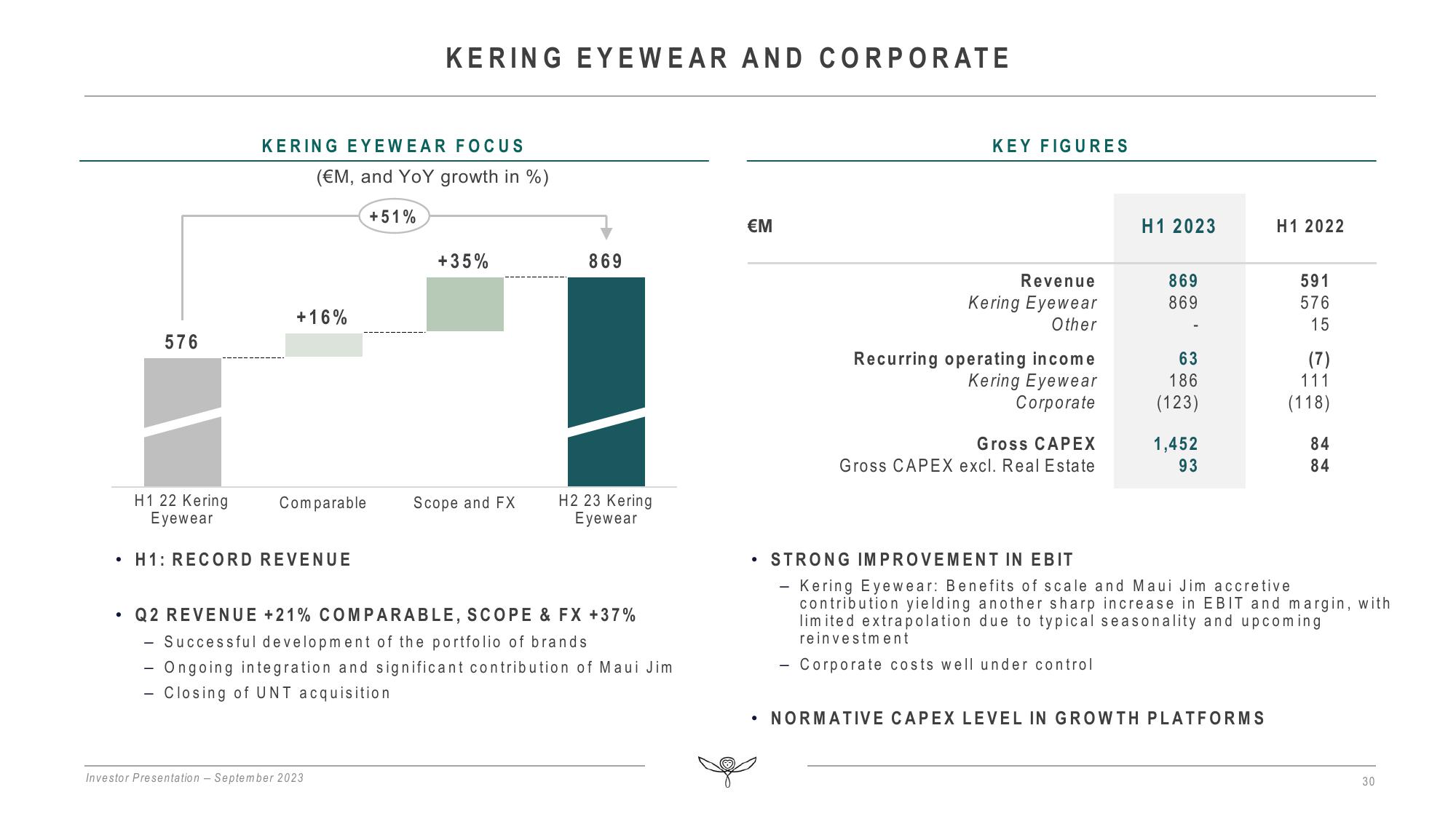

KERING EYEWEAR FOCUS

+16%

(€M, and YoY growth in %)

+51%

Comparable

KERING EYEWEAR AND CORPORATE

H1: RECORD REVENUE

Investor Presentation - September 2023

+35%

Scope and FX

869

H2 23 Kering

Eyewear

Q2 REVENUE +21% COMPARABLE, SCOPE & FX +37%

Successful development of the portfolio of brands

- Ongoing integration and significant contribution of Maui Jim

Closing of UNT acquisition

€M

KEY FIGURES

Revenue

Kering Eyewear

Other

Recurring operating income

Kering Eyewear

Corporate

Gross CAPEX

Gross CAPEX excl. Real Estate

H1 2023

869

869

63

186

(123)

1,452

93

H1 2022

• NORMATIVE CAPEX LEVEL IN GROWTH PLATFORMS

591

576

15

(7)

111

(118)

88

84

84

• STRONG IMPROVEMENT IN EBIT

- Kering Eyewear: Benefits of scale and Maui Jim accretive

contribution yielding another sharp increase in EBIT and margin, with

limited extrapolation due to typical seasonality and upcoming

reinvestment

- Corporate costs well under control

30View entire presentation