Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

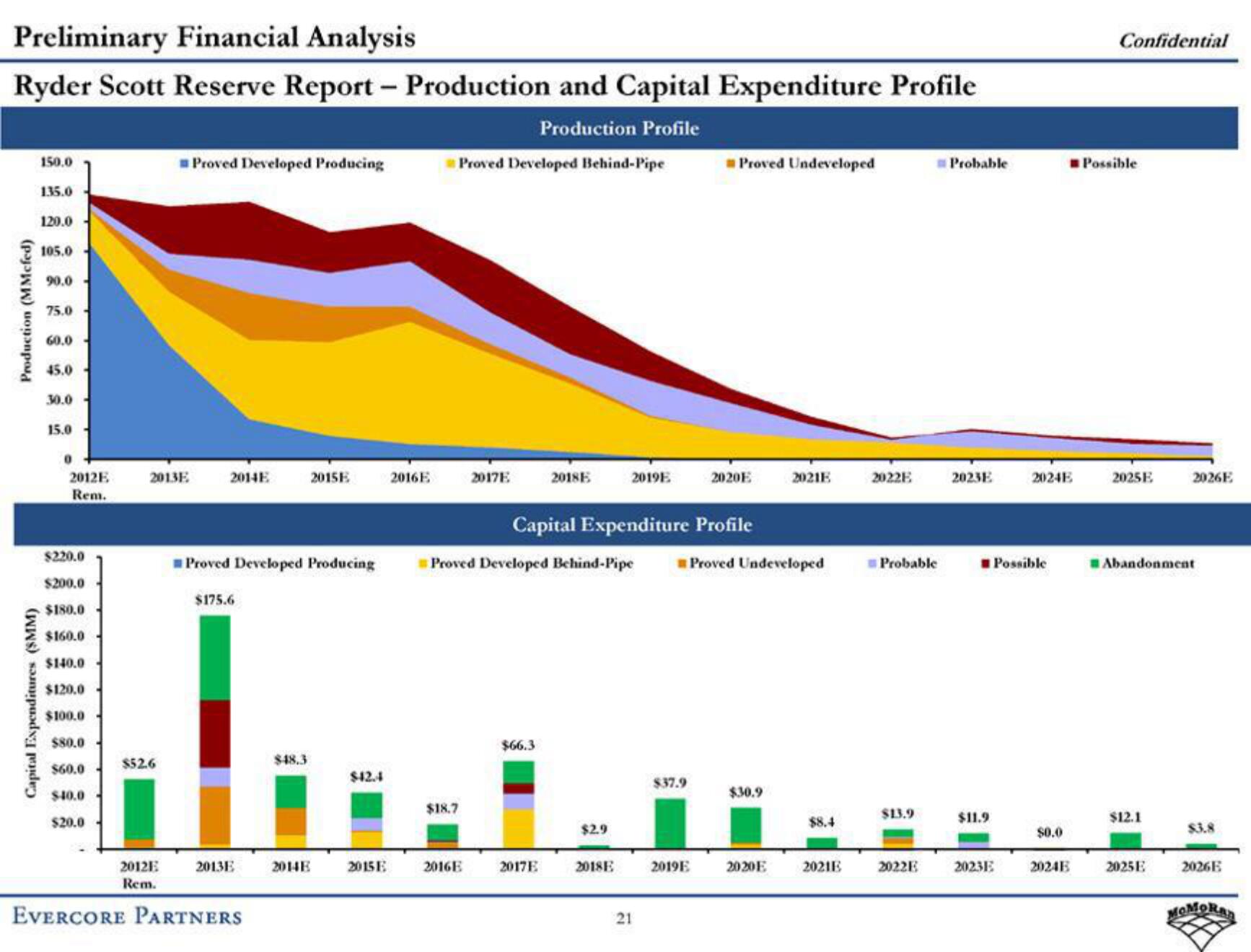

Ryder Scott Reserve Report - Production and Capital Expenditure Profile

Production Profile

Production (MMcfed)

Capital Expenditures (SMM)

150.0

135.0

120.0

105.0

90.0-

75.0-

60.0

45.0-

30.0-

15.0

0

2012E

Rem.

$220.0

$200.0

$180.0

$160.0

$140.0

$120.0

$100.0

$80.0

$60.0

$40.0

$20.0

2013E

$52.6

Proved Developed Producing

2014E

Proved Developed Producing

$175.6

$48.3

2012E 2013E 2014E

Rem.

EVERCORE PARTNERS

2015E

$42.4

2015E

2016E

Proved Developed Behind-Pipe

$18.7

2017E

2016E

Proved Developed Behind-Pipe

2018E

$66.3

2017E

Capital Expenditure Profile

2019E

$2.9

2018E

21

$37.9

Proved Undeveloped

2020E

2019E

Proved Undeveloped

$30.9

2021E

2020E

$8.4

2021E

2022E

Probable

$13.9

2022E

Probable

2023E

$11.9

20231

2024E

Possible

$0.0

20241

Confidential

Possible

2025E

Abandonment

$12.1

2026E

2025E

$3.8

2026E

MOMORView entire presentation