Experian Investor Presentation Deck

Executive Summary

Supply Chain

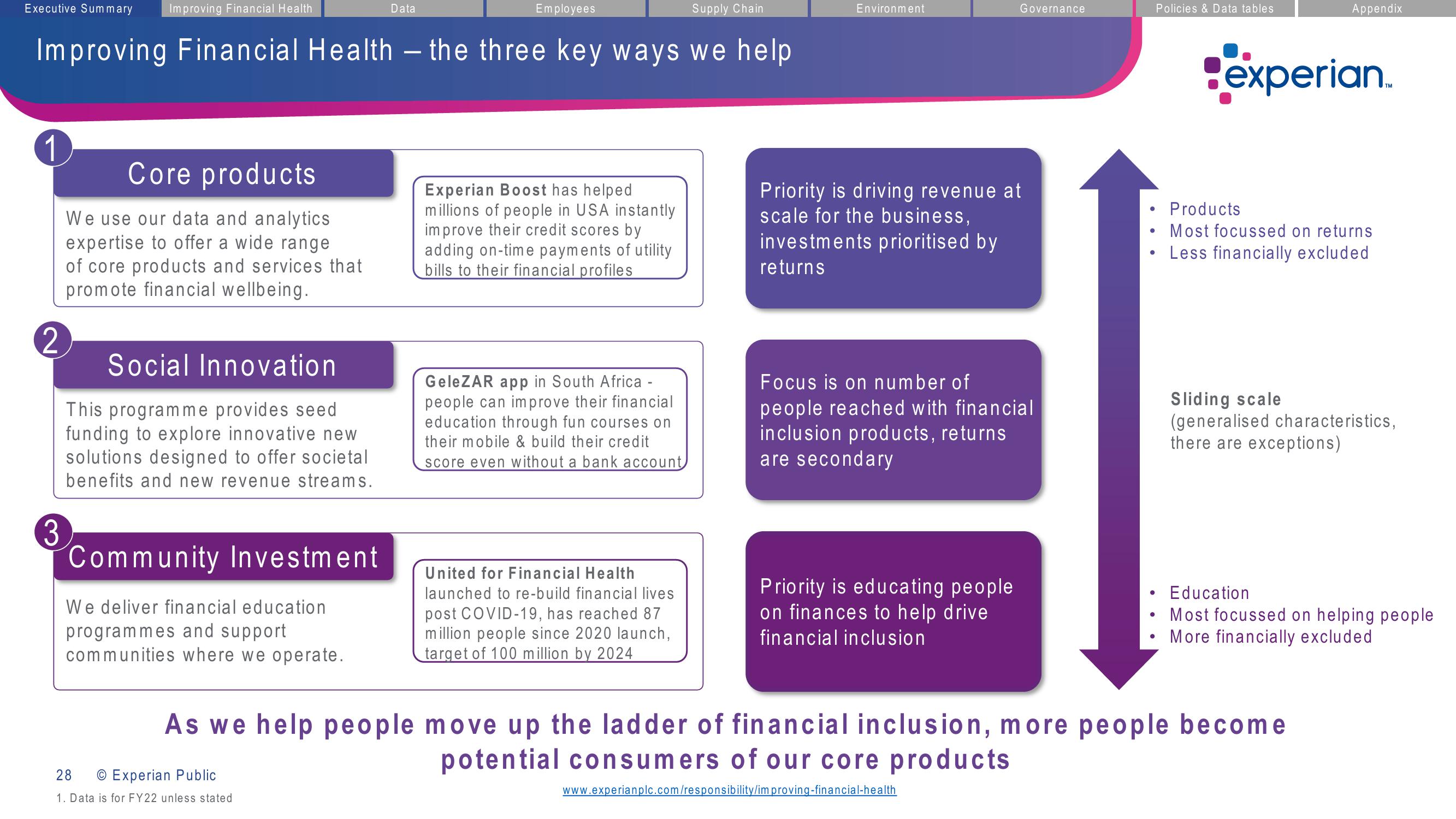

Improving Financial Health - the three key ways we help

1

Improving Financial Health

Core products

We use our data and analytics

expertise to offer a wide range

of core products and services that

promote financial wellbeing.

2

3

Social Innovation

This programme provides seed

funding to explore innovative new

solutions designed to offer societal

benefits and new revenue streams.

Community Investment

We deliver financial education

programmes and support

communities where we operate.

Data

28

O Experian Public

1. Data is for FY22 unless stated

Employees

Experian Boost has helped

millions of people in USA instantly

improve their credit scores by

adding on-time payments of utility

bills to their financial profiles

GeleZAR app in South Africa -

people can improve their financial

education through fun courses on

their mobile & build their credit

score even without a bank account

United for Financial Health

launched to re-build financial lives

post COVID-19, has reached 87

million people since 2020 launch,

target of 100 million by 2024

Environment

Governance

Priority is driving revenue at

scale for the business,

investments prioritised by

returns

Focus is on number of

people reached with financial

inclusion products, returns

are secondary

Priority is educating people

on finances to help drive

financial inclusion

●

●

●

Policies & Data tables

Appendix

Bexperian.

Products

Most focussed on returns

Less financially excluded

Sliding scale

(generalised characteristics,

there are exceptions)

As we help people move up the ladder of financial inclusion, more people become

potential consumers of our core products

www.experianplc.com/responsibility/improving-financial-health

Education

Most focussed on helping people

More financially excludedView entire presentation