Apollo Global Management Investor Day Presentation Deck

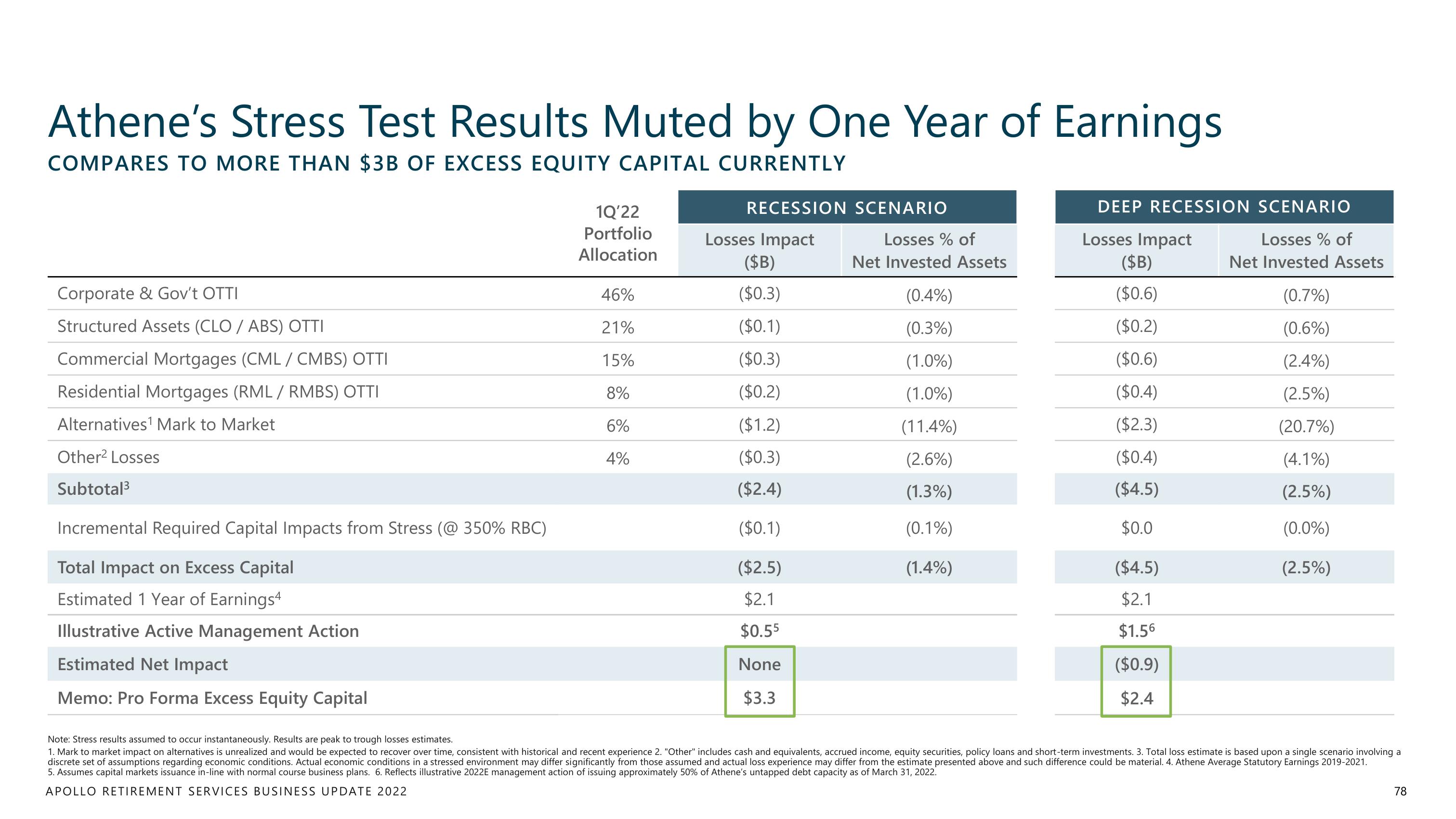

Athene's Stress Test Results Muted by One Year of Earnings

COMPARES TO MORE THAN $3B OF EXCESS EQUITY CAPITAL CURRENTLY

Corporate & Gov't OTTI

Structured Assets (CLO/ABS) OTTI

Commercial Mortgages (CML/CMBS) OTTI

Residential Mortgages (RML/RMBS) OTTI

Alternatives¹ Mark to Market

Other² Losses

Subtotal³

Incremental Required Capital Impacts from Stress (@ 350% RBC)

Total Impact on Excess Capital

Estimated 1 Year of Earnings4

Illustrative Active Management Action

Estimated Net Impact

Memo: Pro Forma Excess Equity Capital

1Q'22

Portfolio

Allocation

46%

21%

15%

8%

6%

4%

RECESSION SCENARIO

Losses Impact

($B)

($0.3)

($0.1)

($0.3)

($0.2)

($1.2)

($0.3)

($2.4)

($0.1)

($2.5)

$2.1

$0.55

None

$3.3

Losses % of

Net Invested Assets

(0.4%)

(0.3%)

(1.0%)

(1.0%)

(11.4%)

(2.6%)

(1.3%)

(0.1%)

(1.4%)

DEEP RECESSION SCENARIO

Losses Impact

Losses % of

($B)

($0.6)

($0.2)

($0.6)

($0.4)

($2.3)

($0.4)

($4.5)

$0.0

($4.5)

$2.1

$1.56

($0.9)

$2.4

Net Invested Assets

(0.7%)

(0.6%)

(2.4%)

(2.5%)

(20.7%)

(4.1%)

(2.5%)

(0.0%)

(2.5%)

Note: Stress results assumed to occur instantaneously. Results are peak to trough losses estimates.

1. Mark to market impact on alternatives is unrealized and would be expected to recover over time, consistent with historical and recent experience 2. "Other" includes cash and equivalents, accrued income, equity securities, policy loans and short-term investments. 3. Total loss estimate is based upon a single scenario involving a

discrete set of assumptions regarding economic conditions. Actual economic conditions in a stressed environment may differ significantly from those assumed and actual loss experience may differ from the estimate presented above and such difference could be material. 4. Athene Average Statutory Earnings 2019-2021.

5. Assumes capital markets issuance in-line with normal course business plans. 6. Reflects illustrative 2022E management action of issuing approximately 50% of Athene's untapped debt capacity as of March 31, 2022.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

78View entire presentation