Tesla Results Presentation Deck

FINANCIAL SUMMARY

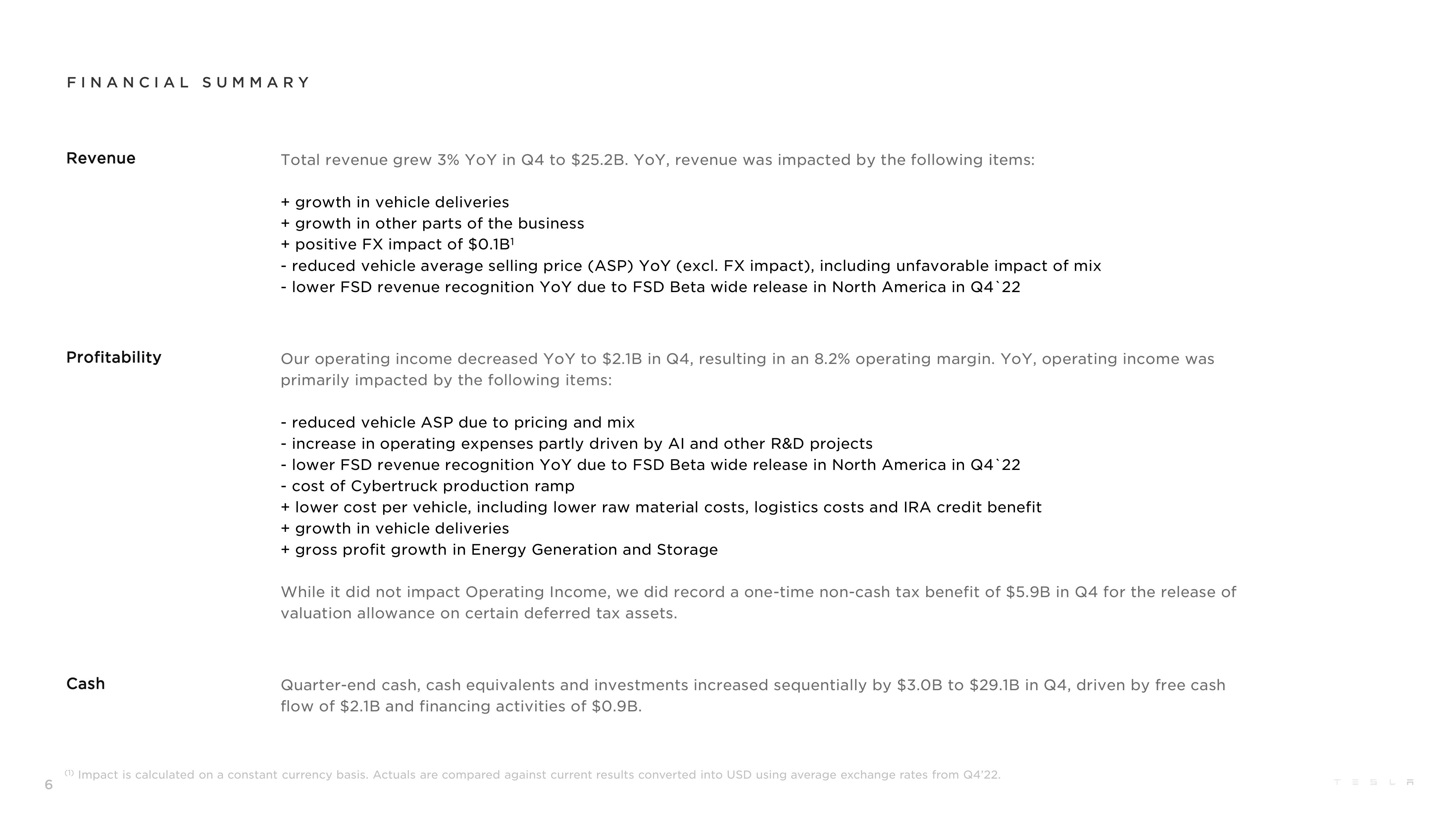

Revenue

Profitability

Cash

Total revenue grew 3% YoY in Q4 to $25.2B. YoY, revenue was impacted by the following items:

+ growth in vehicle deliveries

+ growth in other parts of the business

+ positive FX impact of $0.1B¹

- reduced vehicle average selling price (ASP) YOY (excl. FX impact), including unfavorable impact of mix

- lower FSD revenue recognition YoY due to FSD Beta wide release in North America in Q4 22

Our operating income decreased YoY to $2.1B in Q4, resulting in an 8.2% operating margin. YoY, operating income was

primarily impacted by the following items:

- reduced vehicle ASP due to pricing and mix

- increase in operating expenses partly driven by Al and other R&D projects

- lower FSD revenue recognition YoY due to FSD Beta wide release in North America in Q4 22

- cost of Cybertruck production ramp

+ lower cost per vehicle, including lower raw material costs, logistics costs and IRA credit benefit

+ growth in vehicle deliveries

+ gross profit growth in Energy Generation and Storage

While it did not impact Operating Income, we did record a one-time non-cash tax benefit of $5.9B in Q4 for the release of

valuation allowance on certain deferred tax assets.

Quarter-end cash, cash equivalents and investments increased sequentially by $3.0B to $29.1B in Q4, driven by free cash

flow of $2.1B and financing activities of $0.9B.

(1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q4'22.

6

TESLAView entire presentation