CorpAcq SPAC Presentation Deck

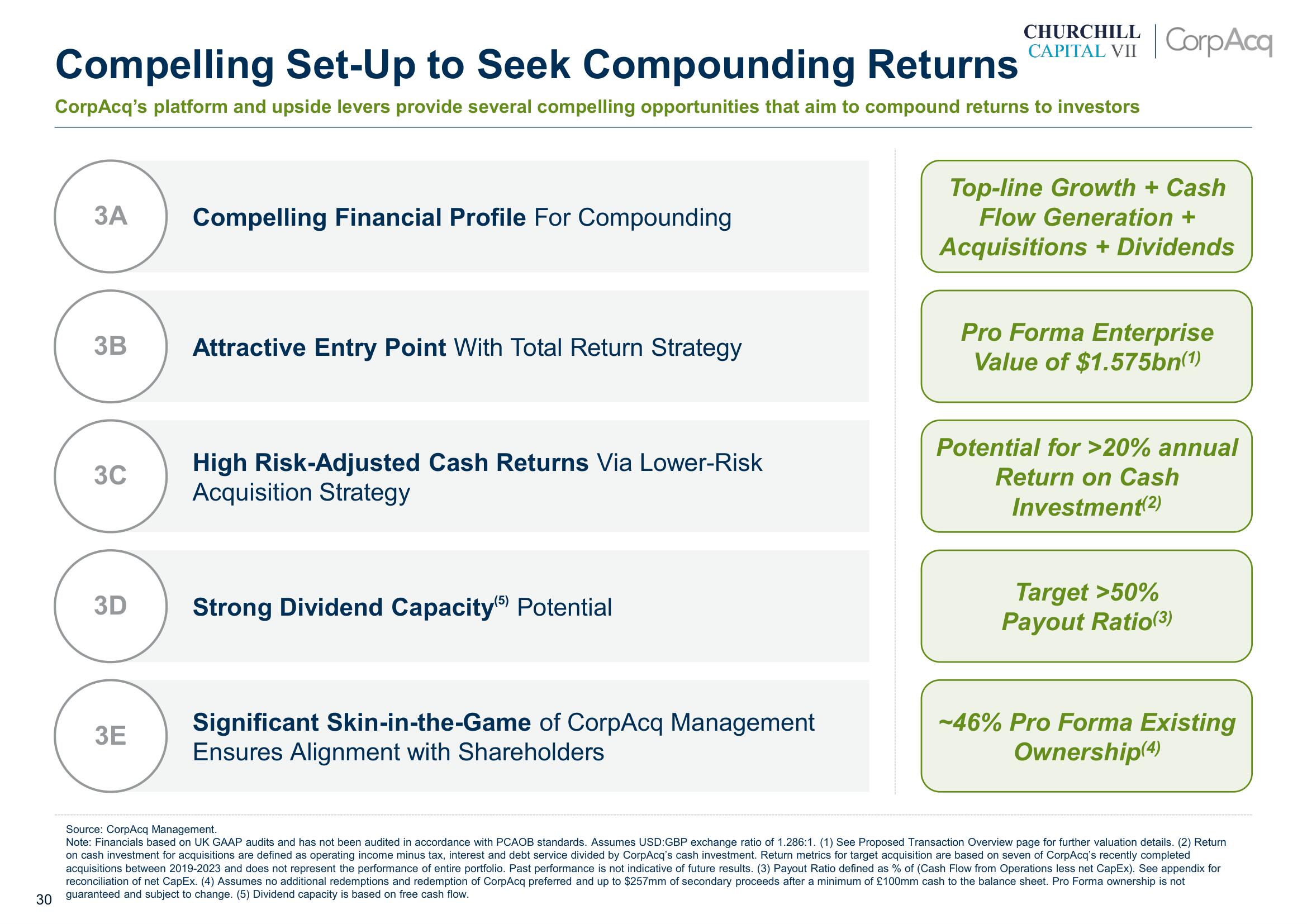

Compelling Set-Up to Seek Compounding Returns

CorpAcq's platform and upside levers provide several compelling opportunities that aim to compound returns to investors

3A

3B

3C

3D

3E

Compelling Financial Profile For Compounding

Attractive Entry Point With Total Return Strategy

High Risk-Adjusted Cash Returns Via Lower-Risk

Acquisition Strategy

Strong Dividend Capacity(5) Potential

CHURCHILL

CAPITAL VII CorpAcq

Significant Skin-in-the-Game of CorpAcq Management

Ensures Alignment with Shareholders

Top-line Growth + Cash

Flow Generation +

Acquisitions + Dividends

Pro Forma Enterprise

Value of $1.575bn(1)

Potential for >20% annual

Return on Cash

Investment(2)

Target >50%

Payout Ratio (3)

-46% Pro Forma Existing

Ownership(4)

Source: CorpAcq Management.

Note: Financials based on UK GAAP audits and has not been audited in accordance with PCAOB standards. Assumes USD:GBP exchange ratio of 1.286:1. (1) See Proposed Transaction Overview page for further valuation details. (2) Return

on cash investment for acquisitions are defined as operating income minus tax, interest and debt service divided by CorpAcq's cash investment. Return metrics for target acquisition are based on seven of CorpAcq's recently completed

acquisitions between 2019-2023 and does not represent the performance of entire portfolio. Past performance is not indicative of future results. (3) Payout Ratio defined as % of (Cash Flow from Operations less net CapEx). See appendix for

reconciliation of net CapEx. (4) Assumes no additional redemptions and redemption of CorpAcq preferred and up to $257mm of secondary proceeds after a minimum of £100mm cash to the balance sheet. Pro Forma ownership is not

30 guaranteed and subject to change. (5) Dividend capacity is based on free cash flow.View entire presentation