Rio Tinto Annual Report 2022

Outlook

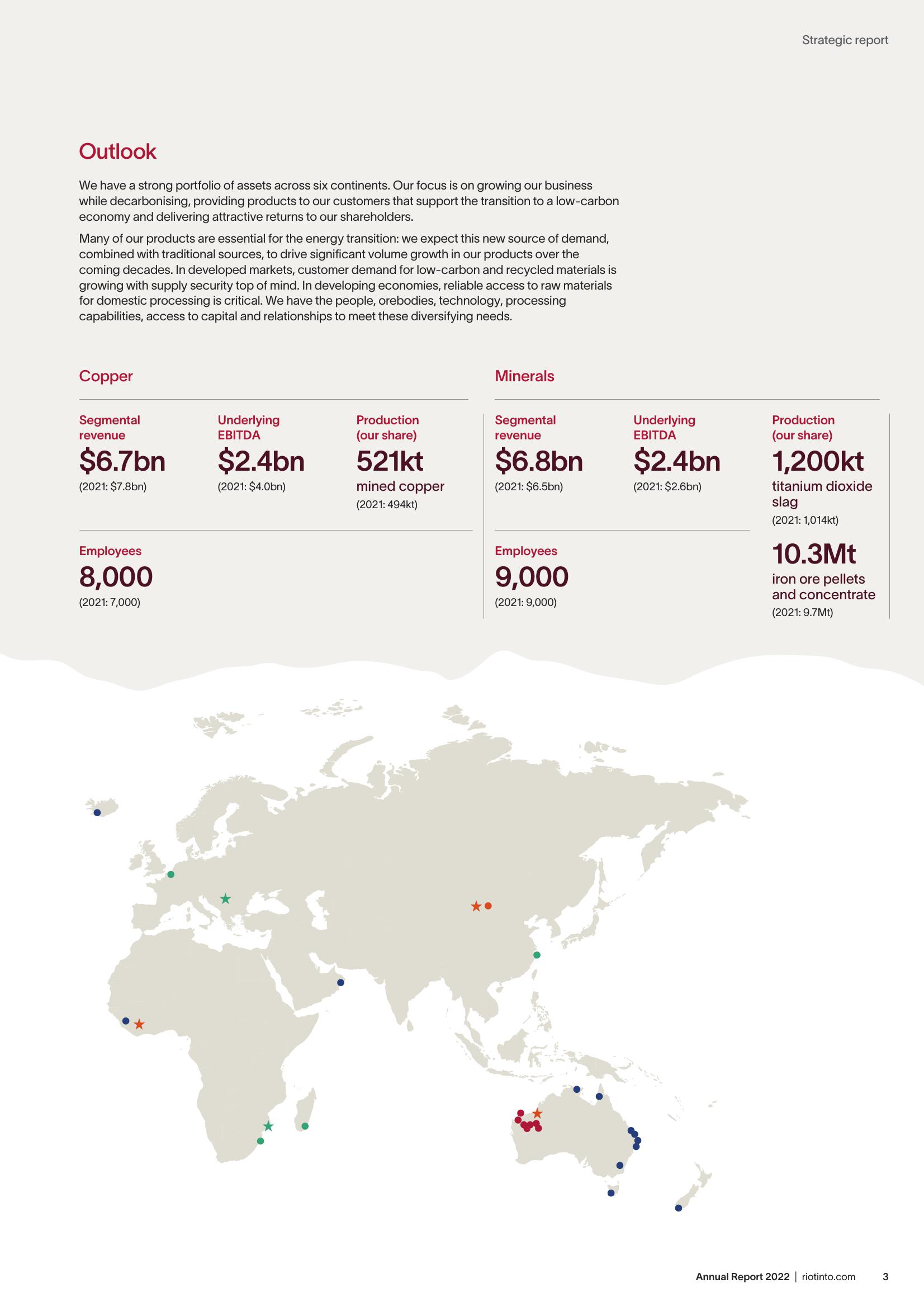

We have a strong portfolio of assets across six continents. Our focus is on growing our business

while decarbonising, providing products to our customers that support the transition to a low-carbon

economy and delivering attractive returns to our shareholders.

Many of our products are essential for the energy transition: we expect this new source of demand,

combined with traditional sources, to drive significant volume growth in our products over the

coming decades. In developed markets, customer demand for low-carbon and recycled materials is

growing with supply security top of mind. In developing economies, reliable access to raw materials

for domestic processing is critical. We have the people, orebodies, technology, processing

capabilities, access to capital and relationships to meet these diversifying needs.

Copper

Segmental

revenue

$6.7bn

(2021: $7.8bn)

Employees

8,000

(2021: 7,000)

Underlying

EBITDA

$2.4bn

(2021: $4.0bn)

Production

(our share)

521kt

mined copp

(2021: 494kt)

Minerals

Segmental

revenue

$6.8bn

(2021: $6.5bn)

Employees

9,000

(2021: 9,000)

Underlying

EBITDA

$2.4bn

(2021: $2.6bn)

Strategic report

Production

(our share)

1,200kt

titanium dioxide

slag

(2021: 1,014kt)

10.3Mt

iron ore pellets

and concentrate

(2021: 9.7Mt)

Annual Report 2022 | riotinto.com 3View entire presentation