Moelis & Company Investment Banking Pitch Book

Selected Publicly Traded Companies

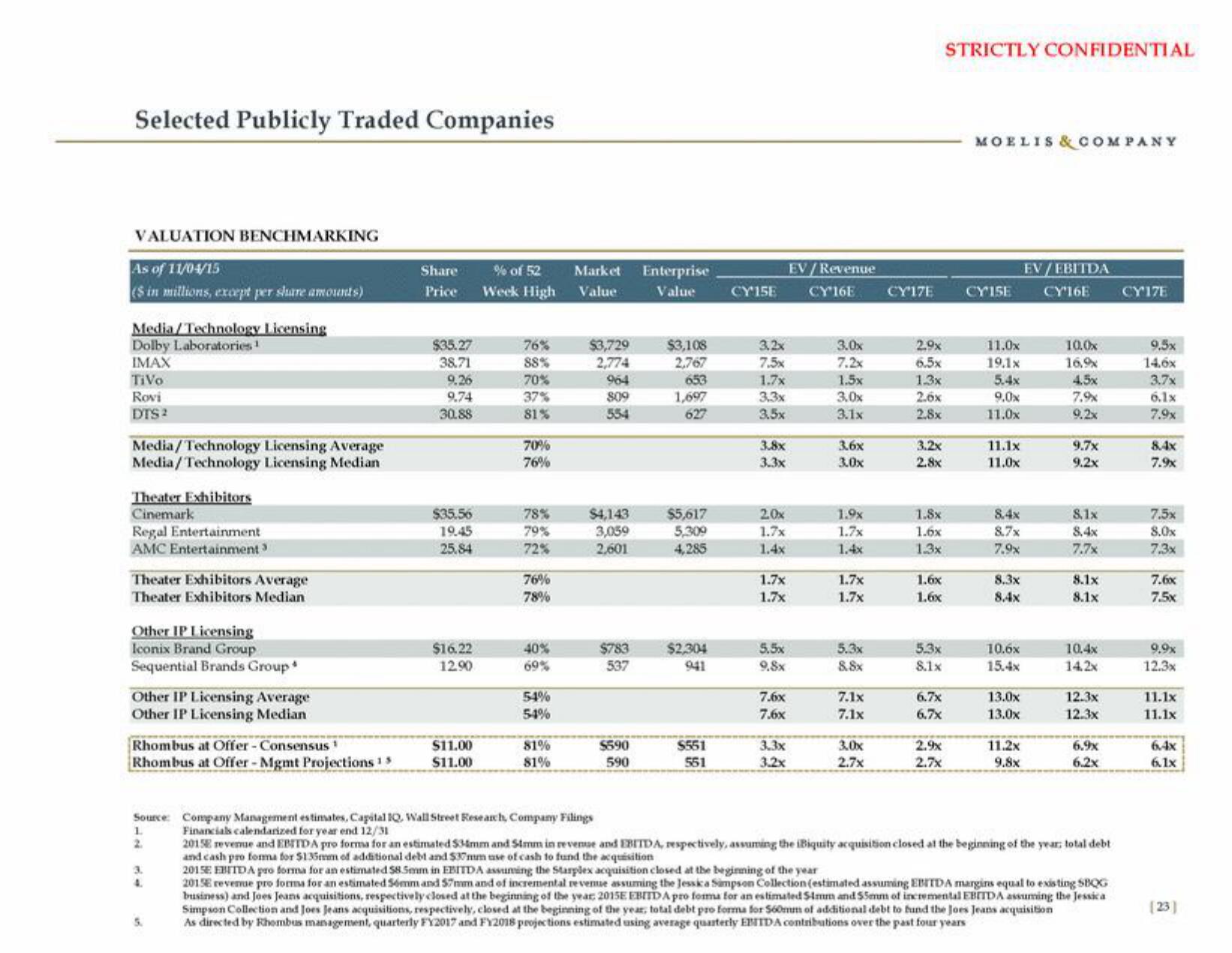

VALUATION BENCHMARKING

As of 11/04/15

($ in millions, except per share amounts)

Media/Technology Licensing

Dolby Laboratories 1

IMAX

TiVo

Rovi

DTS 2

Media/Technology Licensing Average

Media/Technology Licensing Median

Theater Exhibitors

Cinemark

Regal Entertainment

AMC Entertainment ³

Theater Exhibitors Average

Theater Exhibitors Median

Other IP Licensing

Iconix Brand Group

Sequential Brands Group*

Other IP Licensing Average

Other IP Licensing Median

Rhombus at Offer - Consensus ¹

Rhombus at Offer - Mgmt Projections 15

Share

Price

3.

4.

$35.27

38.71

9.26

9.74

30.88

$35.56

19.45

25.84

$16.22

12.90

$11.00

$11.00

% of 52

Week High

76%

88%

70%

37%

81%

70%

76%

78%

79%

72%

76%

78%

40%

69%

54%

54%

81%

81%

Market

Value

$3,729

2,774

964

809

554

$4,143

3,059

2,601

$783

537

$590

590

Enterprise

Value

$3,108

2,767

653

1,697

627

$5,617

5,309

4,285

$2,304

941

$551

551

CY 15E

3.2x

7.5x

1.7x

3.3x

3.5x

3.8x

3.3x

20x

1.7x

1.4x

1.7x

1.7x

5.5x

9,8x

7.6x

7.6x

3.3x

3.2x

EV/Revenue

CY 16E

3.0x

7.2x

1.5x

3,0x

3.1x

3.6x

3.0x

1.9x

1.7x

1.4x

1.7x

1.7x

5.3x

8.8x

7.1x

7.1x

3.0x

2.7x

CY'17E

2,9x

6.5x

1.3x

2.6x

2.8x

3.2x

2.8x

1.8x

1.6x

1.3x

1.6x

1.6x

5.3x

8.1x

6.7x

6.7x

2.9x

2.7x

STRICTLY CONFIDENTIAL

MOELIS & COMPANY

CY' 15E

11.0x

19.1x

5.4x

9.0x

11.0x

11.1x

11.0x

8.4x

8.7x

7.9x

8.3x

8.4x

10.6x

15.4x

13.0x

13.0x

11.2x

9.8x

EV/EBITDA

CY'16E

10.0x

16,9x

4.5x

7.9%

9.2x

9.7x

9.2x

8,1x

8.4x

7.7x

8.1x

8.1x

10.4x

14,2x

12.3x

12.3x

6.9x

6,2x

1

Source: Company Management estimates, Capital IQ, Wall Street Research, Company Filings

Financials calendarized for year end 12/31

2015E revenue and EBITDA pro forma for an estimated 534mm and Simm in revenue and EBITDA, respectively, assuming the iBiquity acquisition closed at the beginning of the year; total debt

and cash pro forma for $135mm of additional debt and $37mm use of cash to fund the acquisition

2015E EBITDA pro forma for an estimated $8.5mm in EBITDA assuming the Starplex acquisition closed at the beginning of the year

2015E revenue pro forma for an estimated 56mm and 57mm and of incremental revenue assuming the Jessica Simpson Collection (estimated assuming EBITDA margins equal to existing SBQG

business) and Joes Jeans acquisitions, respectively closed at the beginning of the year 2015E EBITDA pro forma for an estimated $4mm and 55mm of incremental EBITDA assuming the Jessica

Simpson Collection and Joes Jeans acquisitions, respectively, closed at the beginning of the year, total debt pro forma for 560mm of additional debt to fund the Joes Jeans acquisition

As directed by Rhombus management, quarterly FY2017 and FY2018 projections estimated using average quarterly EBITDA contributions over the past four years

CY'17E

9,5x

14.6x

3.7x

6.1x

7.9x

8.4x

7.9x

7.5x

8.0x

7.3x

7.6x

7.5x

9.9x

12.3x

11.1x

11.1x

6.1x

[23]View entire presentation