J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

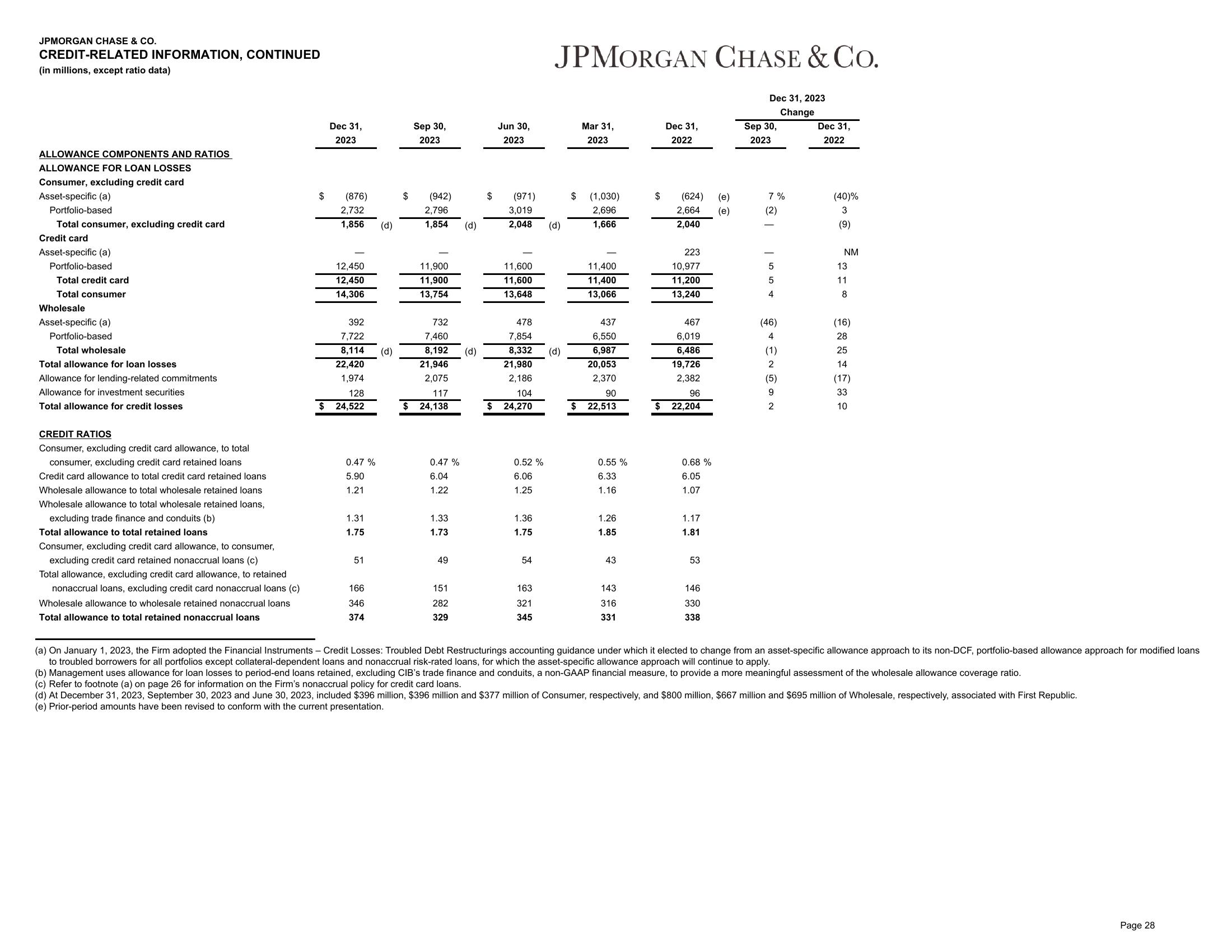

ALLOWANCE COMPONENTS AND RATIOS

ALLOWANCE FOR LOAN LOSSES

Consumer, excluding credit card

Asset-specific (a)

Portfolio-based

Total consumer, excluding credit card

Credit card

Asset-specific (a)

Portfolio-based

Total credit card

Total consumer

Wholesale

Asset-specific (a)

Portfolio-based

Total wholesale

Total allowance for loan losses

Allowance for lending-related commitments

Allowance for investment securities

Total allowance for credit losses

CREDIT RATIOS

Consumer, excluding credit card allowance, to total

consumer, excluding credit card retained loans

Credit card allowance to total credit card retained loans

Wholesale allowance to total wholesale retained loans

Wholesale allowance to total wholesale retained loans,

excluding trade finance and conduits (b)

Total allowance to total retained loans

Consumer, excluding credit card allowance, to consumer,

excluding credit card retained nonaccrual loans (c)

Total allowance, excluding credit card allowance, to retained

nonaccrual loans, excluding credit card nonaccrual loans (c)

Wholesale allowance to wholesale retained nonaccrual loans

Total allowance to total retained nonaccrual loans

$

Dec 31,

2023

(876)

2,732

1,856

12,450

12,450

14,306

392

7,722

8,114

22,420

1,974

128

24,522

0.47 %

5.90

1.21

1.31

1.75

51

166

346

374

(d)

(d)

$

Sep 30,

2023

(942)

2,796

1,854

11,900

11,900

13,754

732

7,460

8,192

21,946

2,075

117

$ 24,138

0.47 %

6.04

1.22

1.33

1.73

49

151

282

329

(d)

(d)

$

Jun 30,

2023

(971)

3,019

2,048

11,600

11,600

13,648

0.52 %

6.06

1.25

478

7,854

8,332 (d)

21,980

2,186

104

$ 24,270

1.36

1.75

54

JPMORGAN CHASE & CO.

163

321

345

(d)

Mar 31,

2023

$ (1,030)

2,696

1,666

$

11,400

11,400

13,066

437

6,550

6,987

20,053

2,370

90

22,513

0.55 %

6.33

1.16

1.26

1.85

43

143

316

331

$

$

Dec 31,

2022

(624)

2,664

2,040

223

10,977

11,200

13,240

467

6,019

6,486

19,726

2,382

96

22,204

0.68 %

6.05

1.07

1.17

1.81

53

146

330

338

(e)

(e)

Dec 31, 2023

Change

Sep 30,

2023

7%

(2)

5

5

4

(46)

4

(1)

2

(5)

9

2

Dec 31,

2022

(40)%

3

(9)

NM

13

11

8

(16)

28

25

14

(17)

33

10

(a) On January 1, 2023, the Firm adopted the Financial Instruments - Credit Losses: Troubled Debt Restructurings accounting guidance under which it elected to change from an asset-specific allowance approach to its non-DCF, portfolio-based allowance approach for modified loans

to troubled borrowers for all portfolios except collateral-dependent loans and nonaccrual risk-rated loans, for which the asset-specific allowance approach will continue to apply.

(b) Management uses allowance for loan losses to period-end loans retained, excluding CIB's trade finance and conduits, a non-GAAP financial measure, to provide a more meaningful assessment of the wholesale allowance coverage ratio.

(c) Refer to footnote (a) on page 26 for information on the Firm's nonaccrual policy for credit card loans.

(d) At December 31, 2023, September 30, 2023 and June 30, 2023, included $396 million, $396 million and $377 million of Consumer, respectively, and $800 million, $667 million and $695 million of Wholesale, respectively, associated with First Republic.

(e) Prior-period amounts have been revised to conform with the current presentation.

Page 28View entire presentation