LionTree Investment Banking Pitch Book

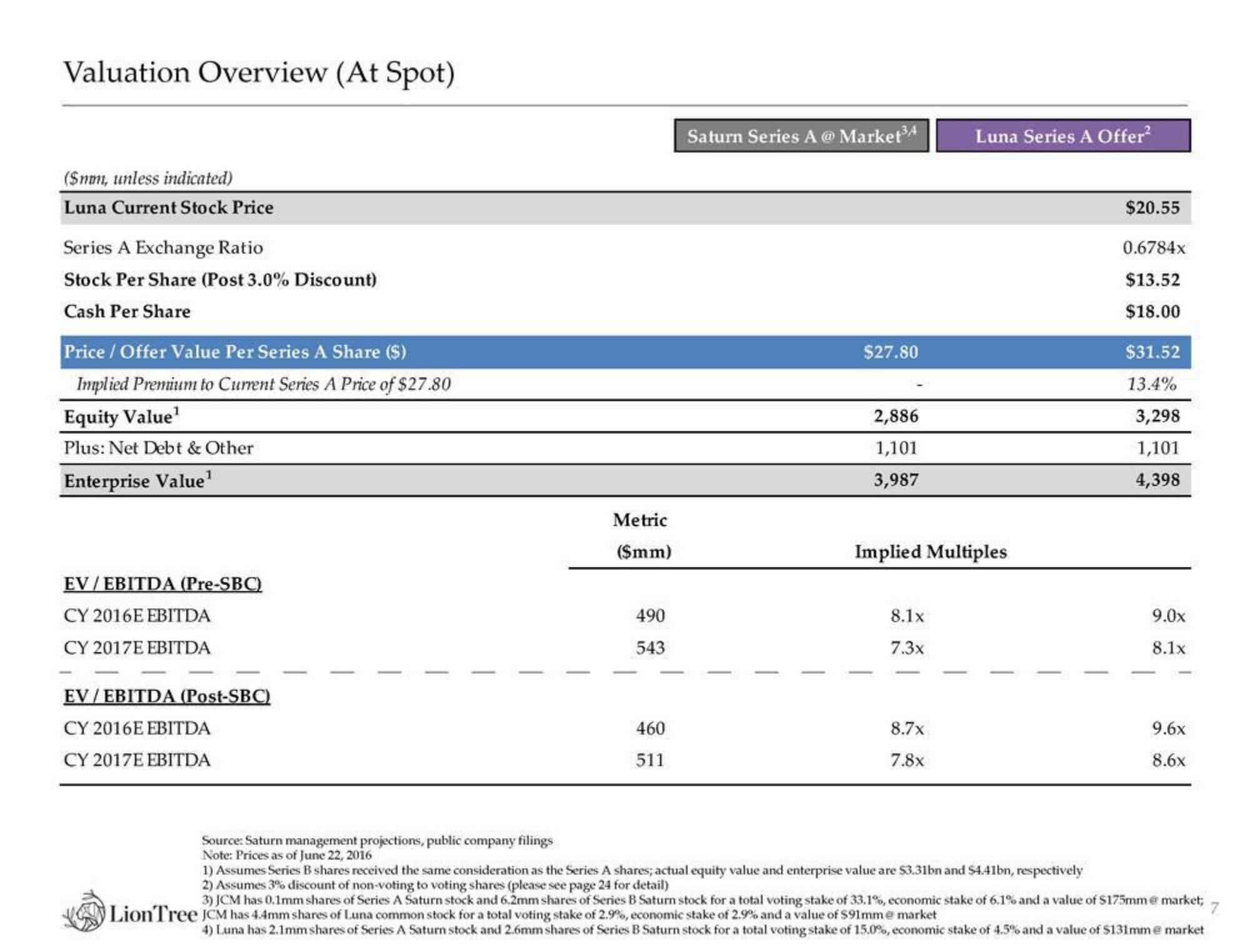

Valuation Overview (At Spot)

($mm, unless indicated)

Luna Current Stock Price

Series A Exchange Ratio

Stock Per Share (Post 3.0% Discount)

Cash Per Share

Price / Offer Value Per Series A Share ($)

Implied Premium to Current Series A Price of $27.80

Equity Value¹

Plus: Net Debt & Other

Enterprise Value¹

EV/EBITDA (Pre-SBC)

CY 2016E EBITDA

CY 2017E EBITDA

EV/EBITDA (Post-SBC)

CY 2016E EBITDA

CY 2017E EBITDA

Metric

($mm)

490

543

460

511

Saturn Series A @Market³4

$27.80

2,886

1,101

3,987

Implied Multiples

8.1x

7.3x

Luna Series A Offer²

8.7x

7.8x

$20.55

0.6784x

$13.52

$18.00

$31.52

13.4%

3,298

1,101

4,398

9.0x

8.1x

9.6x

8.6x

Source: Saturn management projections, public company filings

Note: Prices as of June 22, 2016

1) Assumes Series B shares received the same consideration as the Series A shares; actual equity value and enterprise value are $3.31bn and $4.41bn, respectively

2) Assumes 3% discount of non-voting to voting shares (please see page 24 for detail)

3) JCM has 0.1mm shares of Series A Saturn stock and 6.2mm shares of Series B Saturn stock for a total voting stake of 33.1%, economic stake of 6.1% and a value of $175mm @ market;

LionTree JCM has 4.4mm shares of Luna common stock for a total voting stake of 2.9%, economic stake of 2.9% and a value of $91mm @ market

7

4) Luna has 2.1mm shares of Series A Saturn stock and 2.6mm shares of Series B Saturn stock for a total voting stake of 15.0%, economic stake of 4.5% and a value of $131mm @ marketView entire presentation