Netstreit Investor Presentation Deck

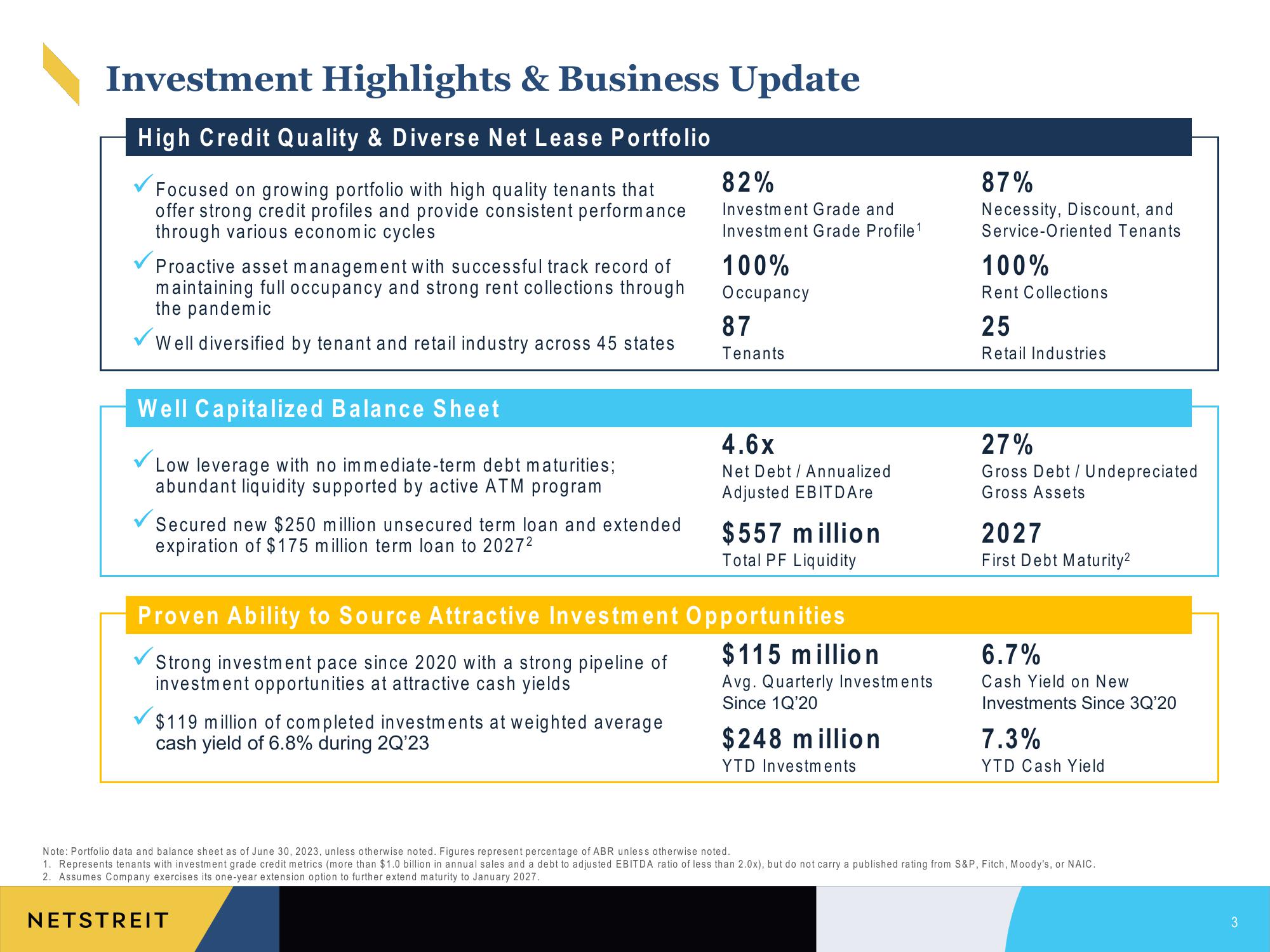

Investment Highlights & Business Update

High Credit Quality & Diverse Net Lease Portfolio

Focused on growing portfolio with high quality tenants that

offer strong credit profiles and provide consistent performance

through various economic cycles

Proactive asset management with successful track record of

maintaining full occupancy and strong rent collections through

the pandemic

Well diversified by tenant and retail industry across 45 states

Well Capitalized Balance Sheet

Low leverage with no immediate-term debt maturities;

abundant liquidity supported by active ATM program

Secured new $250 million unsecured term loan and extended

expiration of $175 million term loan to 2027²

Proven Ability to Source Attractive Investment

Strong investment pace since 2020 with a strong pipeline of

investment opportunities at attractive cash yields

$119 million of completed investments at weighted average

cash yield of 6.8% during 2Q'23

82%

Investment Grade and

Investment Grade Profile¹

100%

Occupancy

87

Tenants

4.6x

Net Debt / Annualized

Adjusted EBITD Are

$557 million

Total PF Liquidity

Opportunities

$115 million

Avg. Quarterly Investments

Since 1Q'20

$248 million

YTD Investments

87%

Necessity, Discount, and

Service-Oriented Tenants

100%

Rent Collections

25

Retail Industries

27%

Gross Debt / Undepreciated

Gross Assets

2027

First Debt Maturity²

6.7%

Cash Yield on New

Investments Since 3Q'20

7.3%

YTD Cash Yield

Note: Portfolio data and balance sheet as of June 30, 2023, unless otherwise noted. Figures represent percentage of ABR unless otherwise noted.

1. Represents tenants with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody's, or NAIC.

2. Assumes Company exercises its one-year extension option to further extend maturity to January 2027.

NETSTREIT

3View entire presentation