Procore IPO Presentation Deck

80%

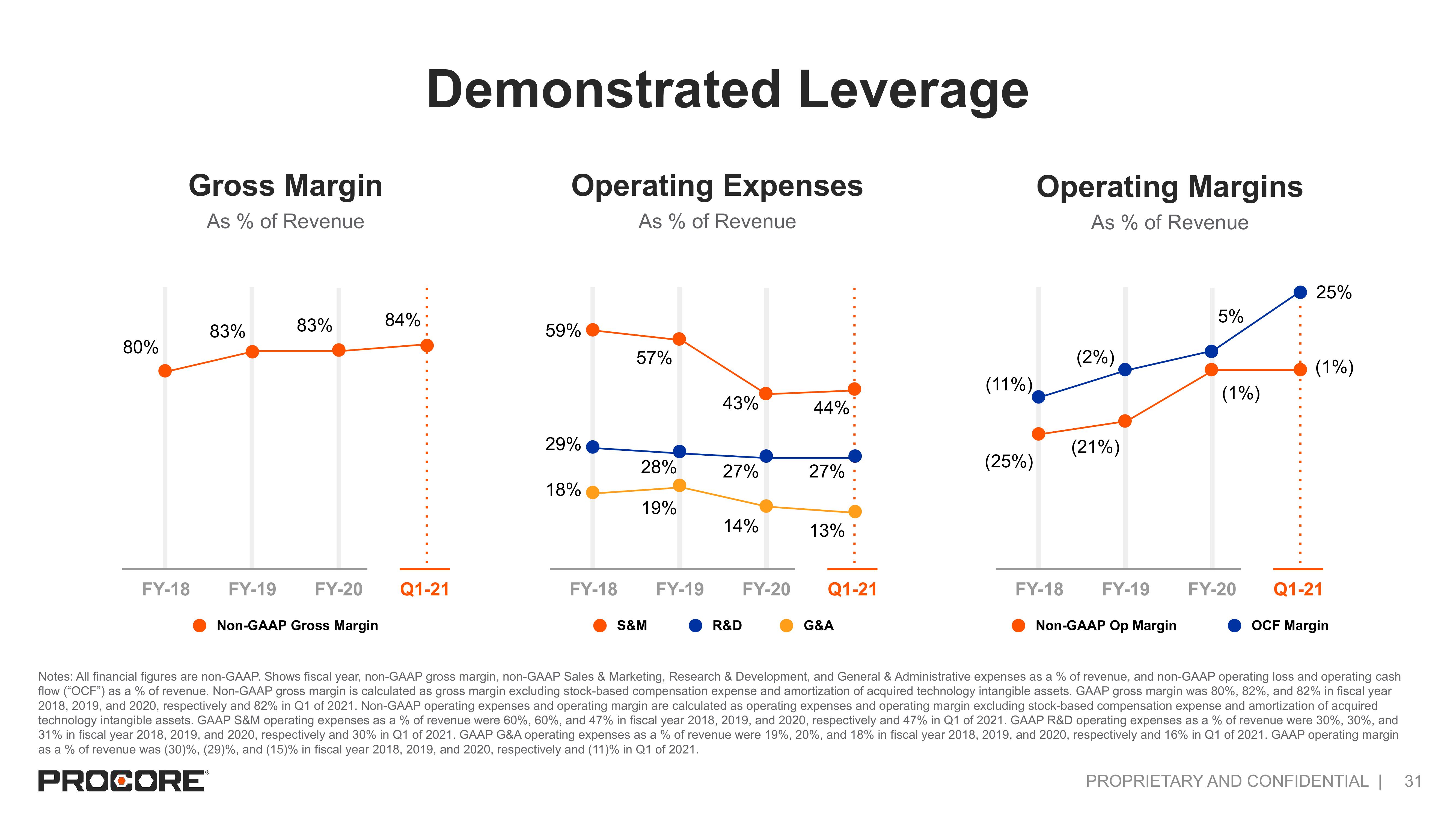

Gross Margin

As % of Revenue

FY-18

83%

83%

84%

Demonstrated Leverage

FY-19 FY-20 Q1-21

Non-GAAP Gross Margin

Operating Expenses

As % of Revenue

59%

29%

18%

FY-18

57%

28%

19%

S&M

FY-19

43%

27%

14%

R&D

44%

27%

13%

FY-20 Q1-21

G&A

(11%)

(25%)

Operating Margins

As % of Revenue

(2%)

(21%)

5%

(1%)

FY-18 FY-19 FY-20

Non-GAAP Op Margin

......

25%

(1%)

Q1-21

OCF Margin

Notes: All financial figures are non-GAAP. Shows fiscal year, non-GAAP gross margin, non-GAAP Sales & Marketing, Research & Development, and General & Administrative expenses as a % of revenue, and non-GAAP operating loss and operating cash

flow ("OCF") as a % of revenue. Non-GAAP gross margin is calculated as gross margin excluding stock-based compensation expense and amortization of acquired technology intangible assets. GAAP gross margin was 80%, 82%, and 82% in fiscal year

2018, 2019, and 2020, respectively and 82% in Q1 of 2021. Non-GAAP operating expenses and operating margin are calculated as operating expenses and operating margin excluding stock-based compensation expense and amortization of acquired

technology intangible assets. GAAP S&M operating expenses as a % of revenue were 60%, 60%, and 47% in fiscal year 2018, 2019, and 2020, respectively and 47% in Q1 of 2021. GAAP R&D operating expenses as a % of revenue were 30%, 30%, and

31% in fiscal year 2018, 2019, and 2020, respectively and 30% in Q1 of 2021. GAAP G&A operating expenses as a % of revenue were 19%, 20%, and 18% in fiscal year 2018, 2019, and 2020, respectively and 16% in Q1 of 2021. GAAP operating margin

as a % of revenue was (30)%, (29) %, and (15) % in fiscal year 2018, 2019, and 2020, respectively and (11) % in Q1 of 2021.

PROCORE

PROPRIETARY AND CONFIDENTIAL |

31View entire presentation