Sumo Logic SPAC Presentation Deck

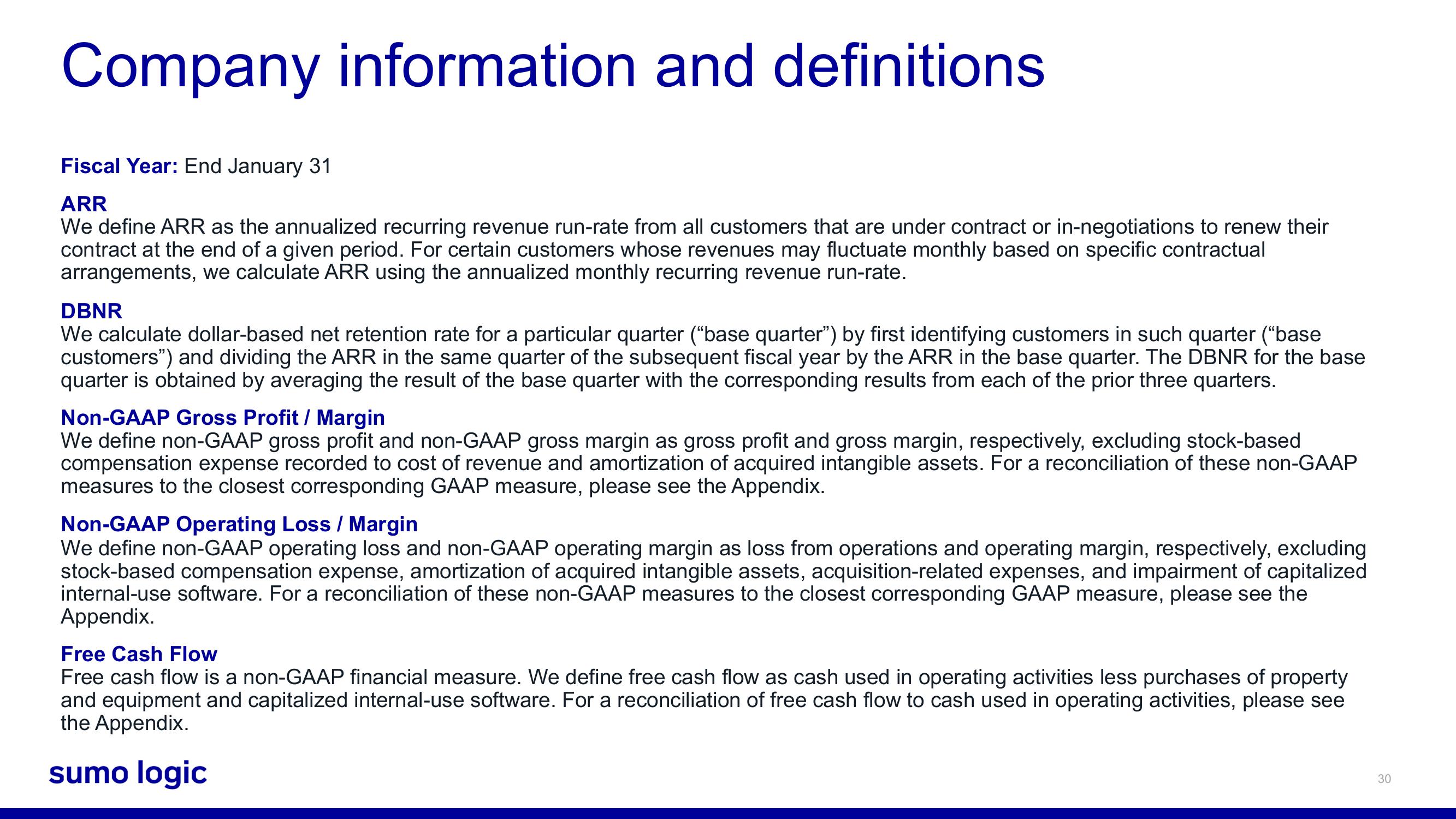

Company information and definitions

Fiscal Year: End January 31

ARR

We define ARR as the annualized recurring revenue run-rate from all customers that are under contract or in-negotiations to renew their

contract at the end of a given period. For certain customers whose revenues may fluctuate monthly based on specific contractual

arrangements, we calculate ARR using the annualized monthly recurring revenue run-rate.

DBNR

We calculate dollar-based net retention rate for a particular quarter ("base quarter") by first identifying customers in such quarter ("base

customers") and dividing the ARR in the same quarter of the subsequent fiscal year by the ARR in the base quarter. The DBNR for the base

quarter is obtained by averaging the result of the base quarter with the corresponding results from each of the prior three quarters.

Non-GAAP Gross Profit / Margin

We define non-GAAP gross profit and non-GAAP gross margin as gross profit and gross margin, respectively, excluding stock-based

compensation expense recorded to cost of revenue and amortization of acquired intangible assets. For a reconciliation of these non-GAAP

measures to the closest corresponding GAAP measure, please see the Appendix.

Non-GAAP Operating Loss / Margin

We define non-GAAP operating loss and non-GAAP operating margin as loss from operations and operating margin, respectively, excluding

stock-based compensation expense, amortization of acquired intangible assets, acquisition-related expenses, and impairment of capitalized

internal-use software. For a reconciliation of these non-GAAP measures to the closest corresponding GAAP measure, please see the

Appendix.

Free Cash Flow

Free cash flow is a non-GAAP financial measure. We define free cash flow as cash used in operating activities less purchases of property

and equipment and capitalized internal-use software. For a reconciliation of free cash flow to cash used in operating activities, please see

the Appendix.

sumo logic

30View entire presentation