Proposed Investment in a Solar Portfolio in Germany

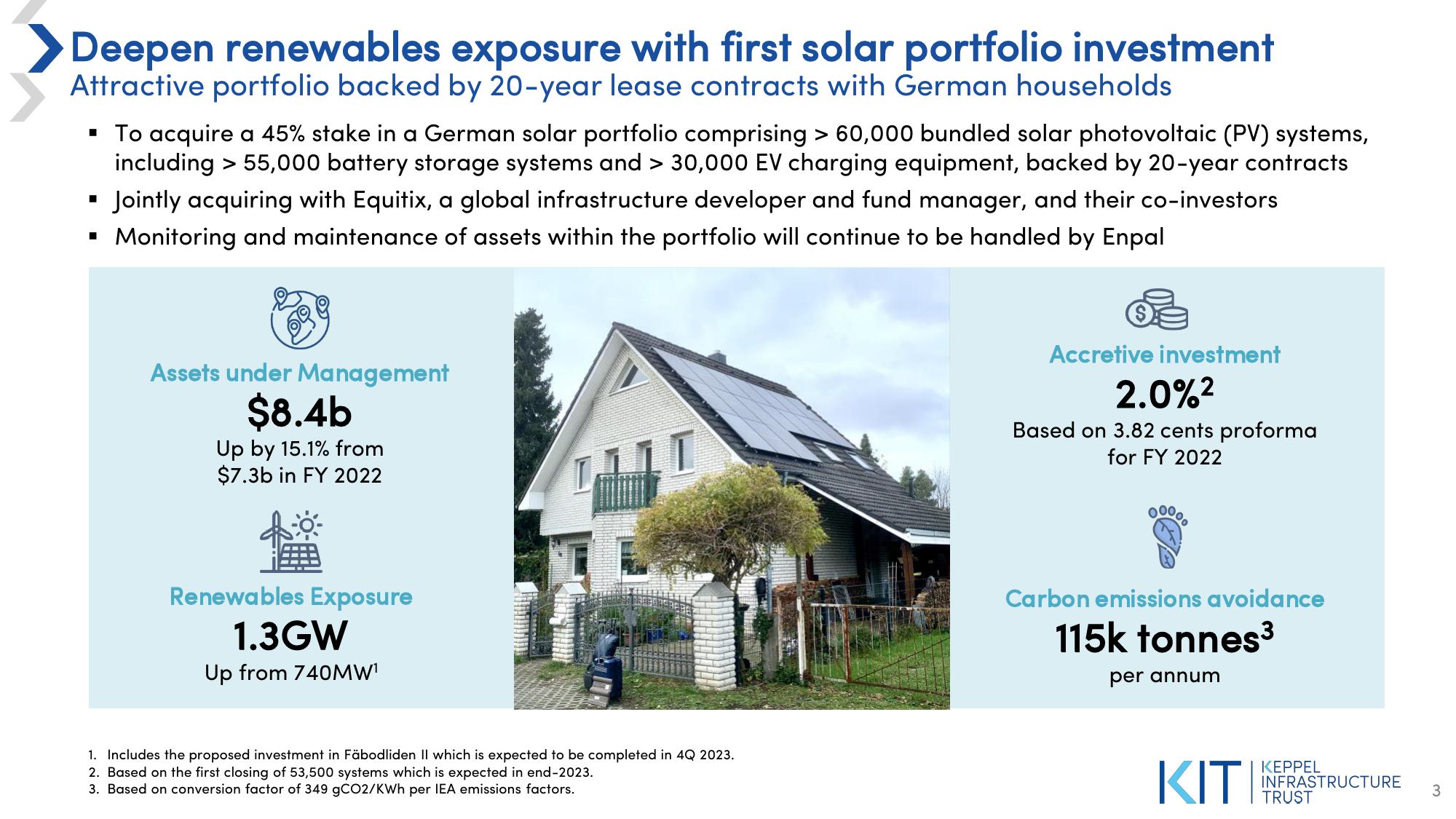

Deepen renewables exposure with first solar portfolio investment

Attractive portfolio backed by 20-year lease contracts with German households

■

■ To acquire a 45% stake in a German solar portfolio comprising > 60,000 bundled solar photovoltaic (PV) systems,

including > 55,000 battery storage systems and > 30,000 EV charging equipment, backed by 20-year contracts

■ Jointly acquiring with Equitix, a global infrastructure developer and fund manager, and their co-investors

Monitoring and maintenance of assets within the portfolio will continue to be handled by Enpal

Assets under Management

$8.4b

Up by 15.1% from

$7.3b in FY 2022

Renewables Exposure

1.3GW

Up from 740MW¹

1. Includes the proposed investment in Fäbodliden II which is expected to be completed in 4Q 2023.

2. Based on the first closing of 53,500 systems which is expected in end-2023.

3. Based on conversion factor of 349 gCO2/KWh per IEA emissions factors.

Accretive investment

2.0%2

Based on 3.82 cents proforma

for FY 2022

Carbon emissions avoidance

115k tonnes³

per annum

KIT

KEPPEL

INFRASTRUCTURE

3

TRUSTView entire presentation