Snap Inc Results Presentation Deck

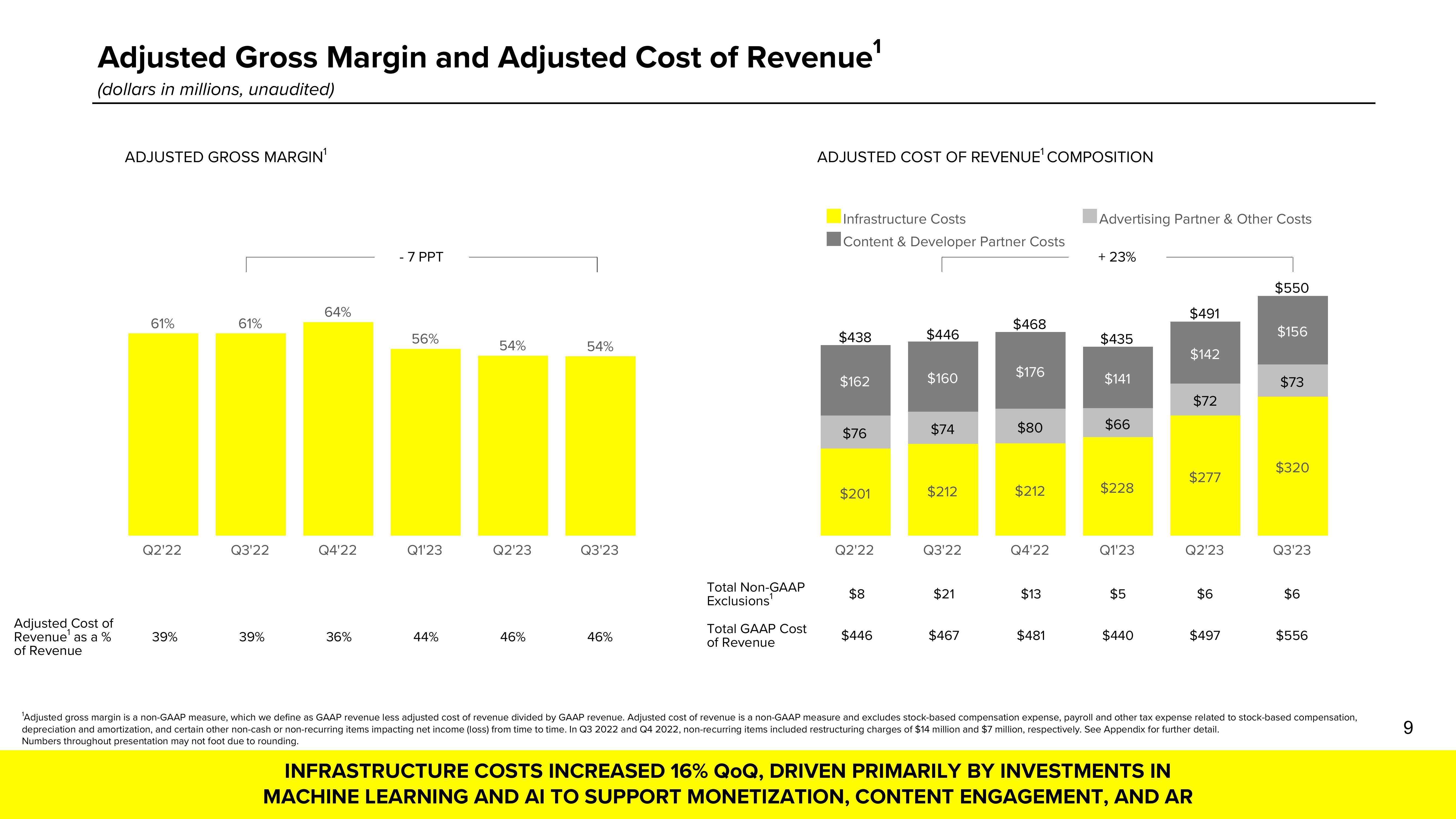

Adjusted Gross Margin and Adjusted Cost of Revenue¹

(dollars in millions, unaudited)

Adjusted Cost of

Revenue as a %

of Revenue

ADJUSTED GROSS MARGIN¹

61%

Q2'22

39%

61%

Q3'22

39%

64%

Q4'22

36%

- 7 PPT

56%

Q1'23

44%

54%

Q2'23

46%

54%

Q3'23

46%

Total Non-GAAP

Exclusions

Total GAAP Cost

of Revenue

ADJUSTED COST OF REVENUE¹ COMPOSITION

Infrastructure Costs

Content & Developer Partner Costs

$438

$162

$76

$201

Q2'22

$8

$446

$446

$160

$74

$212

Q3'22

$21

$467

$468

$176

$80

$212

Q4'22

$13

$481

Advertising Partner & Other Costs

+ 23%

$435

$141

$66

$228

Q1'23

$5

$440

$491

$142

$72

$277

Q2'23

$6

$497

INFRASTRUCTURE COSTS INCREASED 16% QOQ, DRIVEN PRIMARILY BY INVESTMENTS IN

MACHINE LEARNING AND AI TO SUPPORT MONETIZATION, CONTENT ENGAGEMENT, AND AR

$550

$156

$73

$320

Q3'23

$6

$556

'Adjusted gross margin is a non-GAAP measure, which we define as GAAP revenue less adjusted cost of revenue divided by GAAP revenue. Adjusted cost of revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation,

depreciation and amortization, and certain other non-cash or non-recurring items impacting net income (loss) from time to time. In Q3 2022 and Q4 2022, non-recurring items included restructuring charges of $14 million and $7 million, respectively. See Appendix for further detail.

Numbers throughout presentation may not foot due to rounding.

9View entire presentation