Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

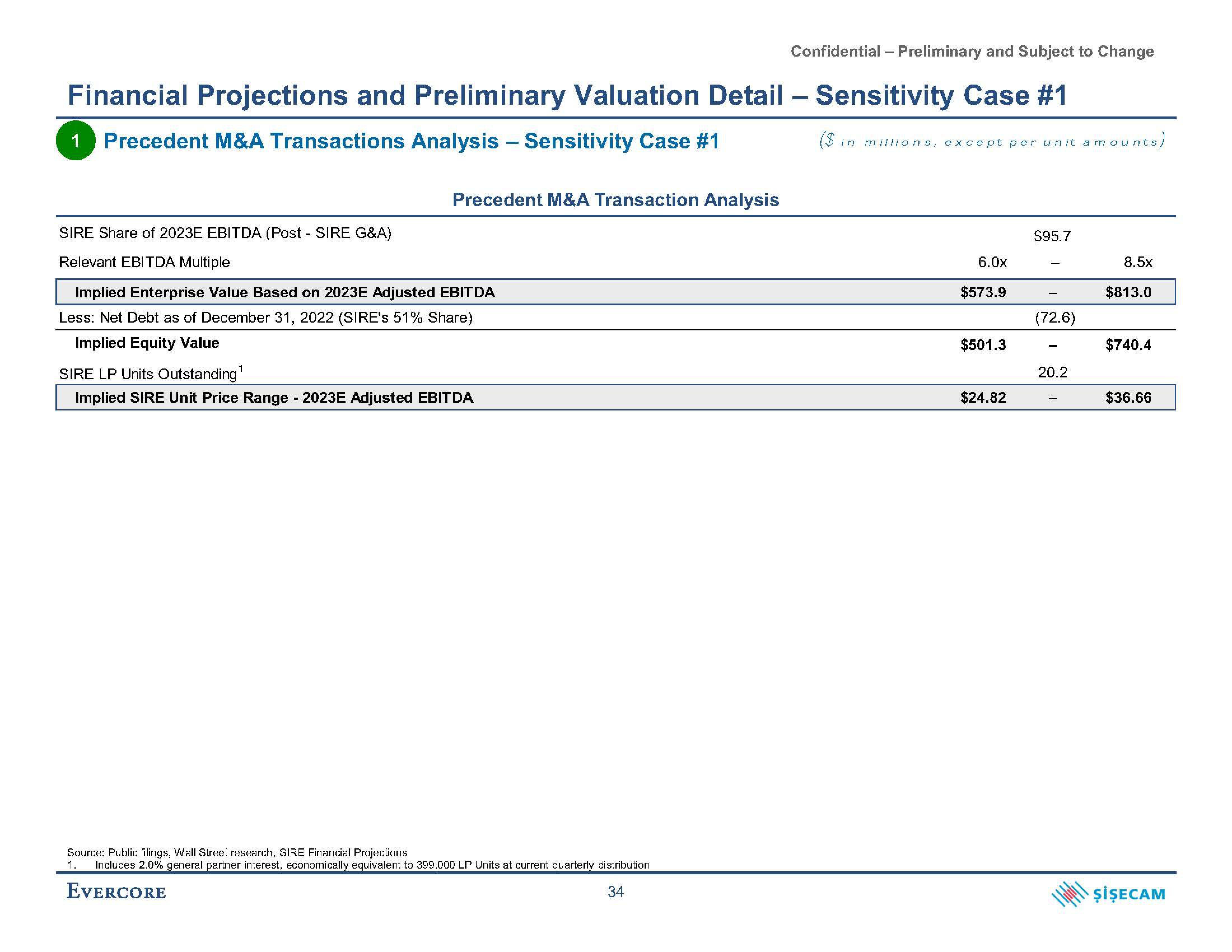

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #1

1 Precedent M&A Transactions Analysis - Sensitivity Case #1

($ in millions, except per unit amounts

SIRE Share of 2023E EBITDA (Post - SIRE G&A)

Relevant EBITDA Multiple

Precedent M&A Transaction Analysis

Implied Enterprise Value Based on 2023E Adjusted EBITDA

Less: Net Debt as of December 31, 2022 (SIRE's 51% Share)

Implied Equity Value

SIRE LP Units Outstanding¹

Implied SIRE Unit Price Range - 2023E Adjusted EBITDA

Source: Public filings, Wall Street research, SIRE Financial Projections

1. Includes 2.0% general partner interest, economically equivalent to 399,000 LP Units at current quarterly distribution

EVERCORE

34

6.0x

$573.9

$501.3

$24.82

$95.7

(72.6)

20.2

8.5x

$813.0

$740.4

$36.66

ŞİŞECAMView entire presentation