Hostess SPAC Presentation Deck

PAGE

16

SPAC TRANSACTION TERMS

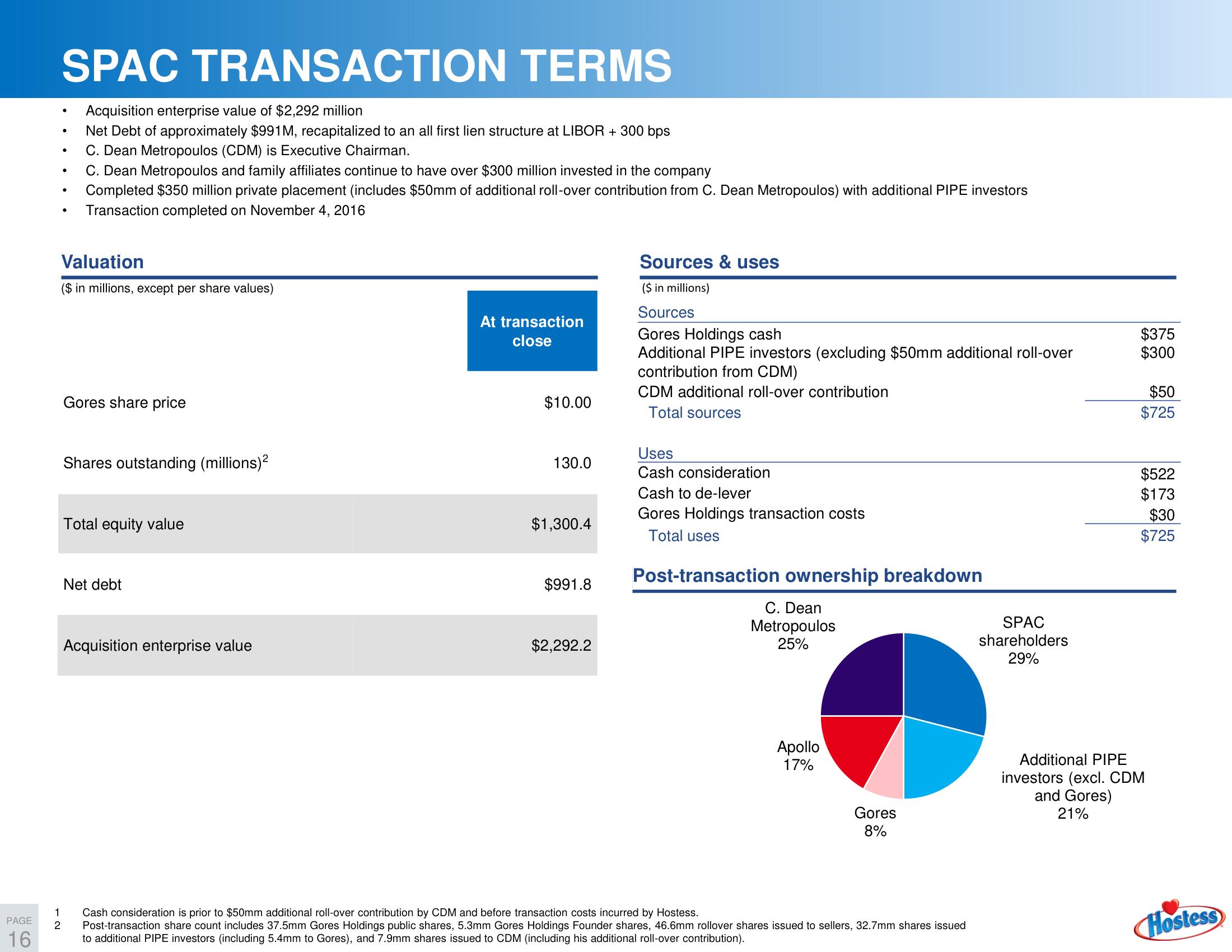

Acquisition enterprise value of $2,292 million

Net Debt of approximately $991 M, recapitalized to an all first lien structure at LIBOR + 300 bps

C. Dean Metropoulos (CDM) is Executive Chairman.

C. Dean Metropoulos and family affiliates continue to have over $300 million invested in the company

Completed $350 million private placement (includes $50mm of additional roll-over contribution from C. Dean Metropoulos) with additional PIPE investors

Transaction completed on November 4, 2016

1

2

●

.

Valuation

($ in millions, except per share values)

Gores share price

Shares outstanding (millions)²

Total equity value

Net debt

Acquisition enterprise value

At transaction

close

$10.00

130.0

$1,300.4

$991.8

$2,292.2

Sources & uses

($ in millions)

Sources

Gores Holdings cash

Additional PIPE investors (excluding $50mm additional roll-over

contribution from CDM)

CDM additional roll-over contribution

Total sources

Uses

Cash consideration

Cash to de-lever

Gores Holdings transaction costs

Total uses

Post-transaction ownership breakdown

C. Dean

Metropoulos

25%

Apollo

17%

Gores

8%

Cash consideration is prior to $50mm additional roll-over contribution by CDM and before transaction costs incurred by Hostess.

Post-transaction share count includes 37.5mm Gores Holdings public shares, 5.3mm Gores Holdings Founder shares, 46.6mm rollover shares issued to sellers, 32.7mm shares issued

to additional PIPE investors (including 5.4mm to Gores), and 7.9mm shares issued to CDM (including his additional roll-over contribution).

SPAC

shareholders

29%

$375

$300

$50

$725

$522

$173

$30

$725

Additional PIPE

investors (excl. CDM

and Gores)

21%

HostessView entire presentation