Ashtead Group Results Presentation Deck

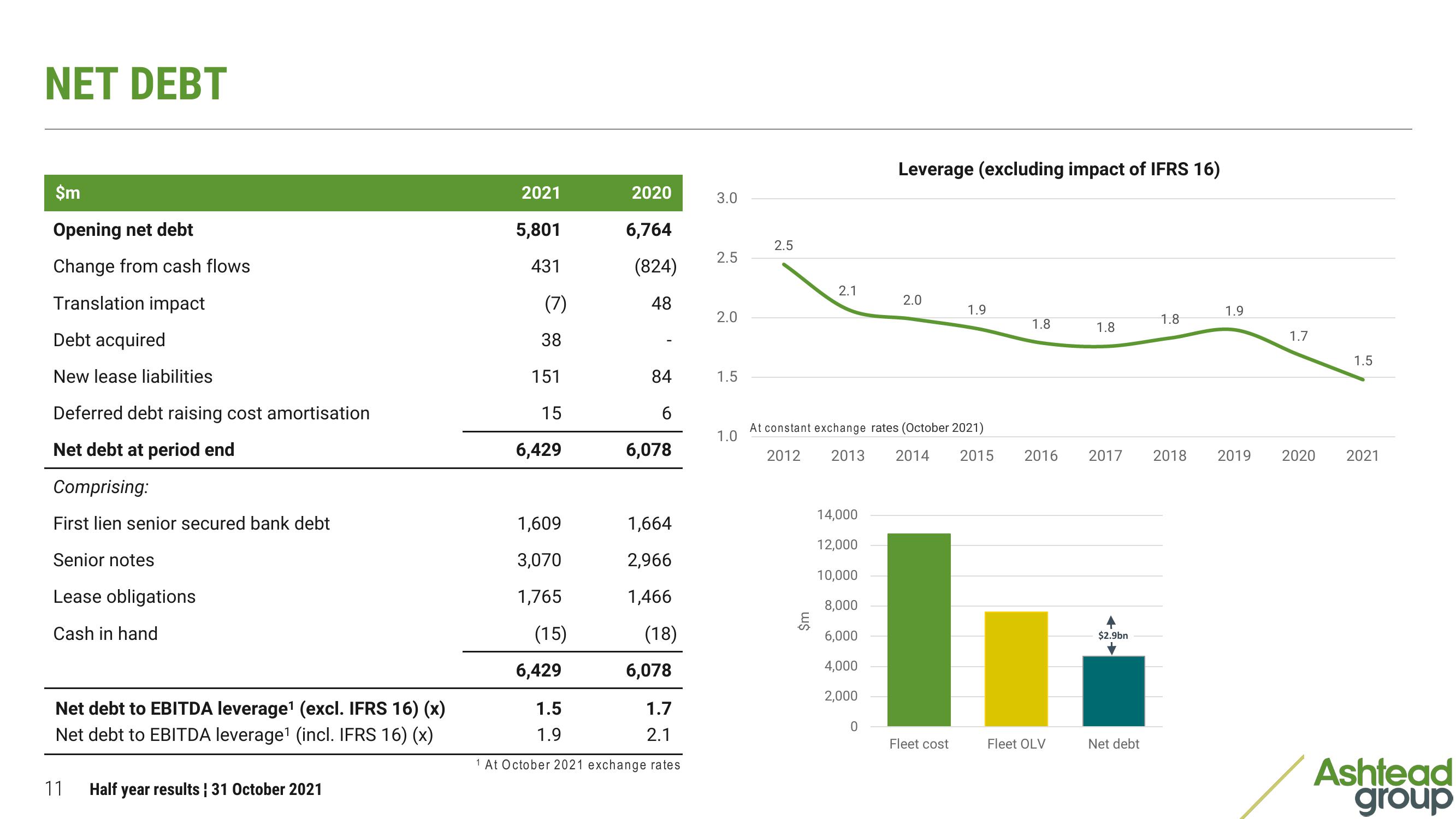

NET DEBT

$m

Opening net debt

Change from cash flows

Translation impact

Debt acquired

New lease liabilities

Deferred debt raising cost amortisation

Net debt at period end

Comprising:

First lien senior secured bank debt

Senior notes

Lease obligations

Cash in hand

Net debt to EBITDA leverage¹ (excl. IFRS 16) (x)

Net debt to EBITDA leverage¹ (incl. IFRS 16) (x)

11

Half year results | 31 October 2021

2021

5,801

431

(7)

38

151

15

6,429

1,609

3,070

1,765

(15)

6,429

2020

1.5

1.9

6,764

(824)

48

84

6

6,078

1,664

2,966

1,466

(18)

6,078

1.7

2.1

1 At October 2021 exchange rates

3.0

2.5

2.0

1.5

1.0

2.5

2.1

ած

14,000

12,000

10,000

8,000

6,000

4,000

2,000

Leverage (excluding impact of IFRS 16)

0

2.0

At constant exchange rates (October 2021)

2012 2013 2014 2015 2016

1.9

Fleet cost

1.8

Fleet OLV

1.8

2017

$2.9bn

Net debt

1.8

1.9

2018 2019

1.7

2020

1.5

2021

Ashtead

groupView entire presentation