Snap Inc Results Presentation Deck

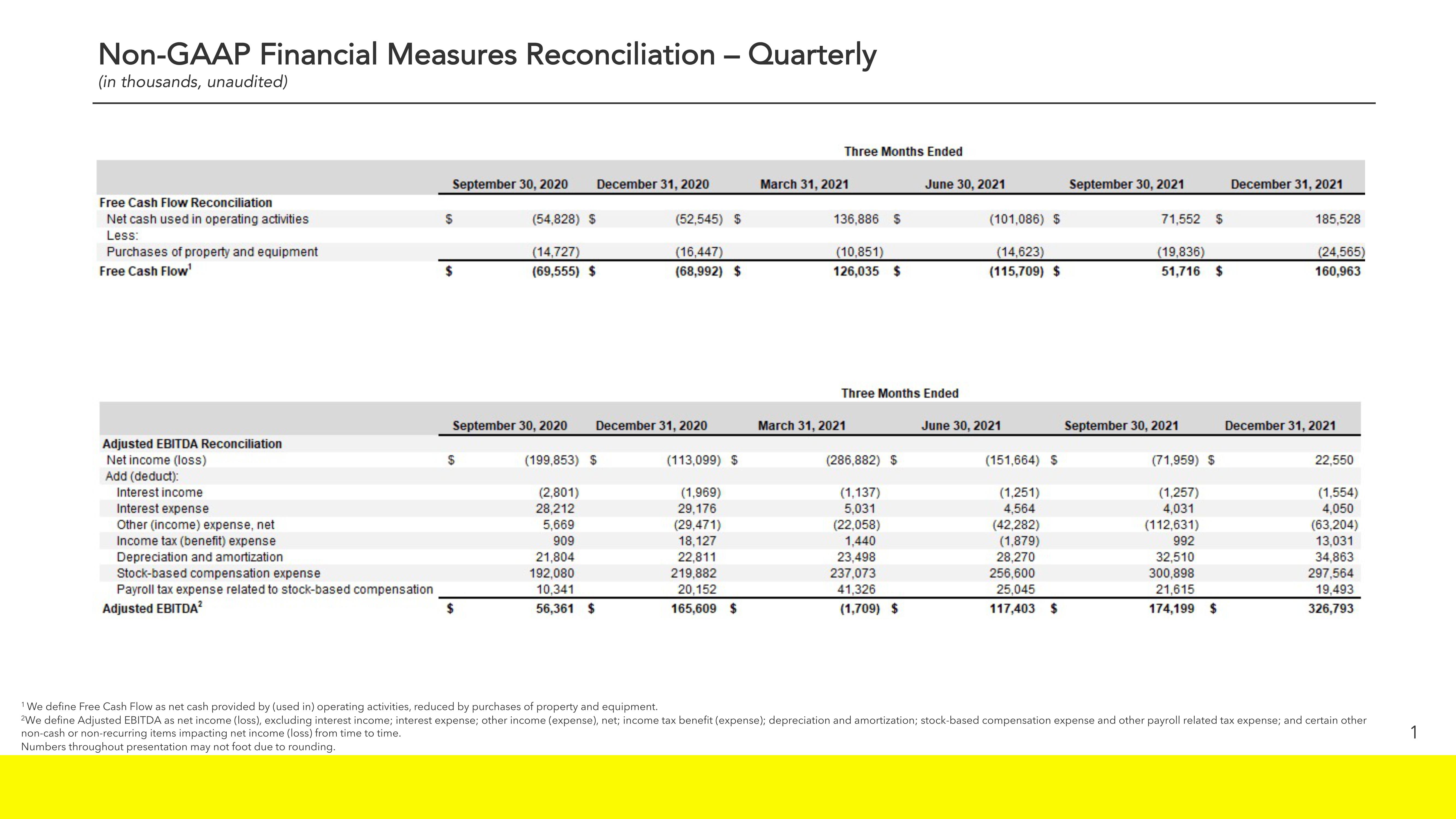

Non-GAAP Financial Measures Reconciliation - Quarterly

(in thousands, unaudited)

Free Cash Flow Reconciliation

Net cash used in operating activities

Less:

Purchases of property and equipment

Free Cash Flow¹

Adjusted EBITDA Reconciliation

Net income (loss)

Add (deduct):

Interest income

Interest expense

Other (income) expense, net

Income tax (benefit) expense

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Adjusted EBITDA²

September 30, 2020

$

$

$

(54,828) $

September 30, 2020

$

(14,727)

(69,555) $

December 31, 2020

(199,853) S

(2,801)

28,212

5,669

909

21,804

192,080

10,341

56,361 $

(52,545) S

(16,447)

(68,992) $

December 31, 2020

(113,099) S

(1,969)

29,176

(29,471)

18,127

22,811

219,882

20,152

165,609 $

Three Months Ended

March 31, 2021

136,886 $

(10,851)

126,035 $

Three Months Ended

March 31, 2021

(286,882) S

(1,137)

5,031

(22,058)

1,440

23,498

237,073

41,326

June 30, 2021

(1,709) $

(101,086) S

(14,623)

(115,709) $

June 30, 2021

(151,664) $

(1,251)

4,564

(42,282)

(1,879)

28,270

256,600

25,045

117,403 $

September 30, 2021

71,552

(19,836)

51,716 $

September 30, 2021

$

(71,959) $

(1,257)

4,031

(112,631)

992

32,510

300,898

21,615

174,199

$

December 31, 2021

185,528

(24,565)

160,963

December 31, 2021

22,550

(1,554)

4,050

(63,204)

13,031

34,863

297,564

19,493

326,793

¹ We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment.

2We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and other payroll related tax expense; and certain other

non-cash or non-recurring items impacting net income (loss) from time to time.

Numbers throughout presentation may not foot due to rounding.

1View entire presentation