PropertyGuru SPAC Presentation Deck

6

=========

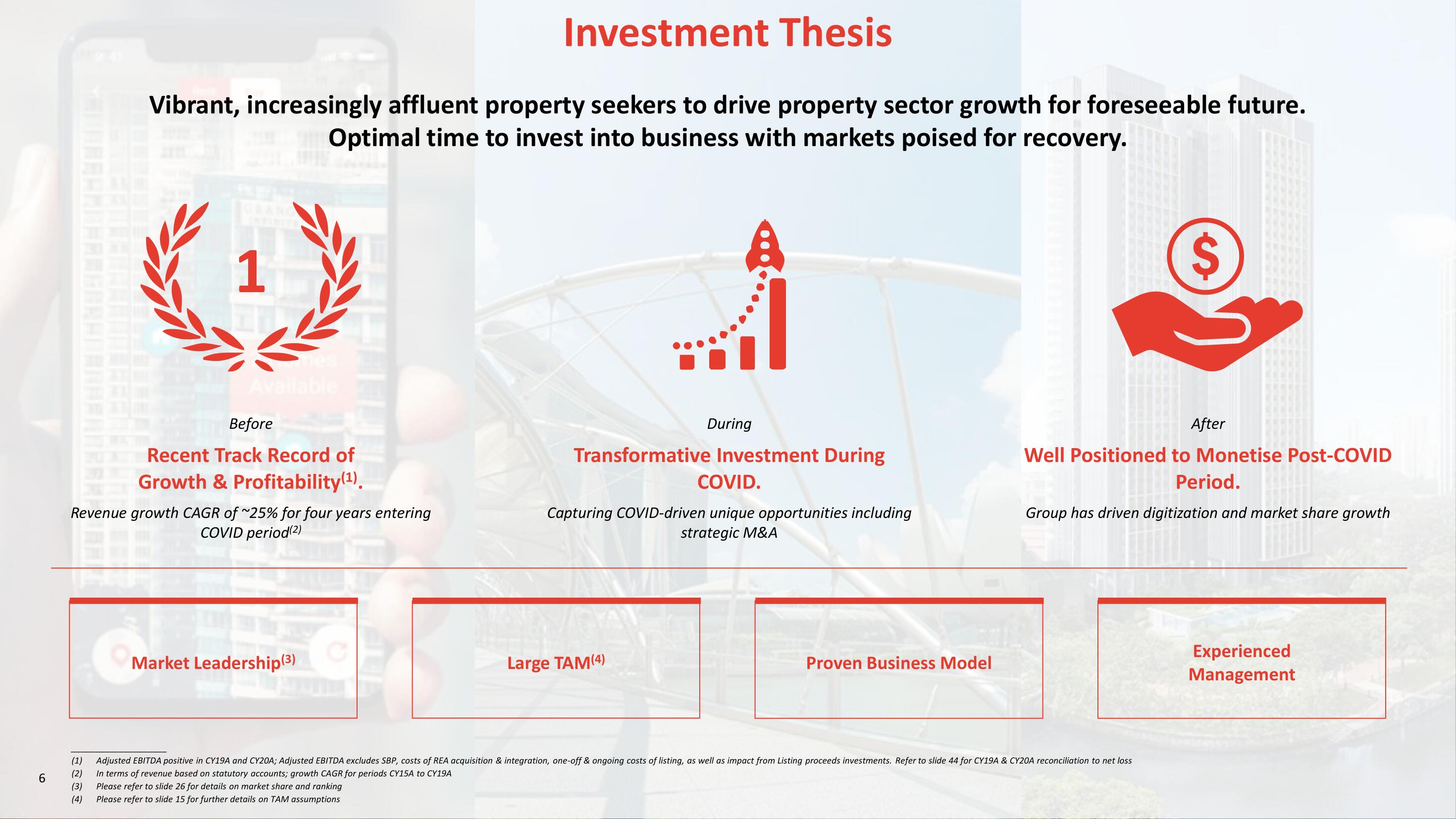

Investment Thesis

Vibrant, increasingly affluent property seekers to drive property sector growth for foreseeable future.

Optimal time to invest into business with markets poised for recovery.

1

Available

Before

Recent Track Record of

Growth & Profitability(¹).

Revenue growth CAGR of ~25% for four years entering

COVID period(2)

Market Leadership(3)

During

Transformative Investment During

COVID.

Capturing COVID-driven unique opportunities including

strategic M&A

Large TAM(4)

Proven Business Model

FORS

$

Well Positioned to Monetise Post-COVID

Period.

Group has driven digitization and market share growth

(1)

Adjusted EBITDA positive in CY19A and CY20A; Adjusted EBITDA excludes SBP, costs of REA acquisition & integration, one-off & ongoing costs of listing, as well as impact from Listing proceeds investments. Refer to slide 44 for CY19A & CY20A reconciliation to net loss

In terms of revenue based on statutory accounts; growth CAGR for periods CY15A to CY19A

(2)

(3) Please refer to slide 26 for details on market share and ranking

(4)

Please refer to slide 15 for further details on TAM assumptions

After

Experienced

ManagementView entire presentation