Gogoro SPAC Presentation Deck

Risk Factors

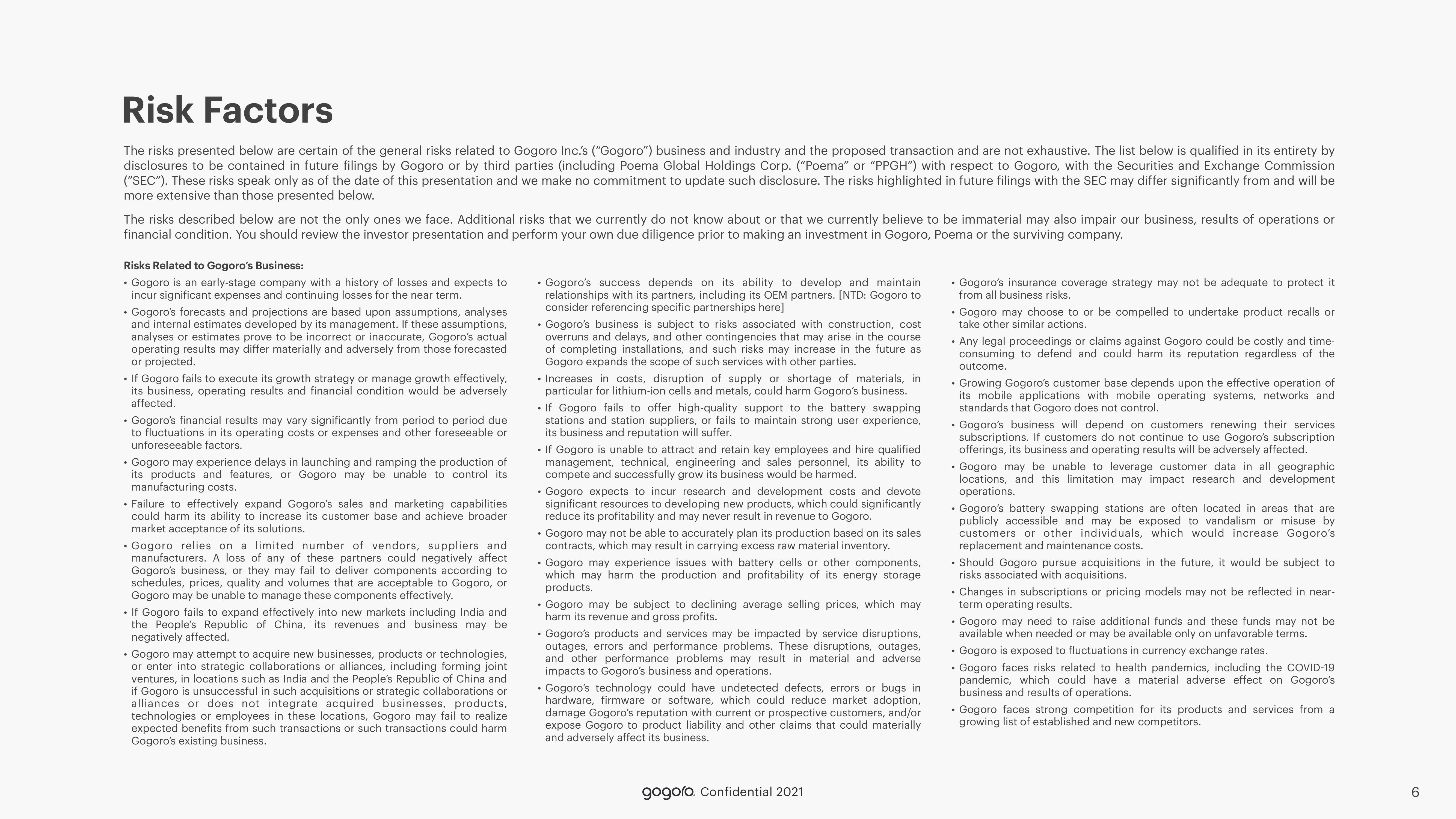

The risks presented below are certain of the general risks related to Gogoro Inc.'s ("Gogoro") business and industry and the proposed transaction and are not exhaustive. The list below is qualified in its entirety by

disclosures to be contained in future filings by Gogoro or by third parties (including Poema Global Holdings Corp. ("Poema" or "PPGH") with respect to Gogoro, with the Securities and Exchange Commission

("SEC"). These risks speak only as of the date of this presentation and we make no commitment to update such disclosure. The risks highlighted in future filings with the SEC may differ significantly from and will be

more extensive than those presented below.

The risks described below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business, results of operations or

financial condition. You should review the investor presentation and perform your own due diligence prior to making an investment in Gogoro, Poema or the surviving company.

Risks Related to Gogoro's Business:

• Gogoro is an early-stage company with a history of losses and expects to

incur significant expenses and continuing losses for the near term.

• Gogoro's forecasts and projections are based upon assumptions, analyses

and internal estimates developed by its management. If these assumptions,

analyses or estimates prove to be incorrect or inaccurate, Gogoro's actual

operating results may differ materially and adversely from those forecasted

or projected.

• If Gogoro fails to execute its growth strategy or manage growth effectively,

its business, operating results and financial condition would be adversely

affected.

• Gogoro's financial results may vary significantly from period to period due

to fluctuations in its operating costs or expenses and other foreseeable or

unforeseeable factors.

• Gogoro may experience delays in launching and ramping the production of

its products and features, or Gogoro may be unable to control its

manufacturing costs.

• Failure to effectively expand Gogoro's sales and marketing capabilities

could harm its ability to increase its customer base and achieve broader

market acceptance of its solutions.

. Gogoro relies on a limited number of vendors, suppliers and

manufacturers. A loss of any of these partners could negatively affect

Gogoro's business, or they may fail to deliver components according to

schedules, prices, quality and volumes that are acceptable to Gogoro, or

Gogoro may be unable to manage these components effectively.

• If Gogoro fails to expand effectively into new markets including India and

the People's Republic of China, its revenues and business may be

negatively affected.

• Gogoro may attempt to acquire new businesses, products or technologies,

or enter into strategic collaborations or alliances, including forming joint

ventures, in locations such as India and the People's Republic of China and

if Gogoro is unsuccessful in such acquisitions or strategic collaborations or

alliances or does not integrate acquired businesses, products,

technologies or employees in these locations, Gogoro may fail to realize

expected benefits from such transactions or such transactions could harm

Gogoro's existing business.

Gogoro's success depends on its ability to develop and maintain

relationships with its partners, including its OEM partners. [NTD: Gogoro to

consider referencing specific partnerships here]

• Gogoro's business is subject to risks associated with construction, cost

overruns and delays, and other contingencies that may arise in the course

of completing installations, and such risks may increase in the future as

Gogoro expands the scope of such services with other parties.

Increases in costs, disruption of supply or shortage of materials, in

particular for lithium-ion cells and metals, could harm Gogoro's business.

• If Gogoro fails to offer high-quality support to the battery swapping

stations and station suppliers, or fails to maintain strong user experience,

its business and reputation will suffer.

• If Gogoro is unable to attract and retain key employees and hire qualified

management, technical, engineering and sales personnel, its ability to

compete and successfully grow its business would be harmed.

Gogoro expects to incur research and development costs and devote

significant resources to developing new products, which could significantly

reduce its profitability and may never result in revenue to Gogoro.

Gogoro may not be able to accurately plan its production based on its sales

contracts, which may result in carrying excess raw material inventory.

. Gogoro may experience issues with battery cells or other components,

which may harm the production and profitability of its energy storage

products.

Gogoro may be subject to declining average selling prices, which may

harm its revenue and gross profits.

• Gogoro's products and services may be impacted by service disruptions,

outages, errors and performance problems. These disruptions, outages,

and other performance problems may result in material and adverse

impacts to Gogoro's business and operations.

. Gogoro's technology could have undetected defects, errors or bugs in

hardware, firmware or software, which could reduce market adoption,

damage Gogoro's reputation with current or prospective customers, and/or

expose Gogoro to product liability and other claims that could materially

and adversely affect its business.

gogoro. Confidential 2021

Gogoro's insurance coverage strategy may not be adequate to protect it

from all business risks.

• Gogoro may choose to or be compelled to undertake product recalls or

take other similar actions.

• Any legal proceedings or claims against Gogoro could be costly and time-

consuming to defend and could harm its reputation regardless of the

outcome.

• Growing Gogoro's customer base depends upon the effective operation of

its mobile applications with mobile operating systems, networks and

standards that Gogoro does not control.

. Gogoro's business will depend on customers renewing their services

subscriptions. If customers do not continue to use Gogoro's subscription.

offerings, its business and operating results will be adversely affected.

Gogoro may be unable to leverage customer data in all geographic

locations, and this limitation may impact research and development

operations.

. Gogoro's battery swapping stations are often located in areas that are

publicly accessible and may be exposed to vandalism or misuse by

customers or other individuals, which would increase Gogoro's

replacement and maintenance costs.

Should Gogoro pursue acquisitions in the future, it would be subject to

risks associated with acquisitions.

• Changes in subscriptions or pricing models may not be reflected in near-

term operating results.

• Gogoro may need to raise additional funds and these funds may not be

available when needed or may be available only on unfavorable terms.

Gogoro is exposed to fluctuations in currency exchange rates.

• Gogoro faces risks related to health pandemics, including the COVID-19

pandemic, which could have a material adverse effect on Gogoro's

business and results of operations.

Gogoro faces strong competition for its products and services from a

growing list of established and new competitors.

6View entire presentation