Blend Results Presentation Deck

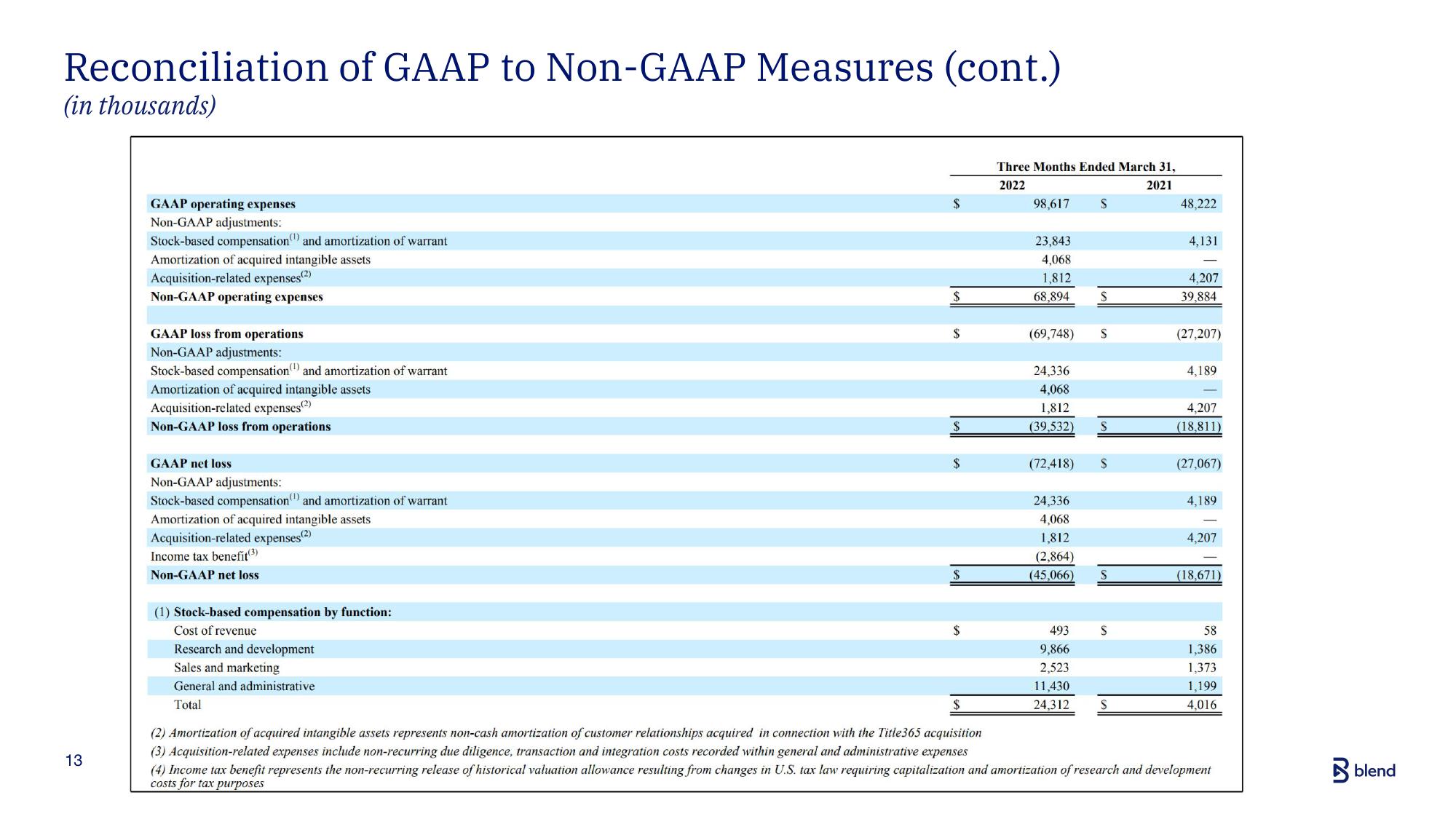

Reconciliation of GAAP to Non-GAAP Measures (cont.)

(in thousands)

13

GAAP operating expenses

Non-GAAP adjustments:

Stock-based compensation and amortization of warrant

Amortization of acquired intangible assets

Acquisition-related expenses (²)

Non-GAAP operating expenses

GAAP loss from operations

Non-GAAP adjustments:

Stock-based compensation and amortization of warrant

Amortization of acquired intangible assets

Acquisition-related expenses(2)

Non-GAAP loss from operations

GAAP net loss

Non-GAAP adjustments:

Stock-based compensation and amortization of warrant

Amortization of acquired intangible assets

Acquisition-related expenses (2)

Income tax benefit (3)

Non-GAAP net loss

(1) Stock-based compensation by function:

Cost of revenue

Research and development

Sales and marketing

General and administrative

Total

S

$

S

S

$

$

$

Three Months Ended March 31,

2022

2021

98,617 $

23,843

4,068

1,812

68,894

(69,748)

24,336

4,068

1,812

(39,532)

(72,418)

24,336

4,068

1,812

(2,864)

(45,066)

493

9,866

2,523

11,430

24,312

$

$

$

48,222

$

4,131

4,207

39,884

(27,207)

4,189

4,207

(18,811)

(27,067)

4,189

4,207

(18,671)

58

1,386

1,373

1,199

4,016

$

(2) Amortization of acquired intangible assets represents non-cash amortization of customer relationships acquired in connection with the Title365 acquisition

(3) Acquisition-related expenses include non-recurring due diligence, transaction and integration costs recorded within general and administrative expenses

(4) Income tax benefit represents the non-recurring release of historical valuation allowance resulting from changes in U.S. tax law requiring capitalization and amortization of research and development

costs for tax purposes

blendView entire presentation