Trian Partners Activist Presentation Deck

Management's Decision to Attempt a Hostile Takeover Was Flawed

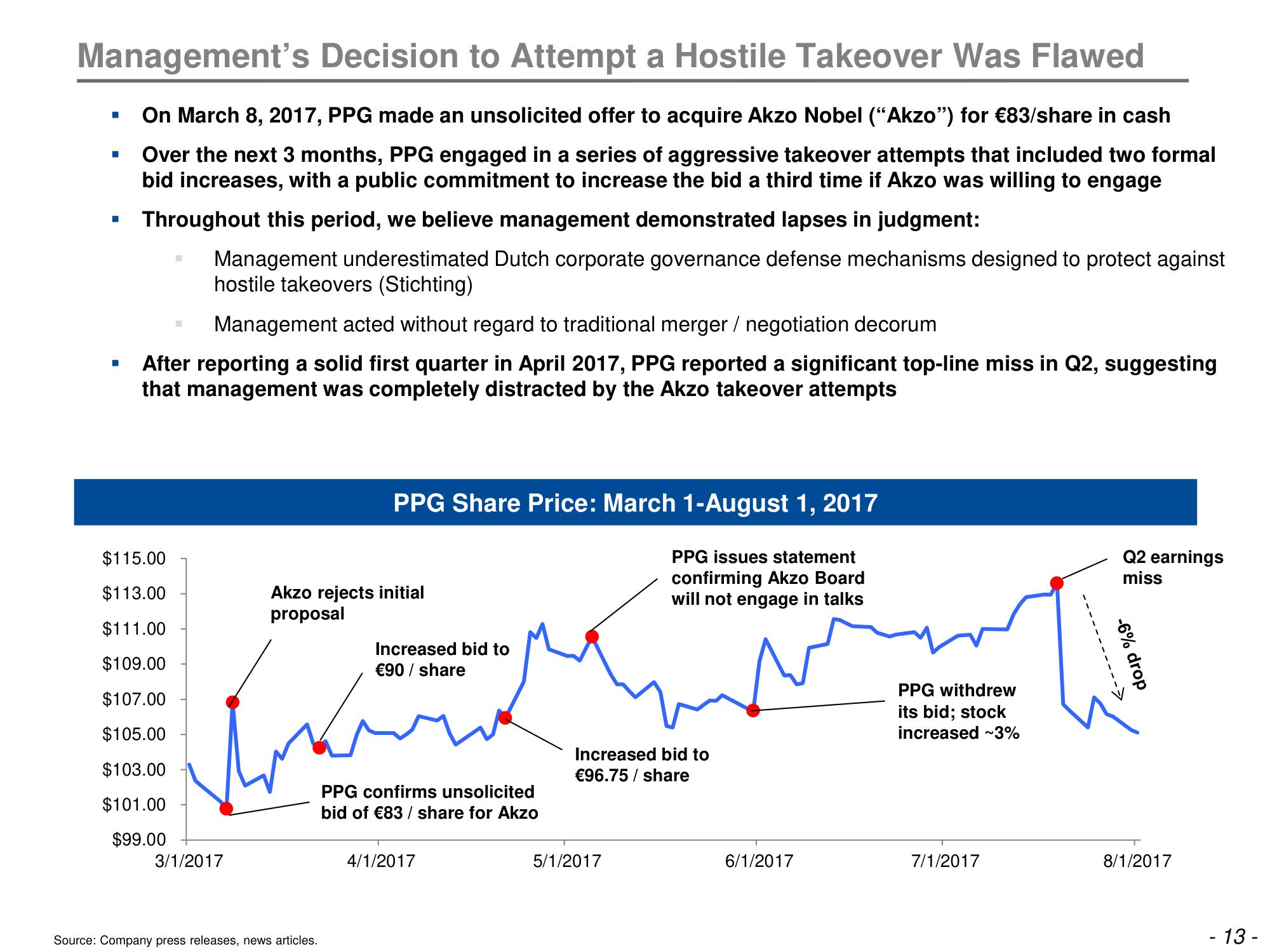

On March 8, 2017, PPG made an unsolicited offer to acquire Akzo Nobel (“Akzo”) for €83/share in cash

Over the next 3 months, PPG engaged in a series of aggressive takeover attempts that included two formal

bid increases, with a public commitment to increase the bid a third time if Akzo was willing to engage

Throughout this period, we believe management demonstrated lapses in judgment:

■

I

Management underestimated Dutch corporate governance defense mechanisms designed to protect against

hostile takeovers (Stichting)

Management acted without regard to traditional merger / negotiation decorum

After reporting a solid first quarter in April 2017, PPG reported a significant top-line miss in Q2, suggesting

that management was completely distracted by the Akzo takeover attempts

$115.00

$113.00

$111.00

$109.00

$107.00

$105.00

$103.00

$101.00

$99.00

3/1/2017

PPG Share Price: March 1-August 1, 2017

PPG issues statement

confirming Akzo Board

will not engage in talks

Akzo rejects initial

proposal

Source: Company press releases, news articles.

Increased bid to

€90 / share

PPG confirms unsolicited

bid of €83 / share for Akzo

4/1/2017

Increased bid to

€96.75 / share

5/1/2017

6/1/2017

PPG withdrew

its bid; stock

increased ~3%

7/1/2017

Q2 earnings

miss

-6% drop

8/1/2017

- 13 -View entire presentation